Improving Public Debt Management

In the OIC Member Countries

46

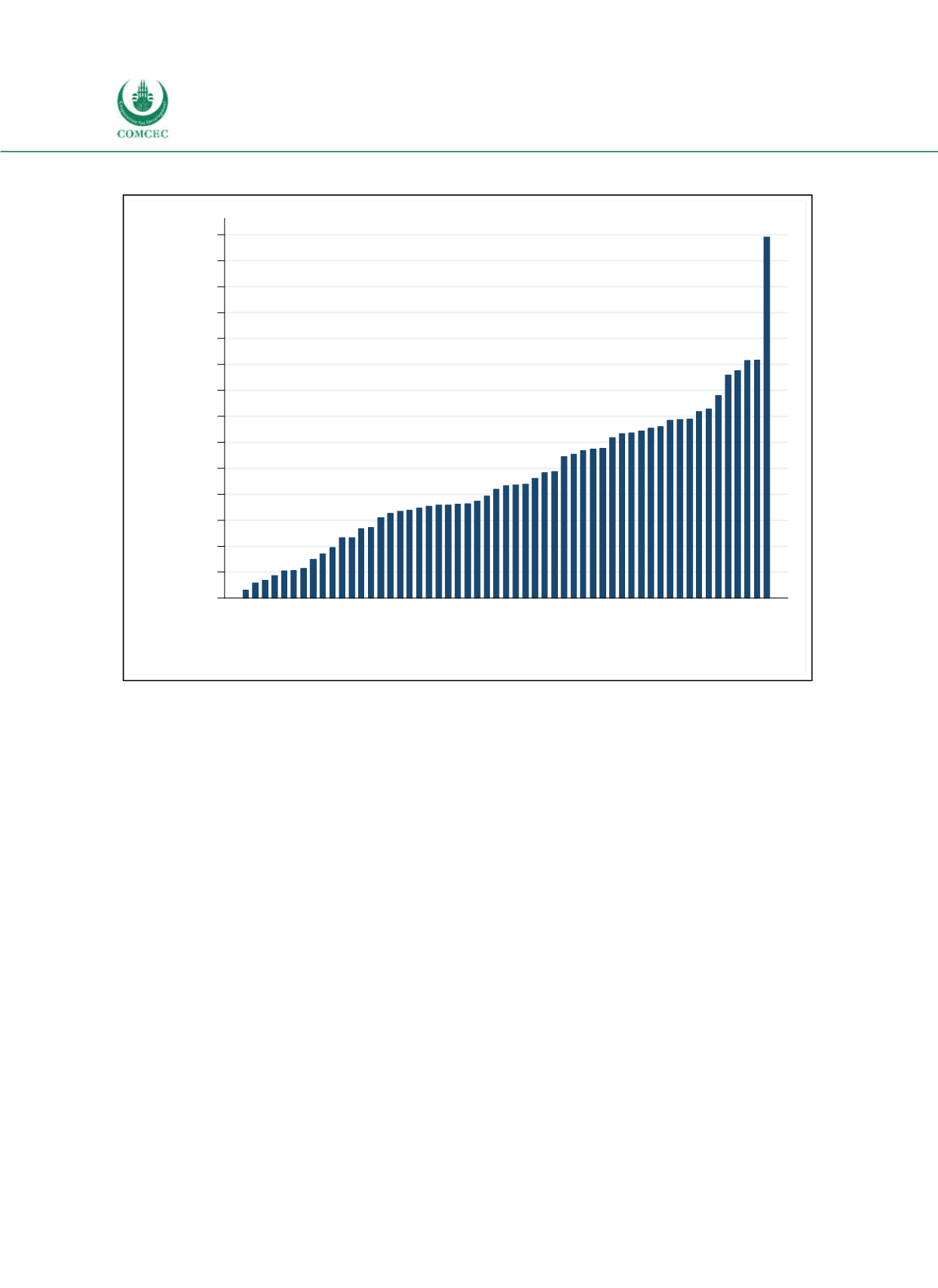

Figure 3-2: Gross Public Debt in OIC Member Countries (2015)

Note: Data for Somalia and Syria is not available.

Sources: WEO (2016), IMF Country Reports (see 4.1 Case Studies).

3.1.2

Government Budgets

To disentangle the effects of fiscal policy on government debt from exchange rate effects,

government budget balances is considered. The upper panel of Figure 33 shows general and

primary government net lending which excludes interest payments on outstanding debt. The

average government net lending of the OIC countries was positive or balanced in most years

between 2006 and 2012. During the financial crisis in 2009 and 2010, however, the average

general net lending turned negative. Net borrowing started to increase strongly in 2013.

Between 2013 and 2015 average borrowing as a share of GDP increased from 1.2% to 6.3%.

While highincome OIC countries ran large surpluses between 2006 and 2014, the situation

changed dramatically in 2015 and the average budget balance turned negative (see lower left

panel of Figure 33). The average budget balance in lowand middleincome countries has

been negative in all years since 2009. Lowand middleincome countries experienced a further

deterioration of their budget balances in the last years, a development more pronounced in

middleincome countries. Across all regional groups a decline in the budget balance can be

observed, with the average net lending being largest in the Arab group in 2015 (see lower right

panel of Figure 33).

0

10

20

30

40

50

60

70

80

90

100

110

120

130

140

Share of GDP (in %)

Brunei Darussalam

Saudi Arabia

Afghanistan

Algeria

Kuwait

Uzbekistan

Nigeria

Oman

Iran

United Arab Emirates

Turkmenistan

Kazakhstan

Comoros

Indonesia

Burkina Faso

Turkey

Cameroon

Bangladesh

Côte d'Ivoire

Uganda

Qatar

Tajikistan

AzerbaijanMali

Benin

Chad

Palestine

Suriname

Niger

Gabon

Sierra Leone

Guinea

Guyana

Tunisia

Djibouti

Senegal

Malaysia

Guinea-Bissau

Togo

Bahrain

Morocco

Pakistan

Libya

Iraq

Yemen

Kyrgyz Republic

Sudan

Albania

Maldives

Mauritania

Mozambique

Egypt

Gambia

Jordan

Lebanon