Improving Public Debt Management

In the OIC Member Countries

23

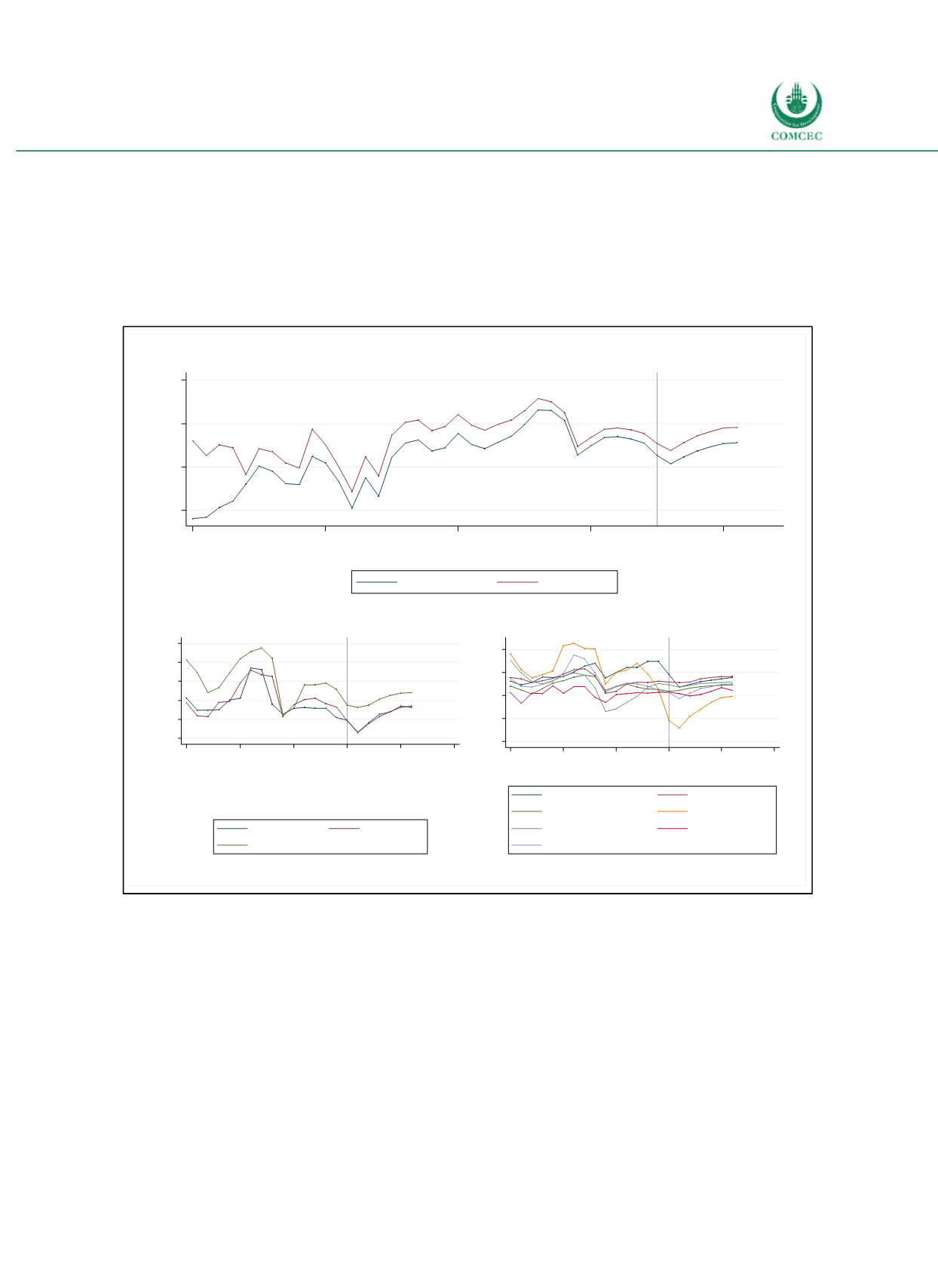

the primary balance. Because of the low interest rate environment, the difference between

both measures has become smaller in the recent past. While the average budget deficit was

7.2% of GDP during the period 19801995, average budget deficits drastically decreased to

1.4% over the period 19962006. However, the global financial crisis has marked a structural

break and pushed balances deeper into deficit, where they will remain in coming years

according to the projections.

Figure 2-4: Government Net Lending Worldwide

Source: WEO (2016), calculations by the Ifo Institute.

The classification according to the income level (lower left panel) shows a remarkable

improvement in government budget balances in lowincome countries. While historically they

ran much larger deficits, their behavior does not differ much from the behavior observed in

middleand highincome countries from 2000 onwards. The regional data (lower right panel)

reveal that the improvement in lowincome countries can be traced back to countries in SubSaharan Africa. This development might be partially attributed to debt relief programs which

were implemented over the last two decades. The volatility observed in Middle Eastern and

North African (MENA) countries is pronounced, which could be due to the role of commodities,

especially oil and gas, as a major source of government revenues. While the MENA countries

ran large surpluses between 2004 and 2008, they currently display the largest deficit of all

-10

-5

0

5

Share of GDP (in %)

1980

1990

2000

2010

2020

Year

General balance

Primary balance

Projections

-6

-4

-2

0

2

4

Share of GDP (in %)

2000

2005

2010

2015

2020

2025

Year

Low income

Middle income

High income

Projections

-15

-10

-5

0

5

Share of GDP (in %)

2000

2005

2010

2015

2020

2025

Year

East Asia, Pacific

Europe, Central Asia

Latin America & Carib.

MENA

North America

South Asia

Sub-Saharan Africa

Projections