National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

16

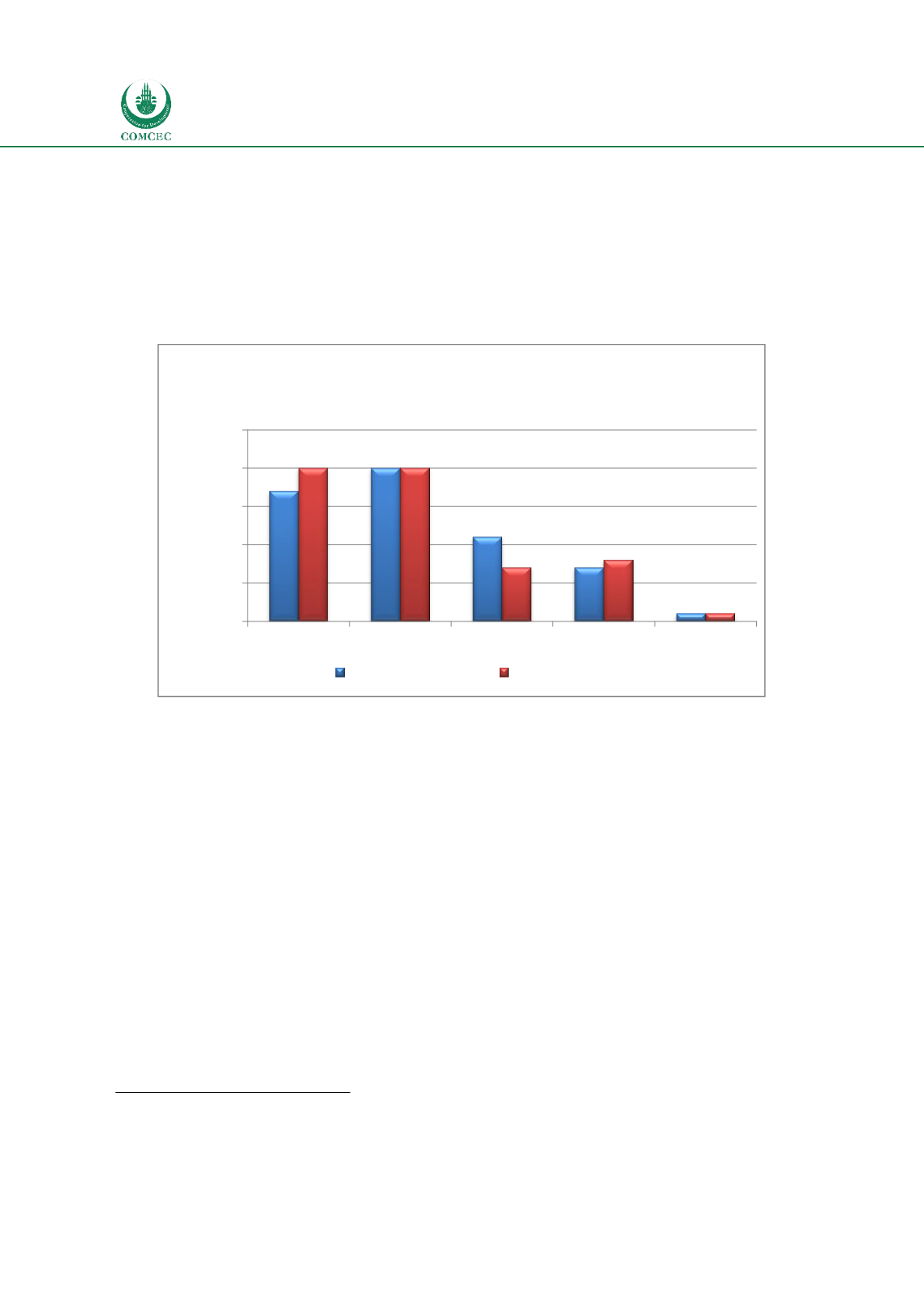

Chart 2.2 shows the breakdown of the percentile rankings of OIC countries for governance

indicators into different quintile groupings. While 17 countries have rankings falling in the

bottom quintile (20 percentile) for Regulatory Quality, 20 countries fall in this category for

Rule of Law. Similarly, 20 OIC MCs have percentile rankings that fall in the 20%-40% range for

both indicators. A few OIC MCs have relatively better rankings for the governance indicators

with one country being in the top 20 percentile for both indicators and 7 countries falling in

the 60%-80% range for Regulatory Quality and 8 countries being in this range for Rule of Law.

Chart

2.2: Distribution of Regulatory Quality and Rule of Law in OIC MCs (2014)

Source: Calculated from World Bank World Governance Indicators Database

2.2. Financial Sector in OIC Member Countries: Size and Characteristics

The status of the financial sector in OIC MCs relative to countries in different income groupings

and the world is presented under two broad categories. First, the overall development of the

financial sector is examined by assessing the relative size of the banking, insurance and capital

market sectors. Second, the status of the financial sector is analyzed in terms of four

characteristics identified in the Global Financial Development Report by World Bank (2016).

Specifically, the depth, access, efficiency and stability of financial institutions and financial

markets of OIC member countries are compare relative to the averages of countries in different

income groupings.

Most of the data used in this section is collected from the Global Financial Development

database of the World Bank for the year 2013.

5

The average figures for different variables for

OIC member countries (MCs) are calculated as a mean of the values of countries for which the

data is reported. As the information for all OIC MCs is not available for different variables, the

5

Most of the data for different variables are from 2013. When information for 2013 was absent, data from

2012 or 2011 were used. The data for ‘Account at a formal financial institution (%age 15+)’ is from 2011.

17

20

11

7

1

20

20

7

8

1

0

5

10

15

20

25

Bottom 20% 20%-40% 40%-60% 60%-80% 80%-100%

No. of Countries

Regulatory Quality Rule of Law