Improving Public Debt Management

In the OIC Member Countries

30

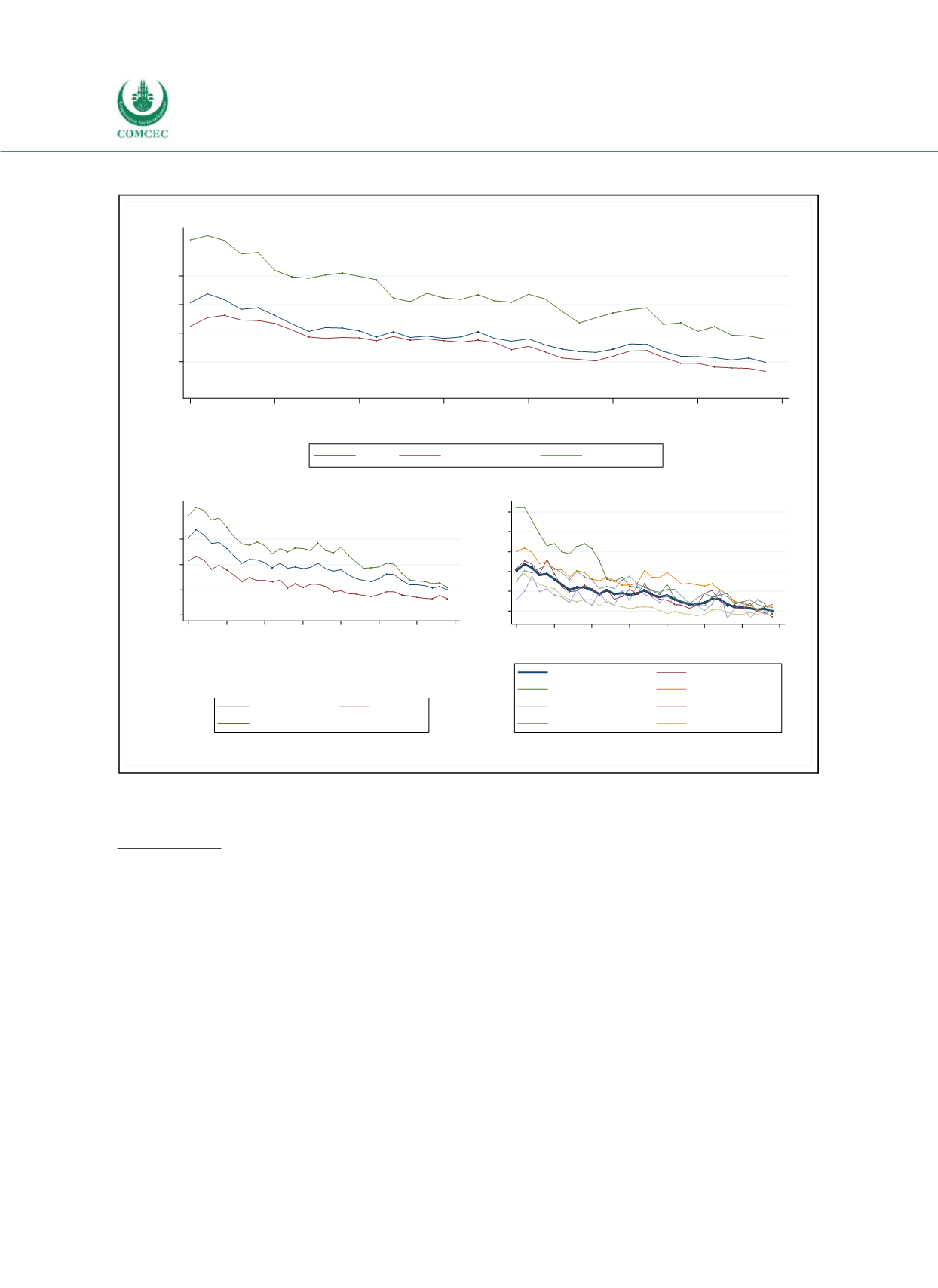

Figure 2-11: Interest Rates on Public Debt Worldwide

Note: The graph displays the average interest rate on newly committed public debt contracts in a given year.

Sources: World Bank (2016) International Debt Statistics, calculations by the Ifo Institute.

Currency Risk

Currency composition

The effect of exchange rate changes on the level of public debt depends on the currency

composition of debt. Governments especially in emerging and developing countries face a

tradeoff. On the one hand, debt denominated in foreign currency is usually less expensive.

Foreign interest rates are generally lower, because domestic interest rates include risk premia

that arise from a higher possibility of a devaluation of the local currency. On the other hand, if

the currency indeed devaluates, the debt burden expressed in local currency increases. To

assess the risks of devaluations, debt denominated in foreign currency can be expressed

relative to the central bank’s international reserves or to export revenues.

Figure 212 shows that the share of debt denominated in domestic currency has decreased

slightly since 1995. In 2015, it made up 64% of total debt on average. The differences between

different income groups are significant: While highincome countries’ debt is almost entirely

denoted in domestic currency, debt in lowincome countries is primarily denominated in

foreign currency.

0

2

4

6

8

%

1980

1985

1990

1995

2000

2005

2010

2015

Year

All

Official creditors

Private creditors

0

2

4

6

8

%

1980 1985 1990 1995 2000 2005 2010 2015

Year

All

Low income

Middle income

2

4

6

8

10

12

%

1980 1985 1990 1995 2000 2005 2010 2015

Year

All

East Asia, Pacific

Europe, Central Asia

Latin America & Carib.

MENA

North America

South Asia

Sub-Saharan Africa