Improving Public Debt Management

In the OIC Member Countries

47

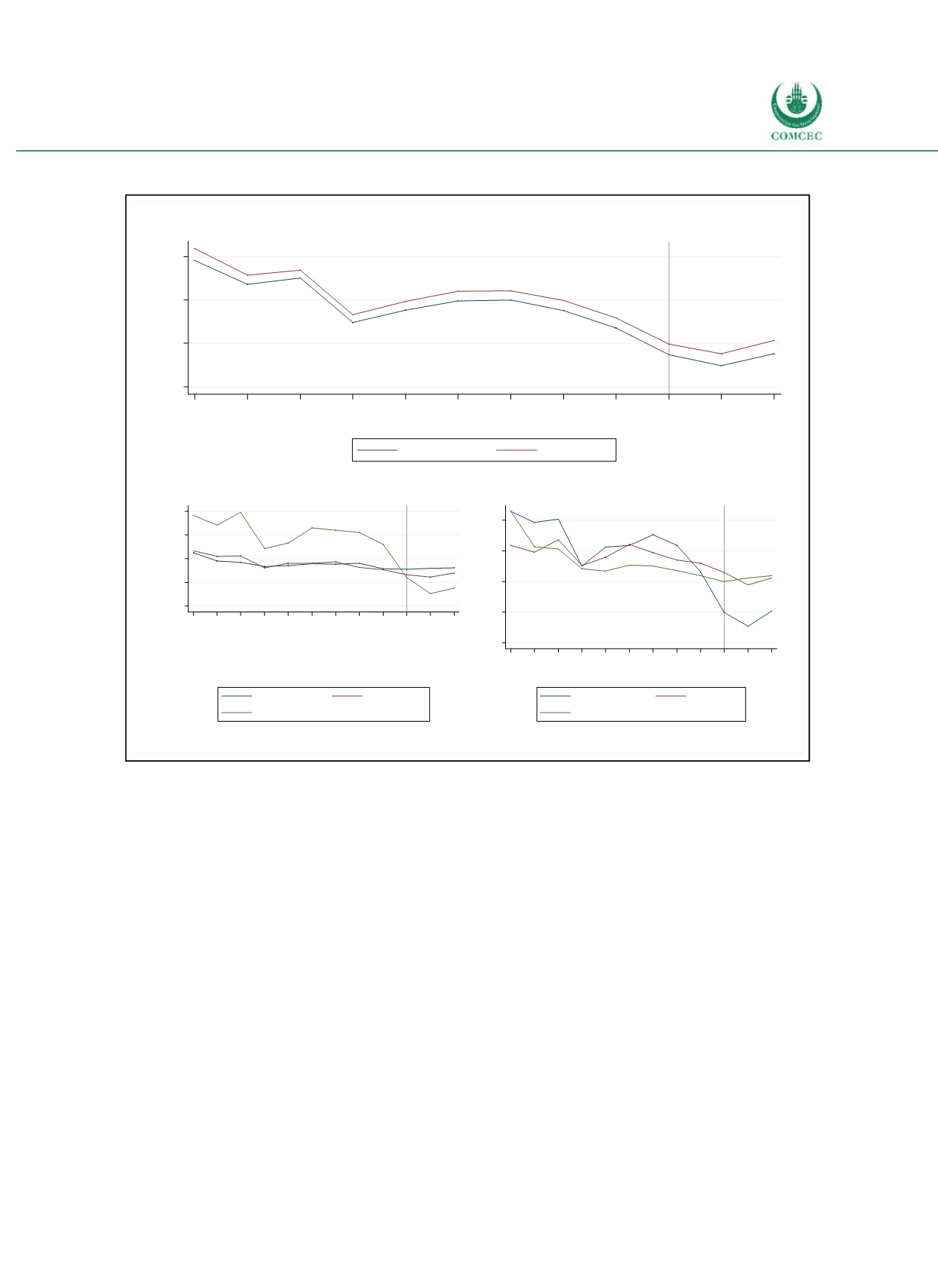

Figure 3-3: Government Net Lending in OIC Member Countries

Sources: WEO (2016), calculations by the Ifo Institute.

What gives rise to the increasing deficits and debt levels in the highincome countries and the

Arab country group? Several of these countries strongly depend on oil revenues. The decline in

oil prices starting in 2014 has had and will continue to have a substantial negative impact on

the economies of the oilproducing countries. Figure 34 shows the average net lending in the

oil producing OIC countries since 2006, as well as the decline in the oil price per barrel and

fiscal breakeven oil prices which oil producing OIC countries need to balance their budgets.

-10

-5

0

5

Share of GDP (in %)

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Year

General balance

Primary balance

Projections

-20

-10

0

10

20

Share of GDP (in %)

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Year

Low income

Middle income

High income

Projections

-15

-10

-5

0

5

Share of GDP (in %)

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Year

Arab Group

Asian Group

African Group

Projections