Improving Public Debt Management

In the OIC Member Countries

20

economic size of a country. To some extent, GDP may be regarded as a measure of the tax

potential of a country.

1

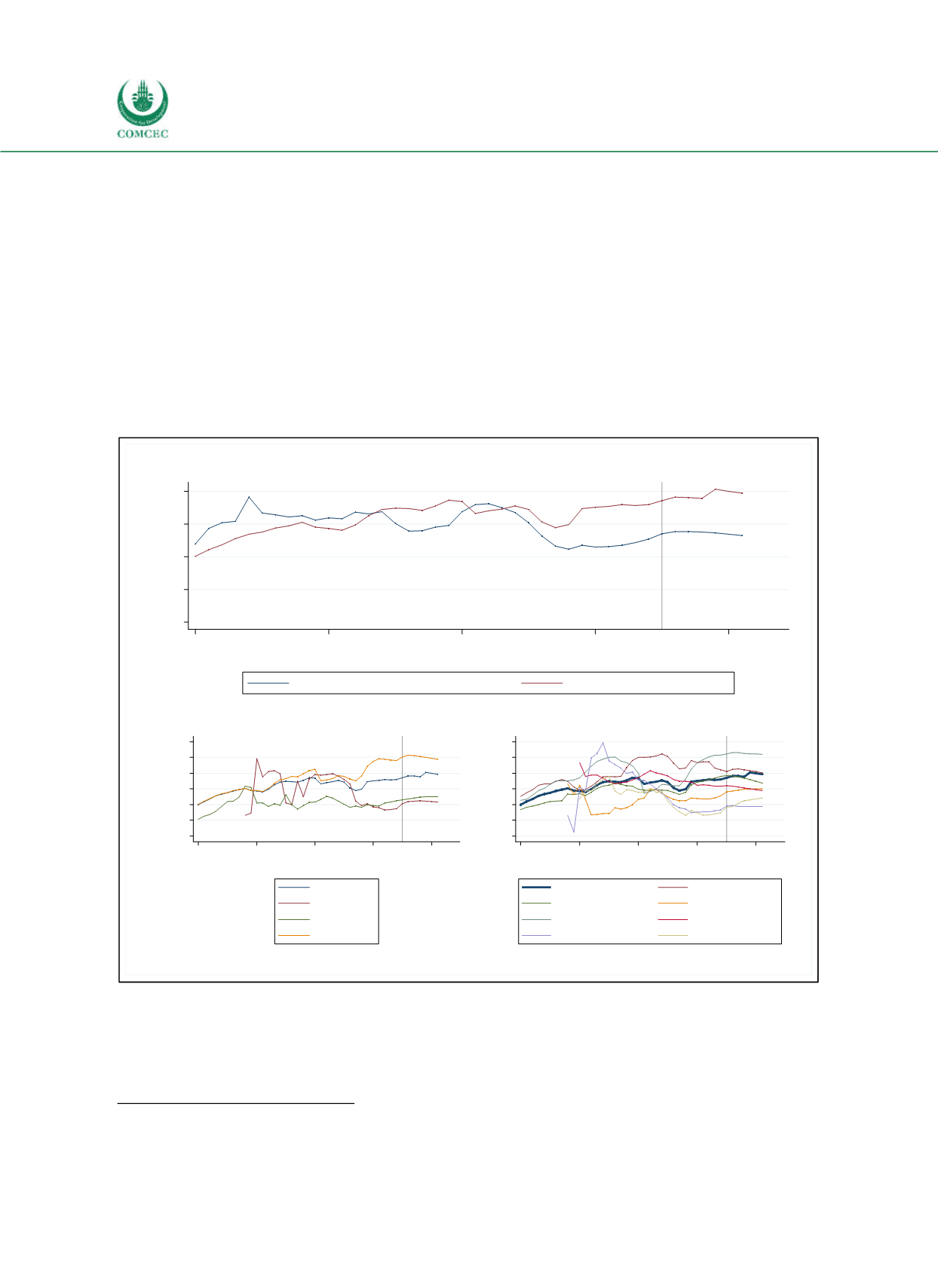

The upper panel of Figure 21 shows two different measures of average debt levels. The blue

line corresponds to the unweighted average of public debt relative to GDP across countries.

The red line is a measure of global indebtedness. It displays the ratio of the worldwide sum of

government debt relative to world GDP. Over the period of consideration, debt levels have

been located between 40% and 80% of GDP with a tendency to increase. Exceptions are the

periods just before and during the global financial crisis and the European sovereign debt

crisis. Debt levels are projected to rise further. While the current average debt level across

countries (blue line) lies below its mean across the period, debt has reached an

unprecedentedly high level if expressed as the aggregated worldwide level (red line).

Figure 2-1: Gross Public Debt Worldwide

Sources: WEO (2016), calculations by the Ifo Institute.

The lower panel of Figure 21 shows the evolution of debt for different countryincome groups

(left) and for different regions (right). In most years, relative sovereign debt in highincome

countries is larger than in middleincome and lowincome countries. This difference has

1

Alternatively, sovereign debt might be scaled by government revenues. This variable would provide information on

government’s ability to repay sovereign debt in the future.

0

20

40

60

80

Share of GDP (in %)

1980

1990

2000

2010

2020

Year

Public debt over GDP averaged across countries

Worldwide public debt over world GDP

Projections

0

20

40

60

80

100

120

Share of GDP (in %)

1980

1990

2000

2010

2020

Year

All

Low income

Middle income

High income

Projections

0

20

40

60

80

100

120

Share of GDP (in %)

1980

1990

2000

2010

2020

Year

All

East Asia, Pacific

Europe, Central Asia

Latin America & Carib.

North America

South Asia

Sub-Saharan Africa

MENA without Jordan

Projections