National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

21

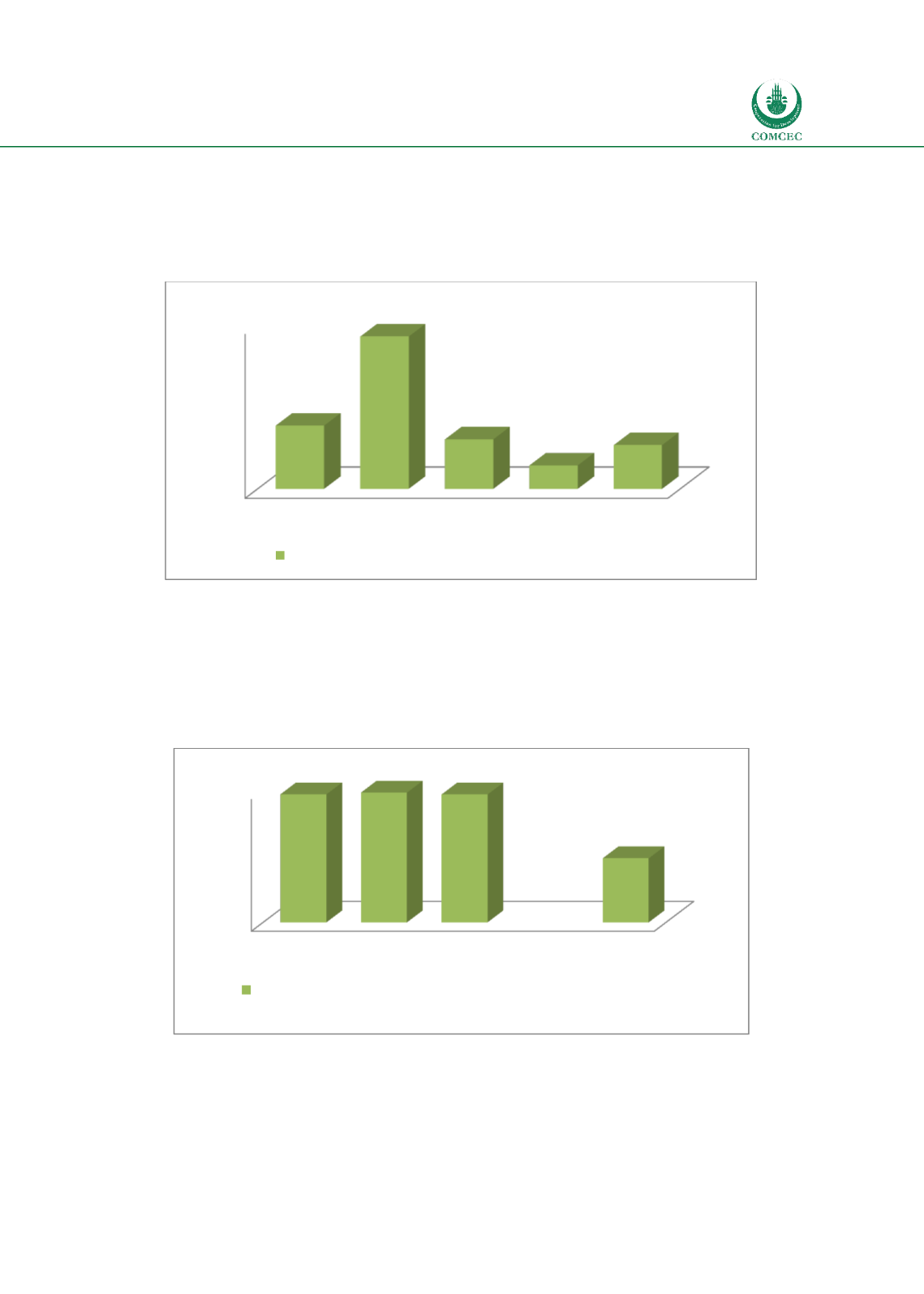

26.8%, which is lower than the world average (38.6%), high income countries (93%), and

middle income countries (30.3%). Though the OIC MCs score better than the average for low

income countries (14.3%), the number indicates that access to financial institutions in OIC MCs

is relatively poor.

Chart

2.8: Financial Institutions-Access

Source: Calculated from World Bank Global Financial Development database

Access to financial markets is estimated by the ratio of market capitalization excluding the top

10 companies to total market capitalization. While no data is available for low income

countries, Chart 2.9 shows that the average access to financial markets for 11 OIC MCs (42.3%)

is lower than that of the average for the world (49.6%), high income countries (19.8%), and

middle income countries (49.6%), indicating a relatively poor access to financial markets.

Chart

2.9: Financial Markets-Access

Source: Calculated from World Bank Global Financial Development database

Efficiency

Efficiency of financial institutions is measured by the spread between lending rate and deposit

interest rate. The average of lending-deposit spread for 30 OIC MCs (7%) is higher than that of

0

20

40

60

80

100

World

High Middle

Low OIC

38,6

93,0

30,3

14,3

26,8

Account at a formal financial institution (% age 15+)

35

40

45

50

World

High Middle

Low OIC

49,6

49,8

49,6

42,3

Market capitalization excluding top 10 companies to total market

capitalization (%)