Improving Public Debt Management

In the OIC Member Countries

52

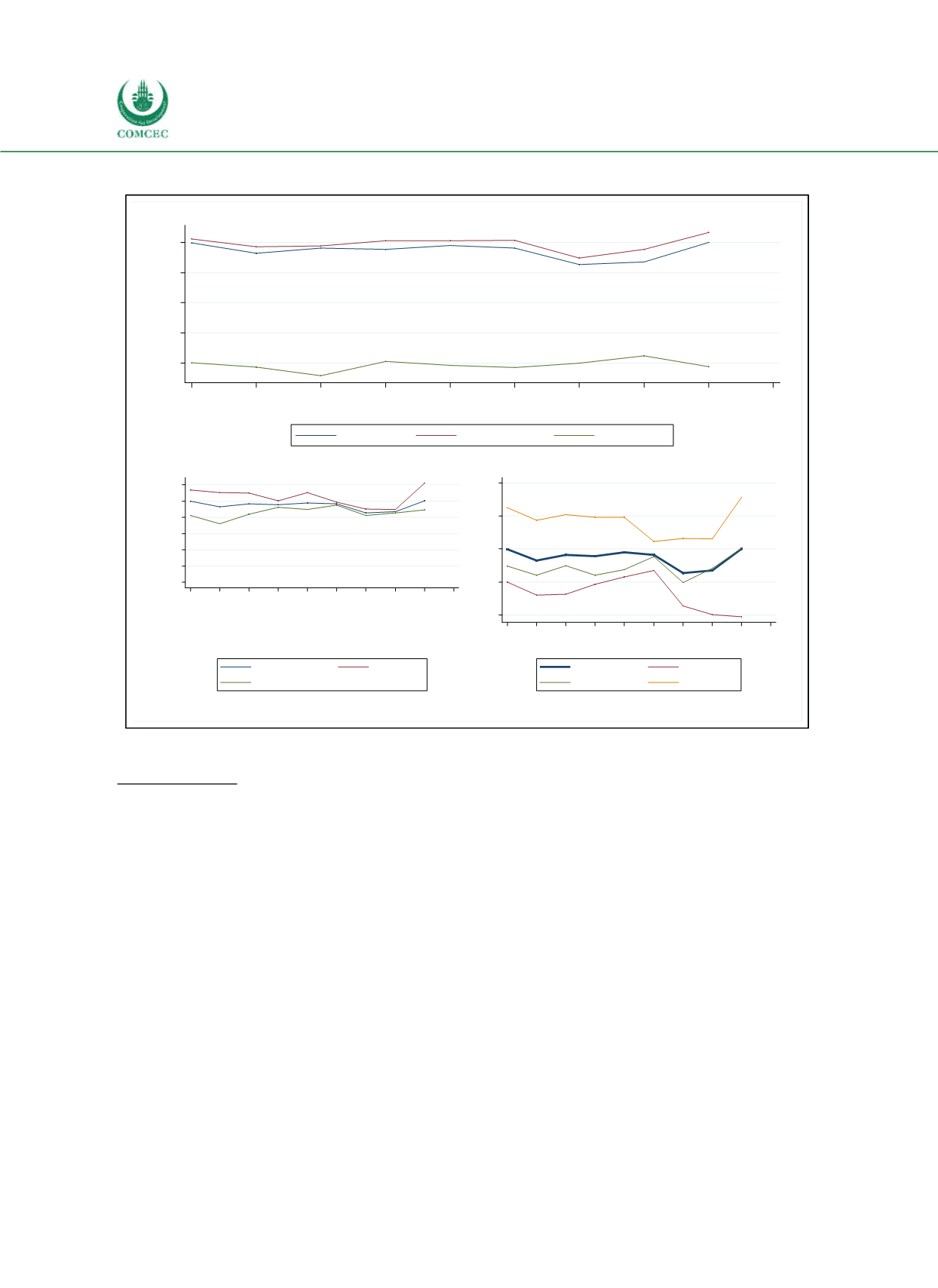

Figure 3-8: Grant Element in OIC Member Countries

Sources: World Bank (2016) International Debt Statistics, calculations by the Ifo Institute.

Refinancing risk

Maturity structure

The share of shortterm debt (debt with an original maturity of one year or less) has decreased

over the last decade in the OIC member countries, amounting to 10.2% of outstanding debt in

2015. This share is slightly higher than the worldwide average of 7.5%.

Figure 39 shows the average maturity of all new public and publicly guaranteed loans

contracted by OIC countries during each year for 20062014. The average maturity of new

debt commitments has fluctuated between 18 and 23 years. Private creditors extend their

credit for an average period of approximately four years. This average maturity for private

credits lies below the worldwide average of five years. Creditors who provide their financial

resources for periods exceeding a decade are typically official creditors such as international

organizations (e.g. the World Bank, regional development banks and other multilateral and

intergovernmental agencies) and governments. The maturity of new contracts is significantly

larger in lowincome countries than in middleincome countries, which might be explained by

the larger share of official creditors in lowincome countries (see lower left panel of Figure

39). Consequently, the average maturity of new contracts is larger in the African group, which

may also be explained by a larger share of official creditors (see lower right panel of Figure

39).

10

20

30

40

50

%

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Year

All creditors

Official creditors

Private creditors

0

10

20

30

40

50

60

%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Year

All

Low income

Middle income

30

40

50

60

70

%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Year

All

Arab group

Asian group

African group