Improving Public Debt Management

In the OIC Member Countries

29

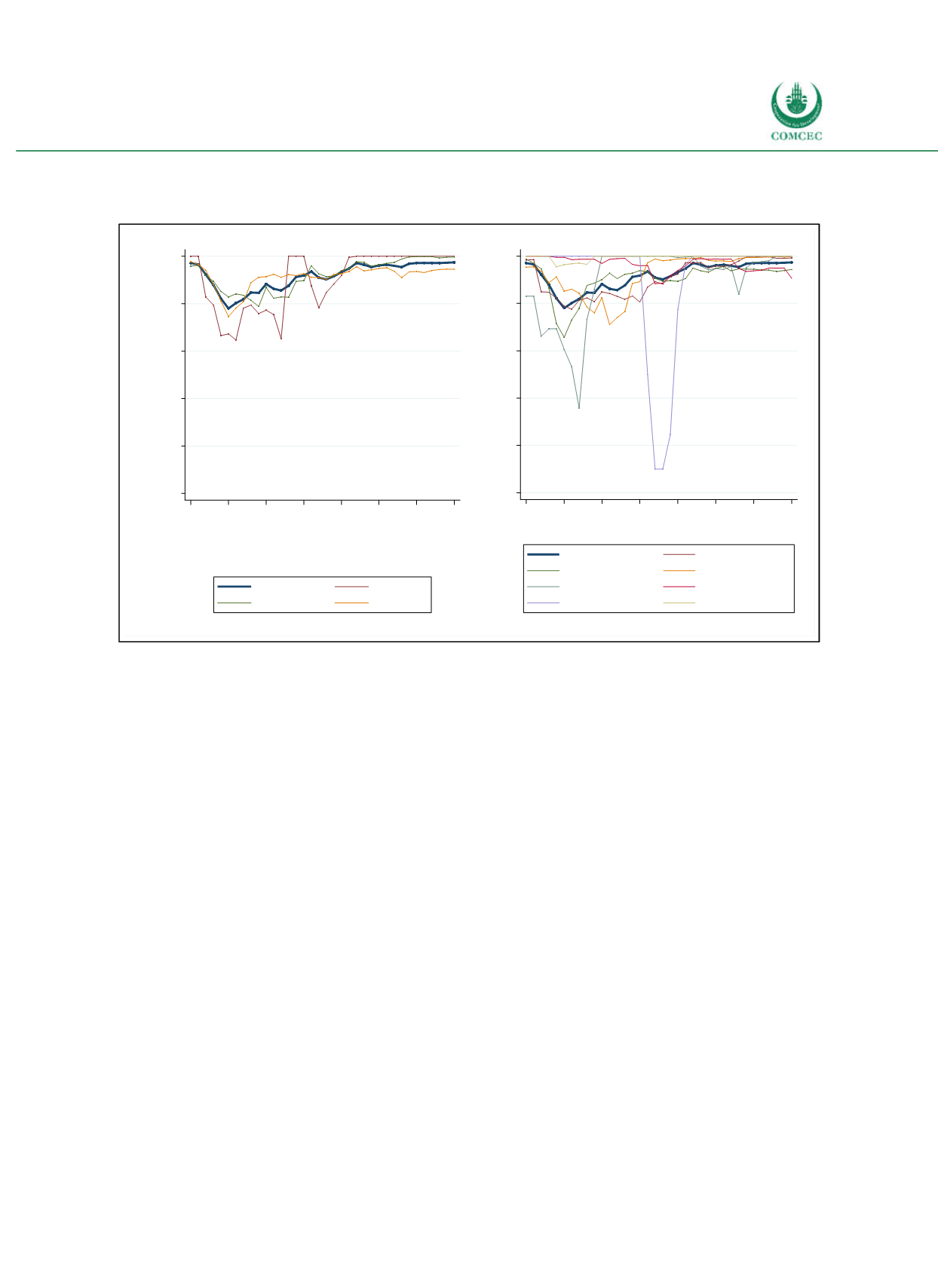

Figure 2-10: Interest Rate Types Worldwide

Share of fixed interest rate credits in total credits (in %)

Sources: BIS Debt Securities Statistics (2016), calculations by the Ifo Institute.

Due to missing data the graphs for Sub-Saharan Africa, South Asia & MENA (right panel) cover a shorter time

period only.

Interest rates

Interest rates determine the costs of outstanding debt. Besides the level of debt, interest rates

influence the difference between general and primary public balance. Figure 211 highlights

that financing costs have decreased over time as interest rates follow the global falling trend.

Interestingly, the average interest rate is often lower than the U.S. lending rate to the private

sector. This might be explained be the importance of concessional lending to governments. The

separation between official and private creditors supports this hypothesis: Official creditors

lend at preferential rates. While the difference between private and official creditors was

substantial in the 1980s, it has become less pronounced since then. Lowincome countries face

lower interest rates than middleincome countries, because they have greater access to

concessional lending.

0

20

40

60

80

100

%

1980 1985 1990 1995 2000 2005 2010 2015

Year

All

Low income

Middle income

High income

0

20

40

60

80

100

%

1980 1985 1990 1995 2000 2005 2010 2015

Year

All

East Asia, Pacific

Europe, Central Asia

Latin America & Carib.

MENA

North America

South Asia

Sub-Saharan Africa