Improving Public Debt Management

In the OIC Member Countries

21

become more pronounced since the middle of the first decade of the 2000s: while debt has

been increasing in highincome countries, debt drastically decreased in lowincome countries.

Debt in lowincome countries shows the largest volatility over time. Different dynamics can

also be observed within the regional country groups: countries in the Middle East and North

Africa and, to a lower extent, those in SubSaharan Africa show a substantial and continuous

reduction of debt levels over the past 20 years. After reaching a peak in the early 2000s, debt

levels in East and South Asia have been decreasing. Debt levels in Latin America and the

Caribbean showed relatively constant values in the recent past. North America, Europe and

Central Asia have increased their debt levels significantly since 2007.

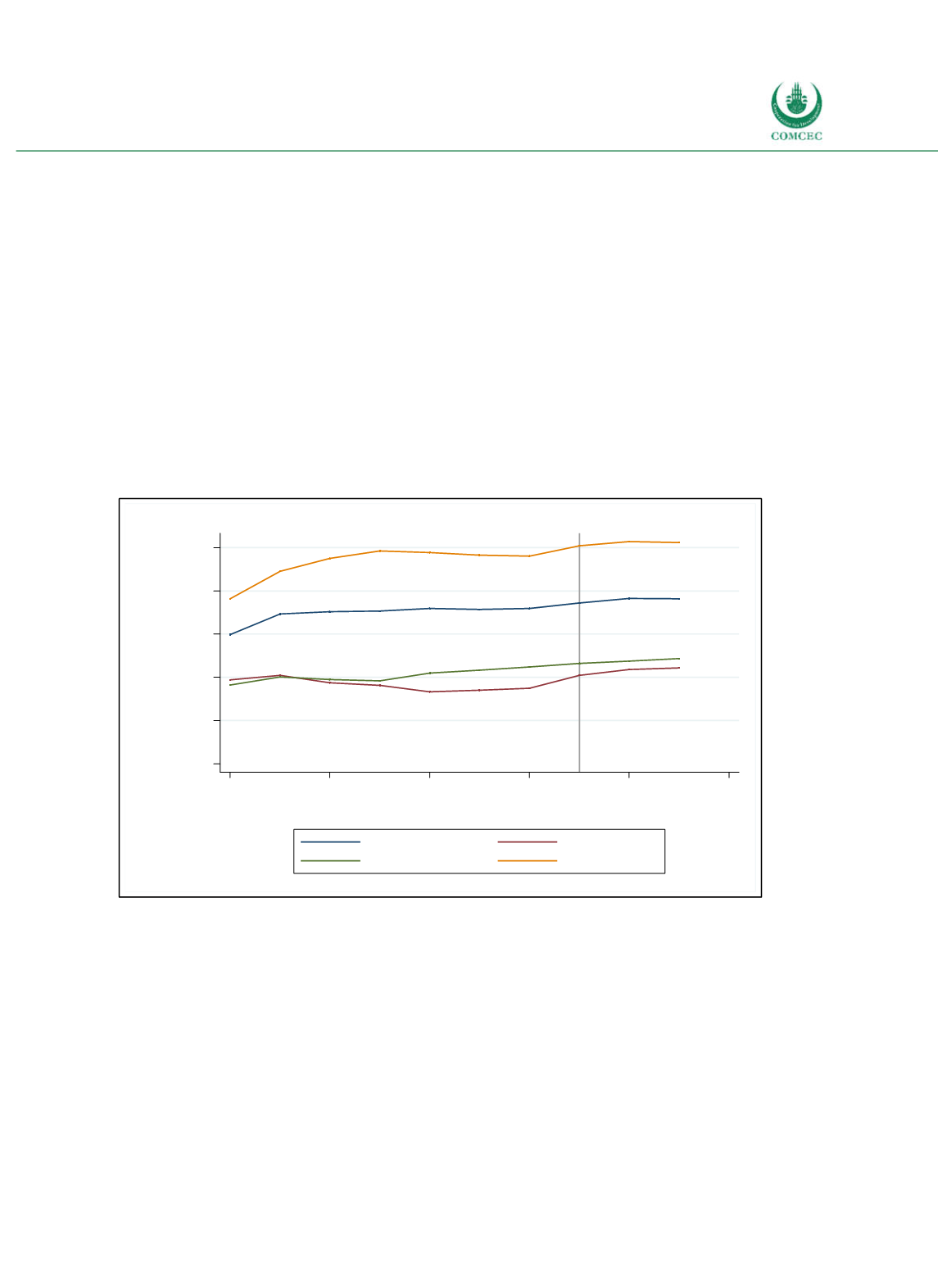

Figure 22 zooms into the more recent period starting in 2008 and presents debt classified

according to income level. Average debt ratios in highincome countries are more than twice as

large as in middleincome and lowincome countries. Debt crises and financial crises in many

advanced countries are responsible for the debt increases until 2011; ratios in middleincome

and lowincome countries, in turn, remained relatively stable.

Figure 2-2: Gross Public Debt Worldwide Since 2008

Sources: WEO (2016), calculations by the Ifo Institute.

Figure 23 provides an alternative way to illustrate global debt developments: it shows the

unconditional distribution of sovereign debt levels (in % of GDP) in selected years for those

countries for which data is available in the IMF World Economic Outlook (WEO 2016).

Histograms and kernel densities portray an increasing concentration of sovereign debt ratios

since 2010 compared to the previous period. While more countries are concentrated at values

around 50%, the number of outliers with high debt levels has also risen. The mean is always

larger than the median. Nevertheless, the standard deviation has decreased. The distribution

has become steeper with more mass being concentrated in the center.

0

20

40

60

80

100

Share of GDP (in %)

2008

2010

2012

2014

2016

2018

Year

All

Low income

Middle income

High income

Projections