Improving Public Debt Management

In the OIC Member Countries

26

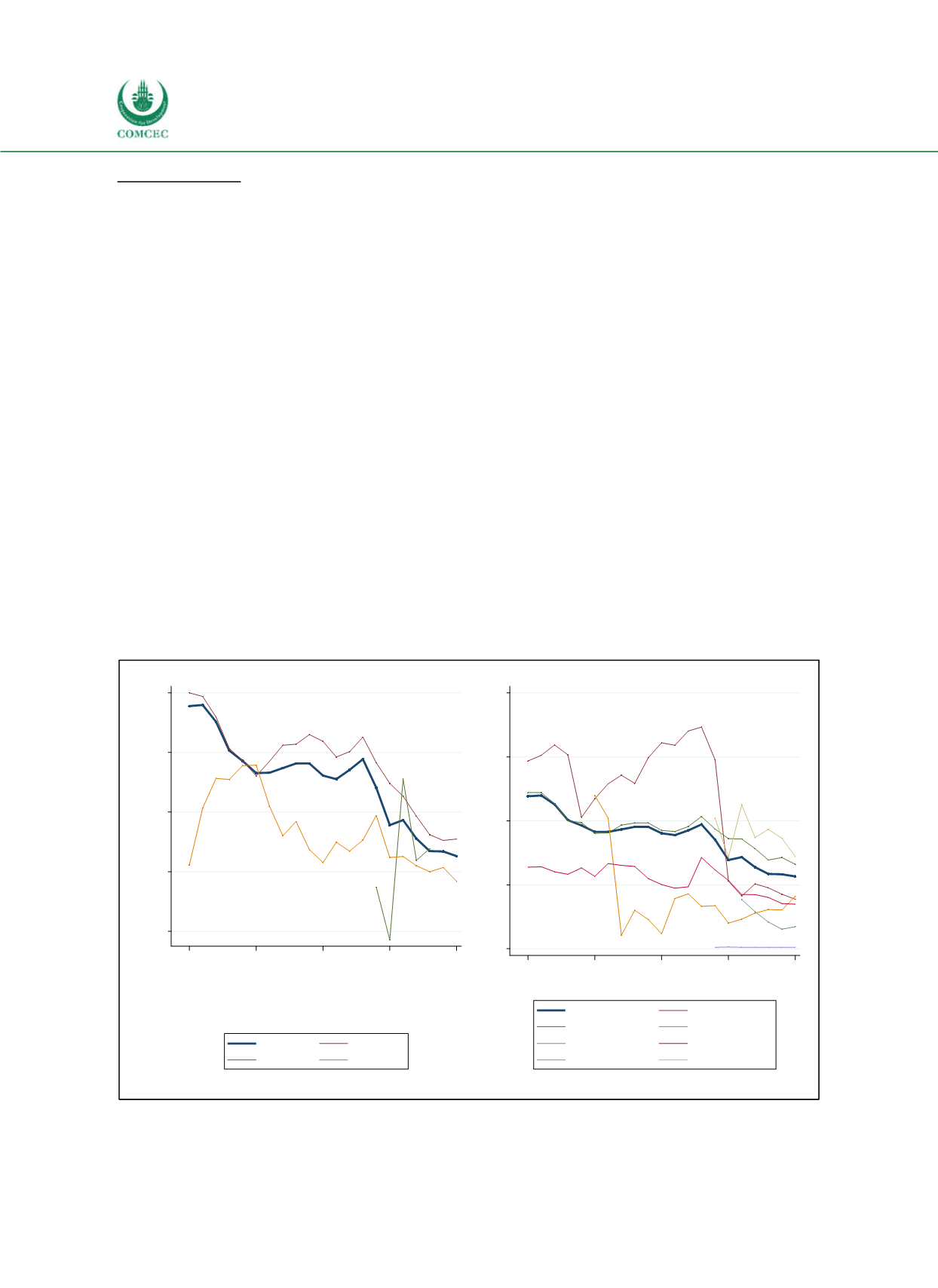

Refinancing Risk

Maturity

The maturity structure of public debt determines the share of debt that has to be refinanced in

a given year. The share of shortterm debt has been identified as an important determinant of

financial and sovereign debt crises. In the period preceding a crisis, shortterm debt financing

usually becomes more important because investors become reluctant to longterm lending. As

such, a high share of longterm debt is a sign of the confidence investors put in the economy.

There are many studies on the maturity structure of public debt (see, among others, Arellano

and Ramanarayanan 2012, Debortoli et al. 2014, Greenwood et al. 2015). Both governments

and investors face tradeoffs: while interest rates on shortterm debt are usually lower than on

longterm debt, shortterm debt is positively associated with refinancing risk. From the

perspective of investors longterm credits provide a hedge against future interest rate

fluctuations, but shortterm contracts are more effective in providing incentives to repay.

Shortterm debt is defined as debt with an original maturity of one year or less. Since 1995 a

substantial reduction in the share of shortterm debt has taken place (see Figure 27) (IMF and

World Bank 2016): The share of shortterm in total public debt averaged across all countries

decreased from 24% in 1995 to 11% in 2015. Lowincome countries have a lower share of

shortterm debt than highincome countries. Figure 28 shows the development of longterm

and shortterm public debt expressed as % of GDP. The increase in public debt since the global

financial crisis has been financed by longterm instruments; the share of shortterm debt in

GDP has remained relatively constant.

Figure 2-7: Share of Short-Term in Total Public Debt Worldwide

Sources: IMF and World Bank (2016), Quarterly Public Sector Debt database, calculations by the Ifo Institute

Note: Due to missing data the graphs for low income countries (left panel) and for Latin America & Carib., Sub-

Saharan Africa, South Asia & MENA (right panel) cover a shorter time period only.

5

10

15

20

25

%

1995

2000

2005

2010

2015

Year

All

High income

Low income

Middle income

0

10

20

30

40

%

1995

2000

2005

2010

2015

Year

All

East Asia, Pacific

Europe, Central Asia

Latin America & Carib.

MENA

North America

South Asia

Sub-Saharan Africa