Improving Public Debt Management

In the OIC Member Countries

50

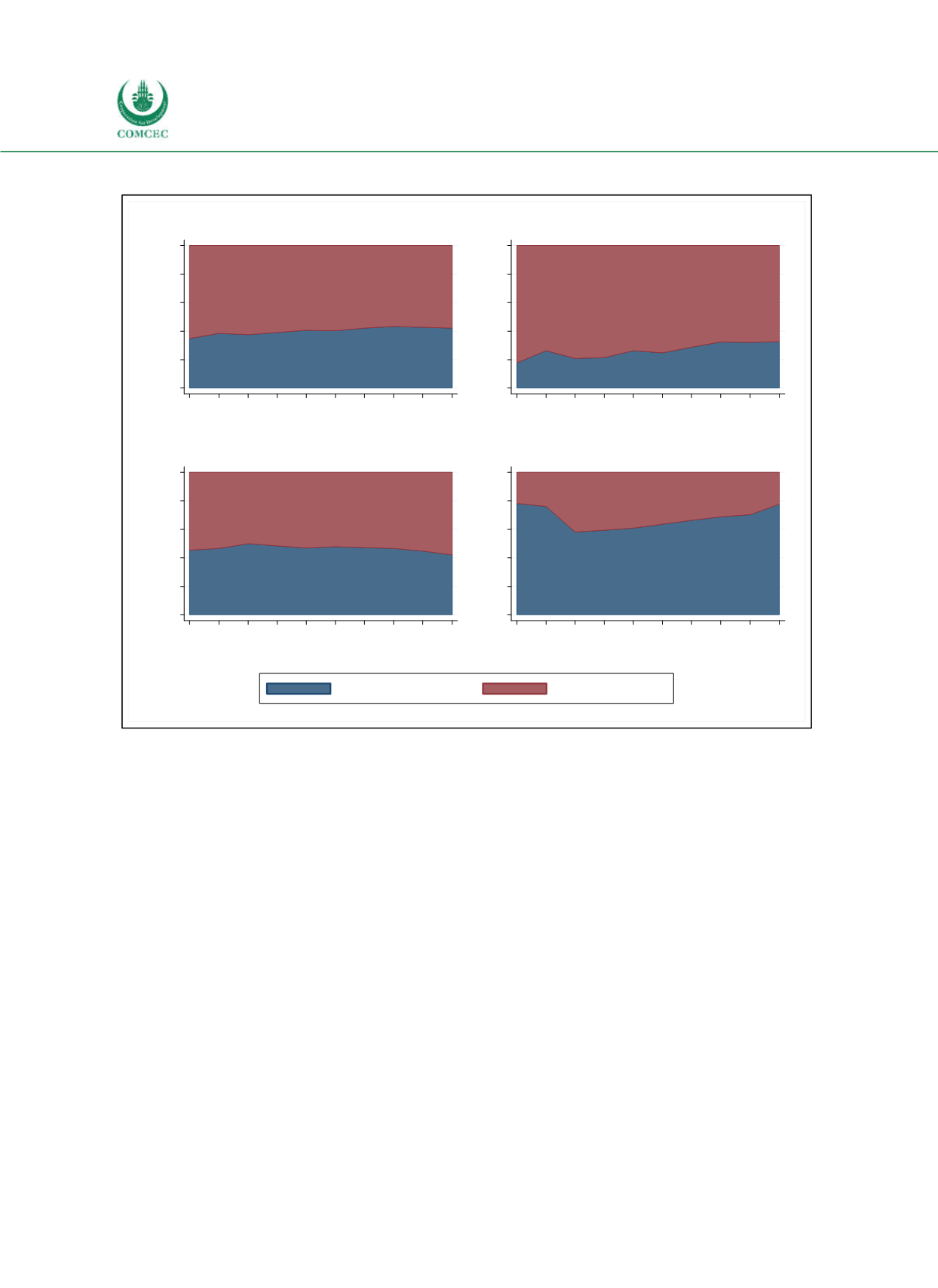

Figure 3-6: Creditor Structure of Public Debt in OIC Member Countries

Sources: IMF Country Reports (see 4.1 Case Studies), national central banks, national Ministries of Finance,

Moody’s, World Bank (2016) International Debt Statistics, calculations by the Ifo Institute.

OIC member countries differ considerably in their creditor structures. Figure 37 shows the

shares of domestic and external debt in the OIC member countries in 2015. All public debt in

Saudi Arabia was owed to domestic institutions, and in Bahrain, Egypt and Iran external public

debt accounted for less than 10% of total public debt in 2015. However, some of the countries

which were indebted mainly domestically plan to or already did access international debt

markets. For example, Saudi Arabia also introduced a debt management office, which was

responsible for the first international bond sale in 2016. Iran is planning to return to

international debt markets. On the other hand, several OIC countries rely heavily on external

debt. Afghanistan’s and Uzbekistan’s public debt comprised completely of external debt in

2015. In the Kyrgyz Republic, Djibouti, Mauretania and Azerbaijan less than 10% of total public

debt is domestic.

0

20

40

60

80

100

%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Year

All income levels

0

20

40

60

80

100

%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Year

Low income

0

20

40

60

80

100

%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Year

Middle income

0

20

40

60

80

100

%

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Year

High income

Domestic creditors

External creditors