Improving Public Debt Management

In the OIC Member Countries

51

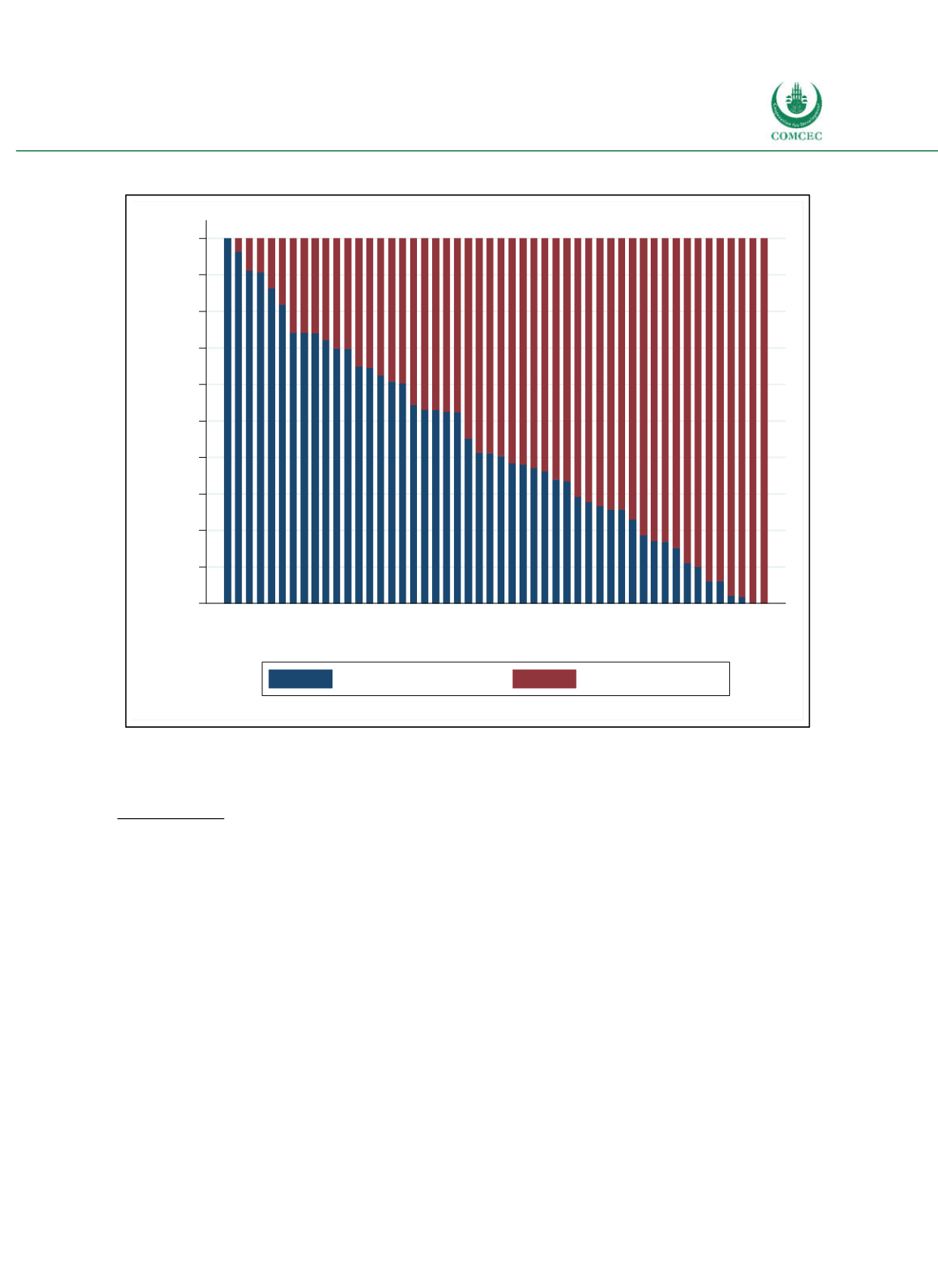

Figure 3-7: Creditor Structure of Public Debt by Country (2015)

Note: Data for Brunei Darussalam, Kuwait, Libya, Palestine, Somalia, Turkmenistan, and UAE is not available.

Sources: IMF Country Reports (see 4.1 Case Countries), national central banks, national Ministries of Finance,

Moody’s, World Bank (2016) International Debt Statistics, calculations by the Ifo Institute.

Grant Element

Figure 38 shows the grant element of loans, defined as the grant equivalent as a percentage of

the amount committed. The average grant element in OIC countries has been about 50% since

2006, similar to the worldwide average. Grants are primarily extended by official creditors,

while private credit contracts have a small grant element. Grants to lowincome countries are

more generous than to middleincome countries (see lower left panel of Figure 38). The grant

element is particularly high in the African group (see lower right panel of Figure 38).

0

10

20

30

40

50

60

70

80

90

100

Share of total public debt (in %)

Saudi Arabia

Bahrain

Egypt

Iran

Lebanon

Nigeria

Syria

Qatar

Kazakhstan

Yemen

Pakistan

Maldives

Turkey

Guinea-Bissau

Jordan

Bangladesh

Malaysia

Guinea

Togo

Albania

Suriname

Morocco

Gambia

Indonesia

Chad

Oman

Côte d'Ivoire

Tunisia

Uganda

Benin

Iraq

Cameroon

Senegal

Sierra Leone

Burkina Faso

Guyana

Niger

Mali

Algeria

Gabon

Mozambique

Tajikistan

Sudan

Comoros

Mauritania

Djibouti

Kyrgyz Republic

Azerbaijan

Afghanistan

Uzbekistan

Domestic creditors

External creditors