Improving Public Debt Management

In the OIC Member Countries

54

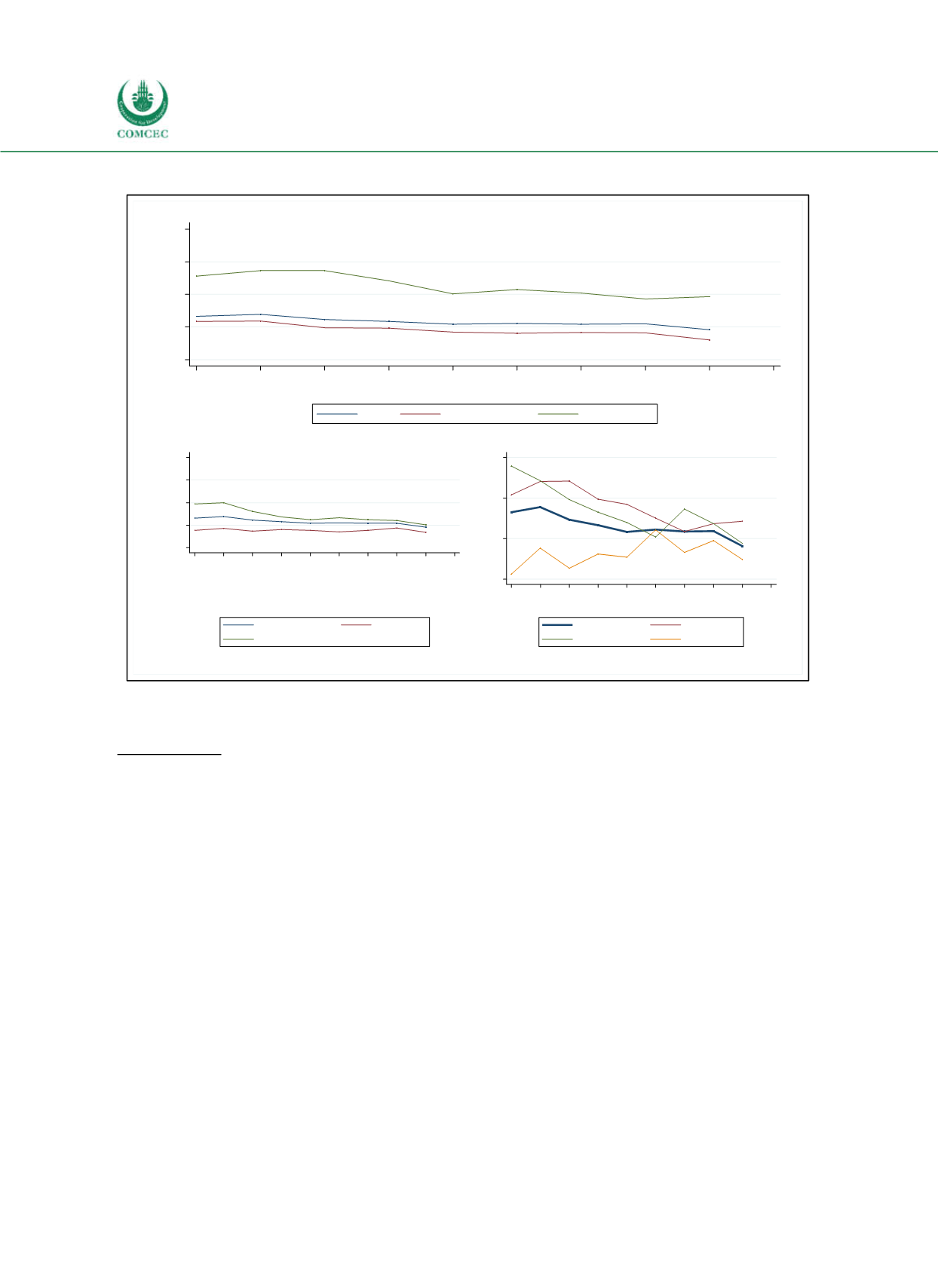

Figure 3-10: Interest Rates on Public Debt in OIC Member Countries

Note: The graph displays the average interest rate on newly committed public debt contracts in a given year.

Sources: World Bank (2016) International Debt Statistics, calculations by the Ifo Institute.

Currency Risk

Currency composition

The currency composition determines the effects of exchange rate changes on public debt.

Figure 311 shows the currency composition of external public debt in the OIC countries over

the period 20062014. In 2014, the largest share of external debt in OIC countries was

denominated in U.S. Dollars (51.3%), followed by Euro (15.4%), Special Drawing Rights (6.6%)

and Japanese Yen (3.2%). The share of external public debt denominated in U.S. Dollar and

Special Drawing Rights (SDR) has increased between 2006 and 2014 while the share of

external public debt denominated in Euro has been relatively constant. The share of external

public debt denominated in Japanese Yen has decreased. The share of external debt

denominated in Euro is higher in middleincome countries than in lowincome countries (see

lower left panel of Figure 311). In lowincome countries the share of SDR is higher than in

middleincome countries.

0

2

4

6

8

%

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Year

All

Official creditors

Private creditors

0

2

4

6

8

%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Year

All

Low income

Middle income

1

2

3

4

%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Year

All

Arab group

Asian group

African group