Improving Public Debt Management

In the OIC Member Countries

24

country groups (10.4% in 2015). It is noted that many countries in this region belong to the

OIC.

2.1.3

Debt Structures

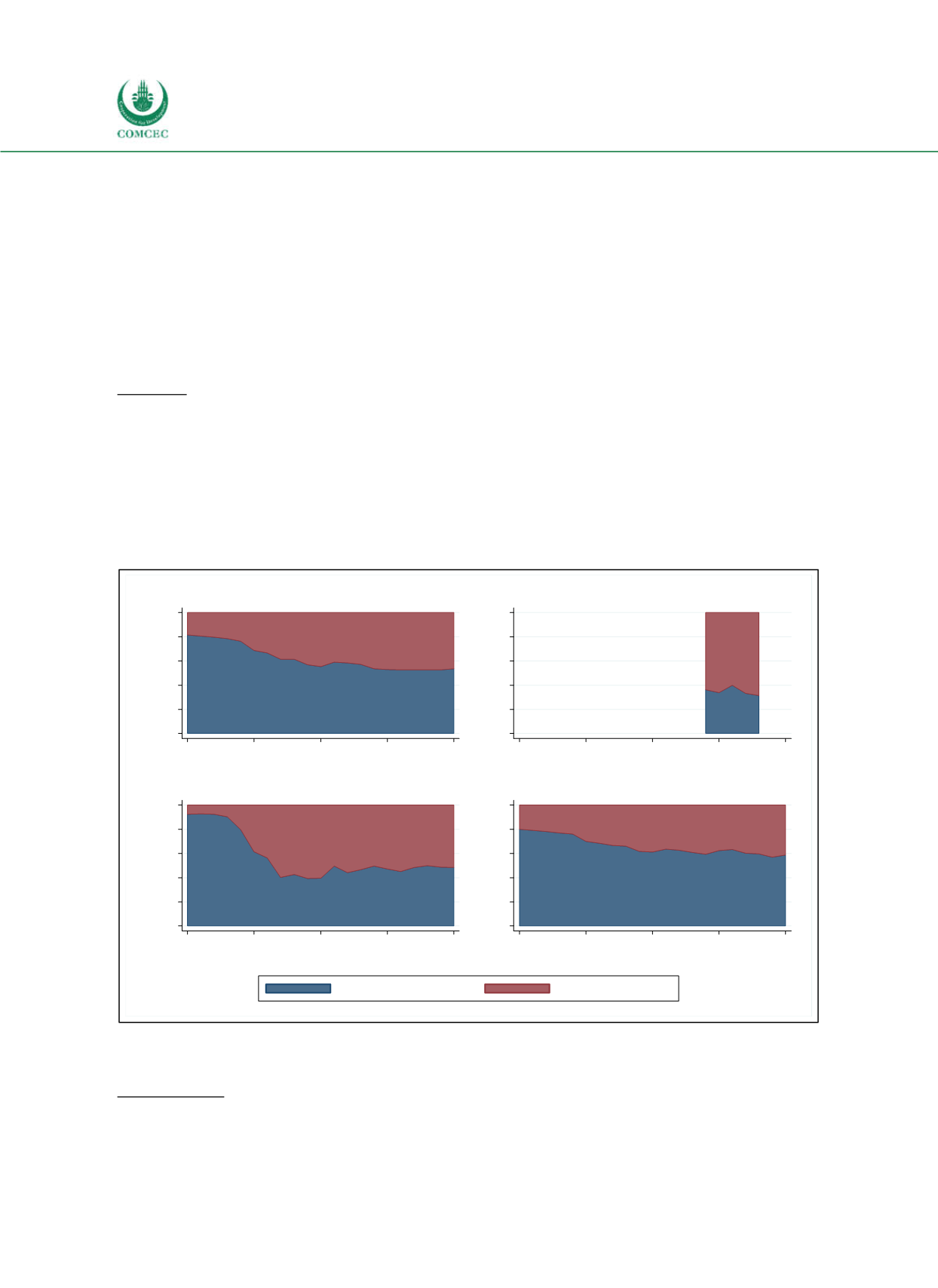

When evaluating fiscal sustainability, key parameters to consider are debt levels and budget

deficits, which enter the intertemporal budget constraint. Besides these “hard” figures, the

structure of public debt provides important information about the risks entailed in public debt.

Consequently, by turning to an analysis of debt structures, a picture of the maturity structure,

currency composition and interest rate types of public debt is drawn. In addition, it will be

distinguished between domestic and foreign as well as private and official creditors.

Creditors

Who lends to governments? Financial resources might be provided by domestic or foreign

creditors. As shown in Figure 25 there is a substantial difference in the residence of creditors

between different income groups: Highincome countries rely mostly on domestic creditors

(59% in 2015), middleincome countries divide their financing needs equally between both

types of investors and lowincome countries only sold 31% of their liabilities to domestic

creditors.

Figure 2-5: Creditor Structure of Public Debt Worldwide

Sources: IMF and World Bank (2016), Quarterly Public Sector Debt database, calculations by the Ifo Institute.

Note: Due to missing data the graph for low income countries covers a shorter time period only.

Grant Element

Individual countries may be unable to finance themselves on international capital markets.

Macroeconomic instability, political uncertainty and legal enforcement problems might deter

0

20

40

60

80

100

%

1995

2000

2005

2010

2015

Year

All income levels

0

20

40

60

80

100

%

1995

2000

2005

2010

2015

Year

Low income

0

20

40

60

80

100

%

1995

2000

2005

2010

2015

Year

Middle income

0

20

40

60

80

100

%

1995

2000

2005

2010

2015

Year

High income

Domestic creditors

External creditors