Improving Public Debt Management

In the OIC Member Countries

43

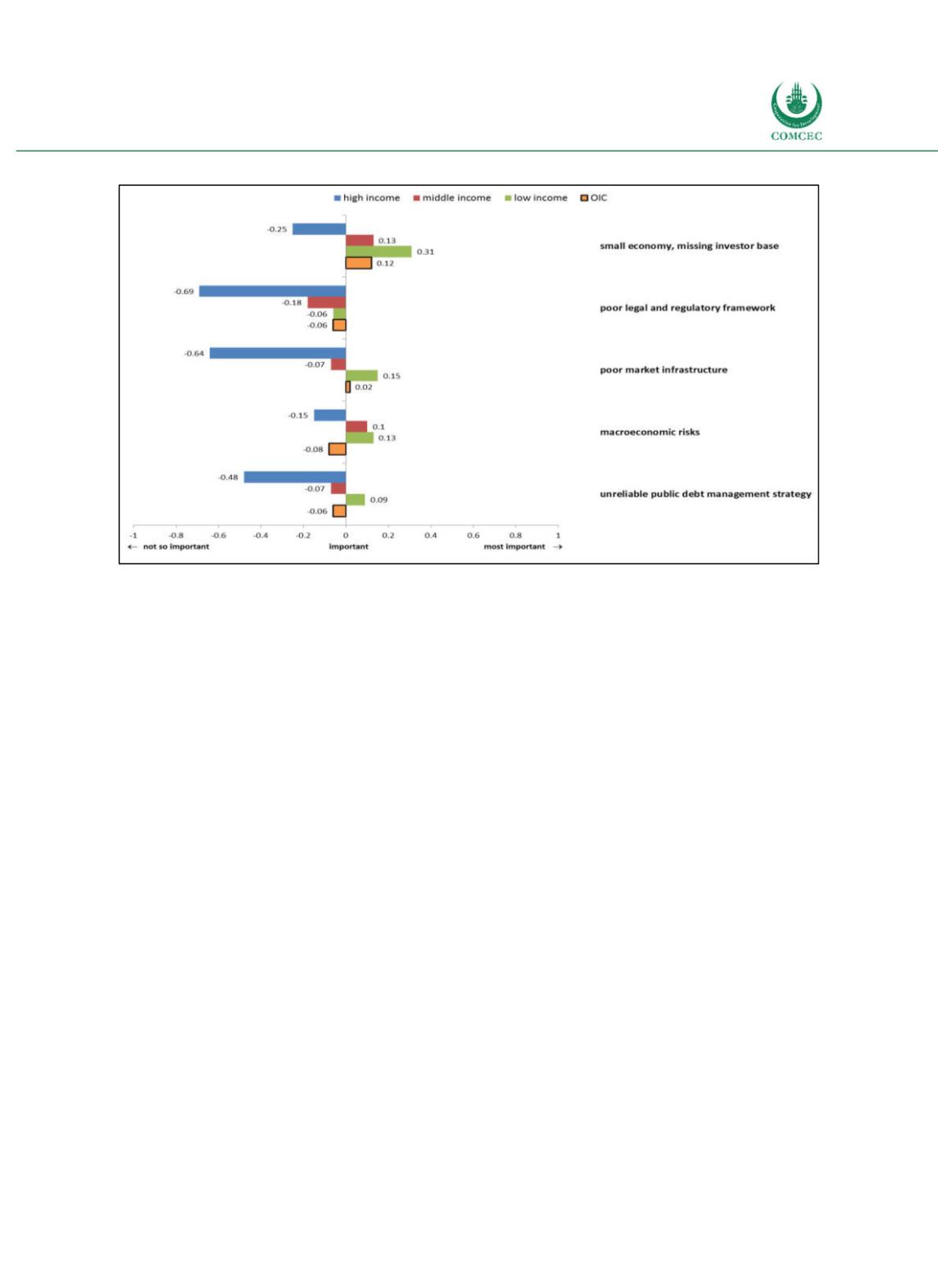

Figure 2-19: Problems Faced by the Domestic Public Debt Market

Source: Ifo World Economic Survey (WES) IV/2016.

In sum, the survey results provide new insights with respect to the question where experts see

public debt management policies and domestic debt market development in OIC countries

compared to the rest of the world. They offer indicators for governments and DMOs

concerning which aspects of their public debt management might be reconsidered or

improved. First, experts see room for improvement in the efficiency of public debt

management. Second, while a majority considers domestic public debt markets to function

satisfactorily, public policies are well advised to provide the necessary regulatory framework

to further improve their functioning. Besides a small investor base, poor market infrastructure

is found to be the most important impediment for properly functioning domestic public debt

markets in OIC countries. Better functioning public debt markets would also help to retain

more savings in the domestic economy, which would alleviate the problem of a small investor

base.

Experts consider foreign currency risk and interest rate risk to be quite important in OIC

public debt markets. OIC member countries might therefore focus on strategies to reduce

vulnerabilities to those risk categories. They might target to issue a higher share of public debt

in domestic currency. Moreover, a further lengthening of the maturity of newly issued debt

instruments might help to reduce interest rate risk.

These survey results provide important information about priorities for a reform of public

debt management in OIC countries. These findings complement the conclusions from the

global best practices and the country case studies. In the following sections recommendations

are based on a comparison between public debt management in the respective country and

global best practice. In contrast to that approach, this section presented the evaluation of

country experts. Their opinion is especially important because the experts might be potential

investors, i.e. those working at financial institutions and firms, or they may influence the public

view of the functioning of public debt markets, i.e. those working at think tanks, research

institutes and universities. If governments succeed in improving experts’ assessment of public

debt markets, they may also be able to expand the investor base and issue debt at a lower cost.