Improving Public Debt Management

In the OIC Member Countries

28

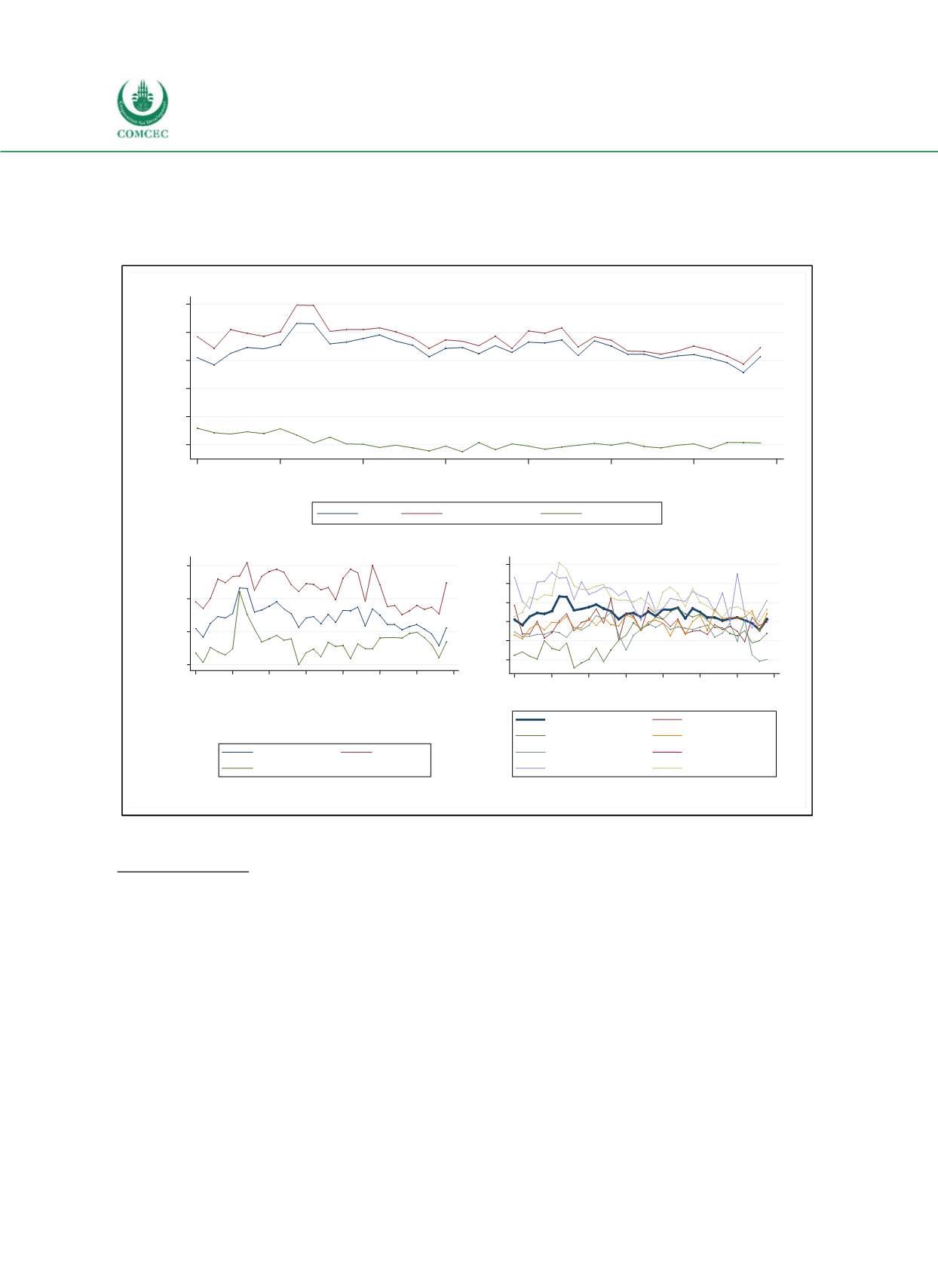

multilateral and intergovernmental agencies and governments. The maturity of new contracts

is significantly larger in lowincome countries than in middleincome countries, which might

be explained by the larger share of official creditors in lowincome countries.

Figure 2-9: Maturity of New External Public Debt Commitments Worldwide

Sources: World Bank (2016) International Debt Statistics, calculations by the Ifo Institute.

Interest Rate Risk

Interest rate types

Longterm debt allows governments to reliably forecast and plan the costs of outstanding debt

in the medium term. However, this only holds if interest rates are fixed. If interest rates are

variable, e.g. reset annually, longterm contracts reduce the rollover risk, but not the risk of

rising costs of debt. Figure 210 shows the share of loans with fixed interest rates in total loans.

Since 2000, lowincome countries have relied almost exclusively on loans with fixed rates.

Albeit small, the share of variable rate contracts is highest in highincome countries. The

classification by regions shows a convergence to fixed interest rates over the past 15 years.

Latin America, which relied on a significant share of loans with variable interest rates until the

mid1990s, has moved to fixed rate financing. The sharp drop in the share of fixed rate loans in

South Asia in the second half of the 1990s can be explained by the Asian financial crisis of

1997/98. When credit ratings had improved afterwards, these countries retuned to fixed rate

financing.

5

10

15

20

25

30

In years

1980

1985

1990

1995

2000

2005

2010

2015

Year

All

Official creditors

Private creditors

15

20

25

30

In years

1980 1985 1990 1995 2000 2005 2010 2015

Year

All

Low income

Middle income

10

15

20

25

30

35

In years

1980 1985 1990 1995 2000 2005 2010 2015

Year

All

East Asia, Pacific

Europe, Central Asia

Latin America & Carib.

MENA

North America

South Asia

Sub-Saharan Africa