Improving Public Debt Management

In the OIC Member Countries

48

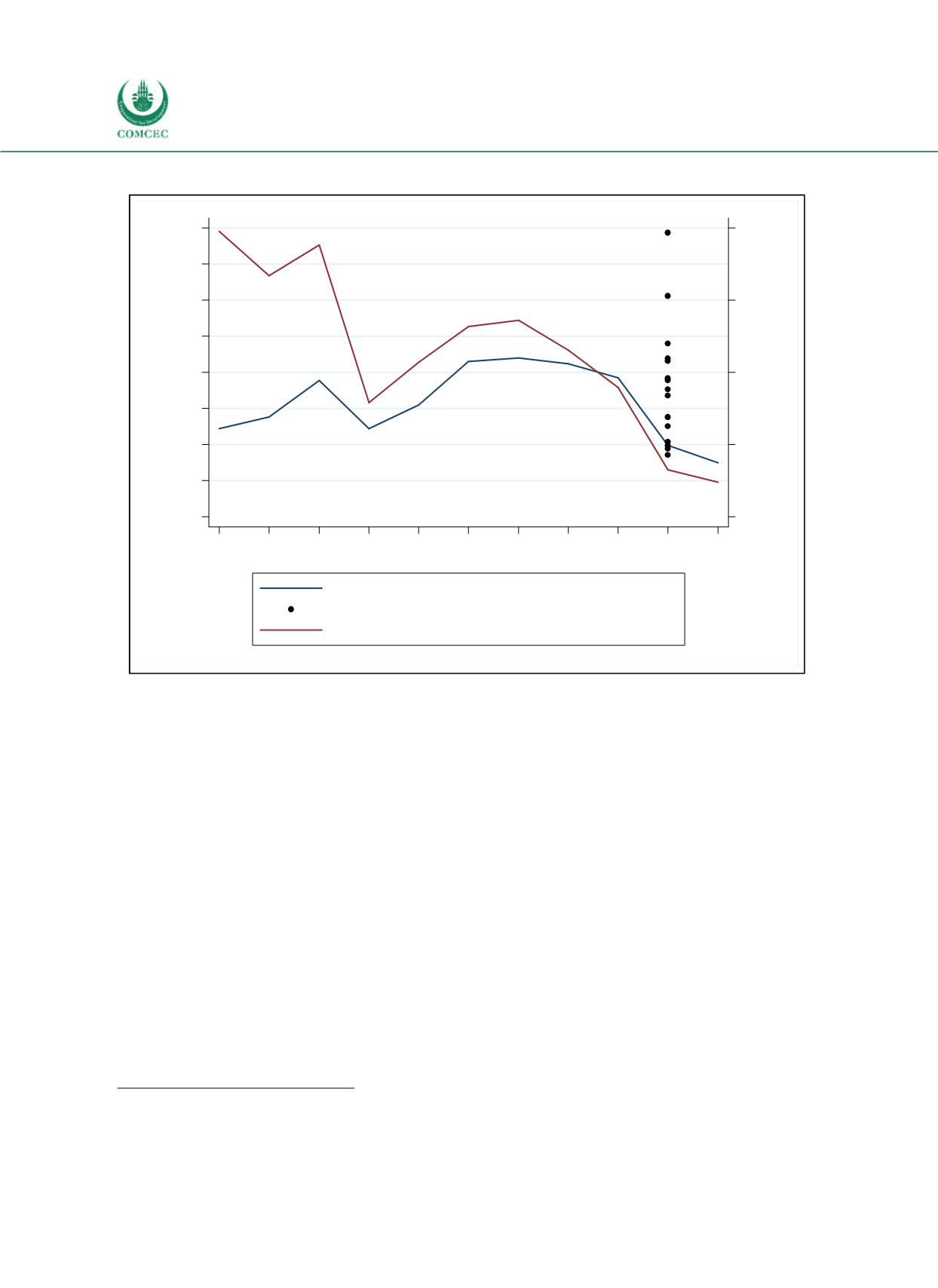

Figure 3-4: Oil Price Developments and Net Lending

Sources: Regional Economic Outlook (2016), WEO (2016), OPEC (2016), Bloomberg (2015), RAM Ratings (Brunei)

(2017), calculations by the Ifo Institute.

Several oil rich OIC countries have accumulated substantial government assets, which can be

used to absorb the incurring deficits. The capacity of OIC countries to absorb deficits by selling

government assets and the deterioration of fiscal buffers in some countries is illustrated in

Figure 35, which shows net debt as a share of GDP calculated as gross debt minus government

assets.

8

Net debt in OIC countries has increased since 2014, when governments started to sell

assets to finance budget deficits.

8

General government net debt refers to gross debt of the general government minus its financial assets in the form of debt

instruments. Examples of financial assets in the form of debt instruments include currency and deposits, debt securities,

loans, insurance, pension, and standardized guarantee schemes, and other accounts receivable.

Libya

Brunei

Algeria Bahrain

Oman Saudi Arabia

Kazakhstan

Iran

UAE

Iraq

Qatar

Kuwait

Azerbaijan

Turkmenistan

Nigeria

-10

-5

0

5

10

Share of GDP (in %)

0

25

50

75

100

125

150

175

200

U.S. Dollars

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Year

Oil price per barrel (left)

Fiscal break-even oil price per barrel (left)

Average net lending in oil producing OIC countries (right)