Improving Public Debt Management

In the OIC Member Countries

25

international investors to provide financial resources. These impediments are reinforced if the

borrower is a sovereign whose likelihood to repay does not only depend on its abilitytorepay,

but also on its willingnesstorepay. Hence, the share of concessional debt in total public debt

is a key figure in a country’s public debt structure. It shows whether a country is able to issue

bonds on domestic or external markets or whether it depends on the willingness of

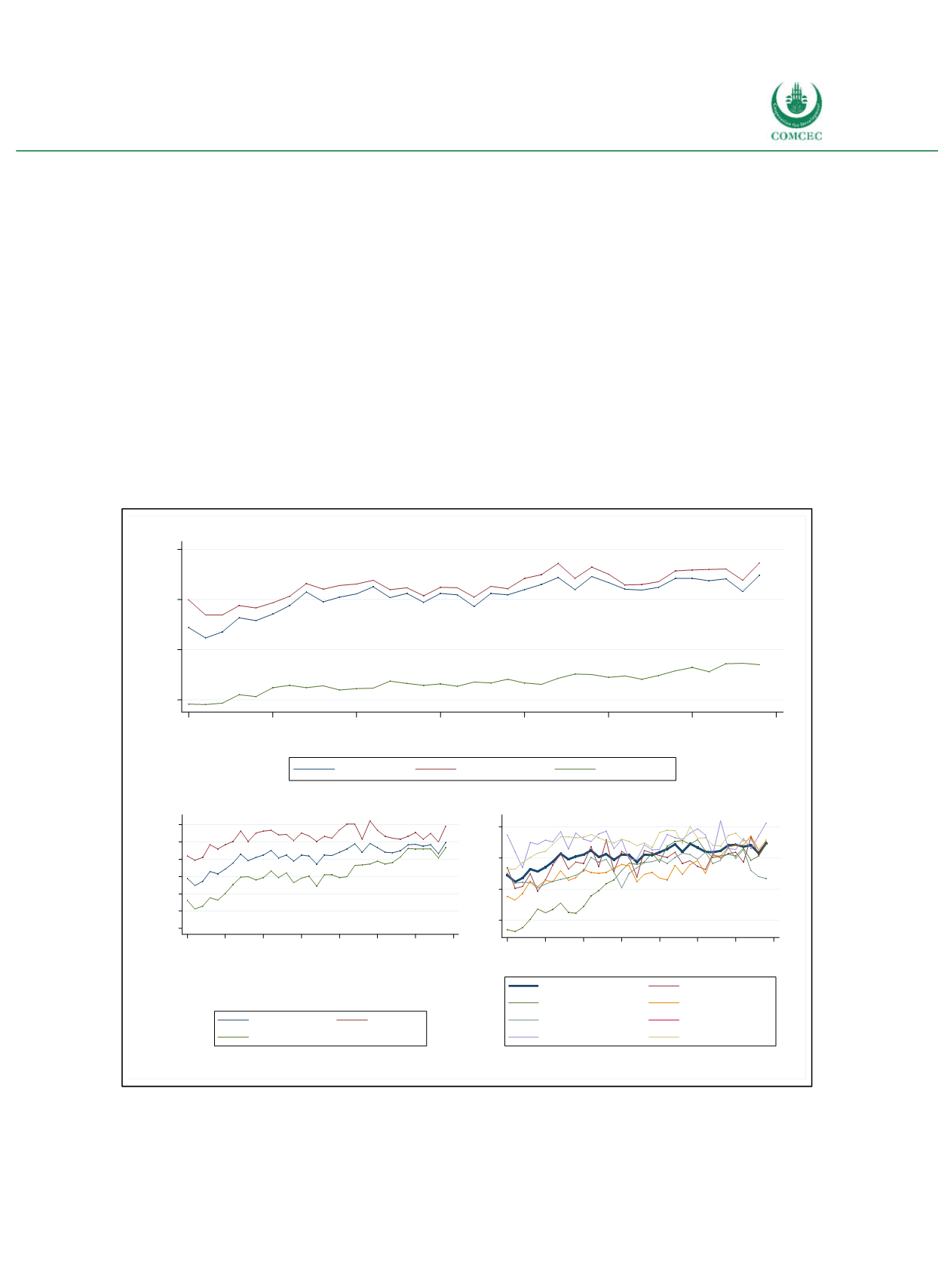

international institutions and other governments to supply funds. Figure 26 displays the

average grant element inherent in public debt. The grant element of a loan is a measure of its

concessionality. It is calculated as the difference between its nominal face value and the sum of

the discounted future debtservice payments (net present value) of the borrower, expressed as

a percentage of the nominal value of the committed loan. Hence, a loan entails a grant element

whenever the interest rate charged for a loan is lower than the discount rate. The grant

element has been rising over time and amounted to 50% in 2014. While grants are primarily

extended by official creditors, private credit contracts also have a small grant element on

average. Grants to lowincome countries are more generous than to middleincome countries.

Grants have been above the global average in SubSaharan Africa and the MENA countries.

Figure 2-6: Grant Element Worldwide

Sources: World Bank (2016) International Debt Statistics, calculations by the Ifo Institute.

0

20

40

60

%

1980

1985

1990

1995

2000

2005

2010

2015

Year

All creditors

Official creditors

Private creditors

0

10

20

30

40

50

60

%

1980 1985 1990 1995 2000 2005 2010 2015

Year

All

Low income

Middle income

0

20

40

60

%

1980 1985 1990 1995 2000 2005 2010 2015

Year

All

East Asia, Pacific

Europe, Central Asia

Latin America & Carib.

MENA

North America

South Asia

Sub-Saharan Africa