Improving Public Debt Management

In the OIC Member Countries

49

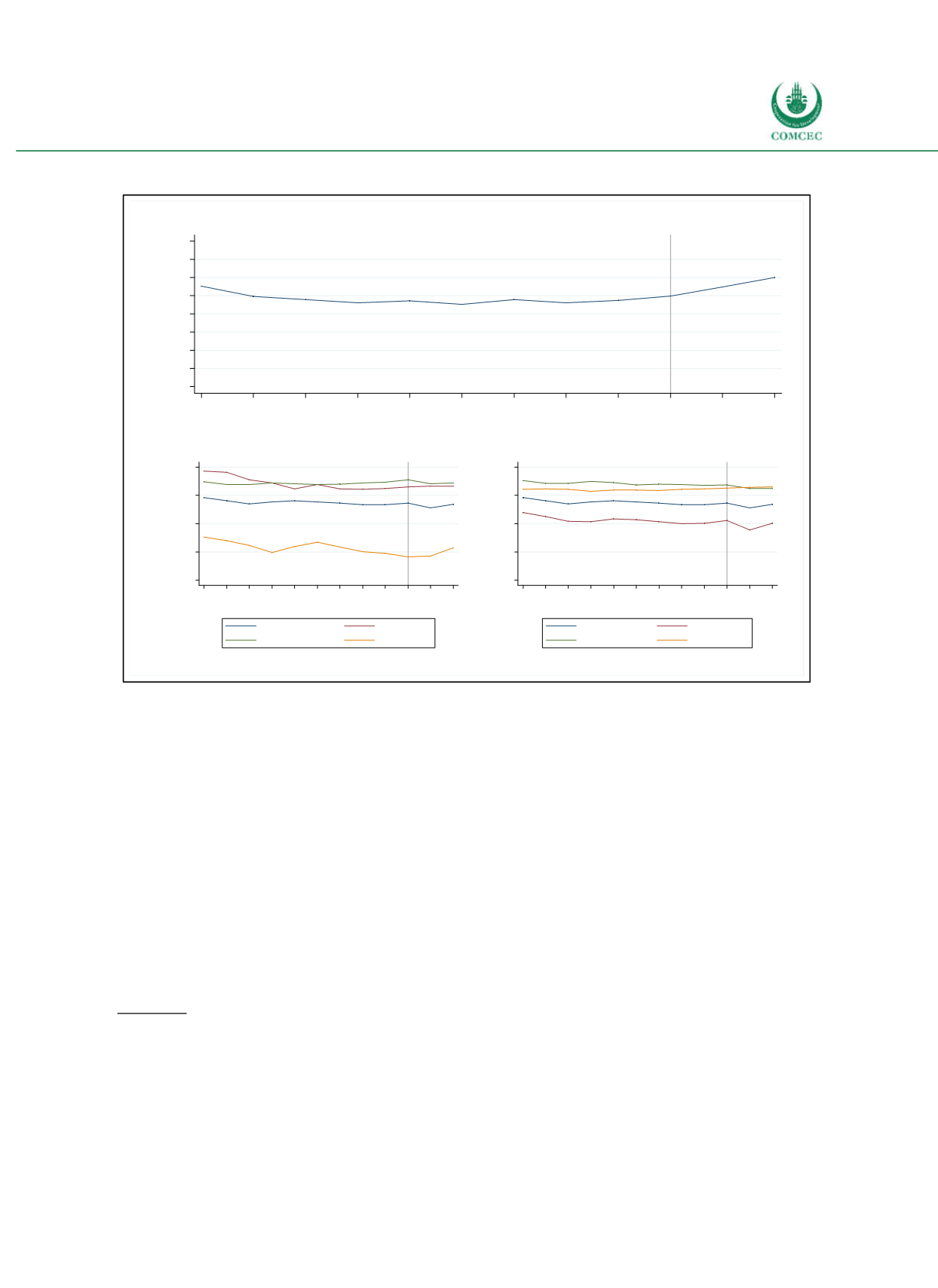

Figure 3-5: Net Debt in OIC Member Countries

Sources: WEO (2016), calculations by the Ifo Institute.

To deal with lower oil revenues, governments have taken various fiscal adjustment measures

including cuts on current and capital spending (see, e.g., Sommer et al. 2016a). Governments

have also increased taxes to tackle fiscal deficits. For example, the GCC countries have reached

a general agreement to introduce a GCCwide valueadded tax (VAT), which could be an

effective instrument to increase fiscal revenues (Alreshan et al. 2015, Sommer et al. 2016b). In

a similar vein, introducing or increasing direct taxes, such as personal or corporate income

taxes, might help reduce fiscal deficits. In addition to the measures mentioned above, most GCC

countries have increased charges or decreased subsidies for fuel, water and electricity.

3.1.3

Debt Structures

The structure of public debt provides important information about the risks entailed in public

indebtedness in the OIC countries. Creditor structures, maturity structures, the currency

composition and interest types of public debt in the OIC member countries are considered.

Creditors

The average share of domestic debt in OIC member states has slightly increased since 2006

and was 42.2% in 2015 (see Figure 36). The share of domestic creditors in OIC countries lies

above the worldwide average. Lowincome countries have a higher share of external creditors

than middleand highincome countries. In highincome countries the share of domestic

creditors has increased since 2008 and amounted to about 77.7% in 2015.

-30

-20

-10

0

10

20

30

40

50

Share of GDP (in %)

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

Year

Projections

-150

-100

-50

0

50

Share of GDP (in %)

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Year

All

Low income

Middle income

High income

Projections

-150

-100

-50

0

50

Share of GDP (in %)

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Year

All

Arab Group

Asian Group

African Group

Projections