National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

20

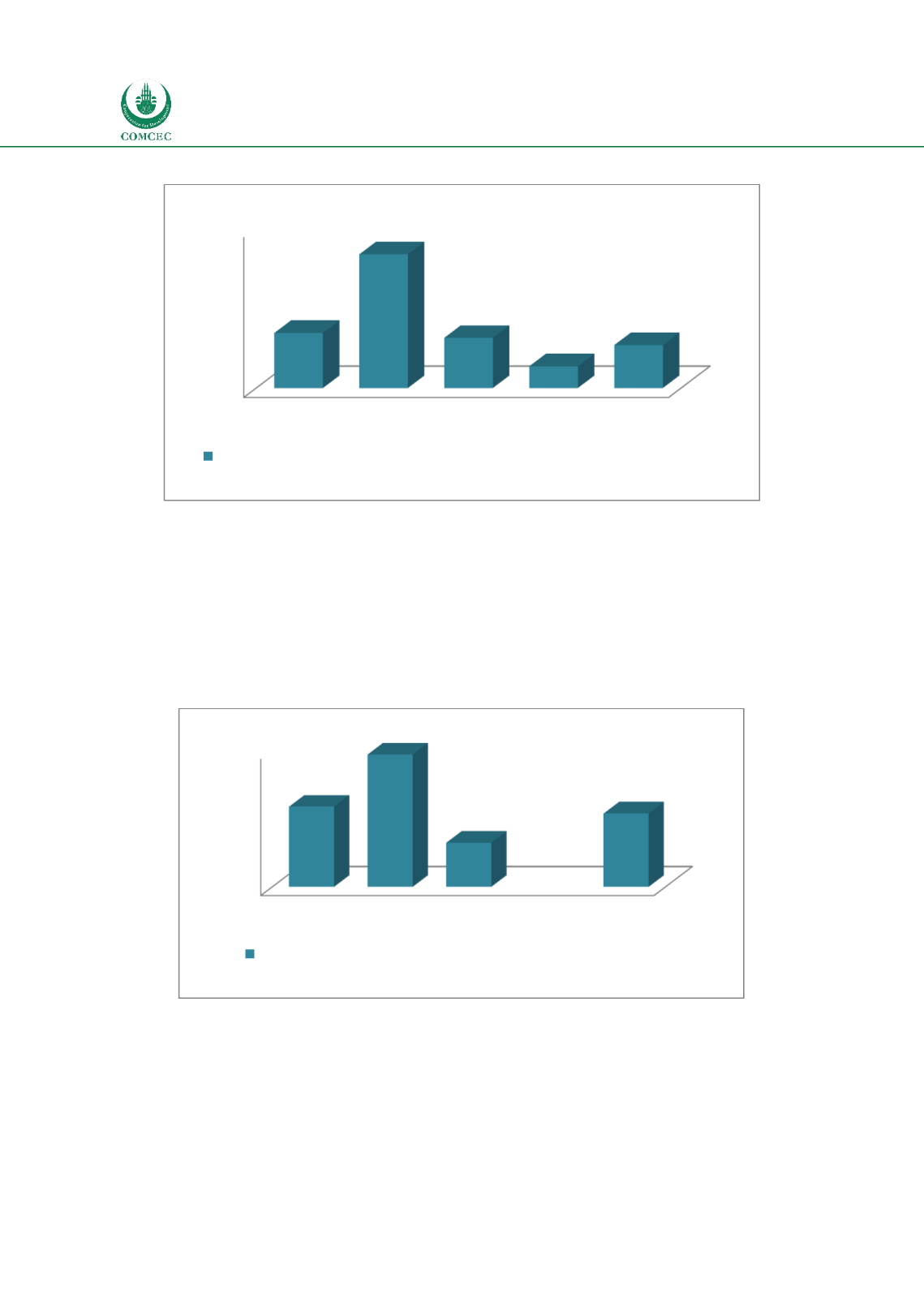

Chart

2.6: Financial Institutions-Depth

Source: Calculated from World Bank Global Financial Development database

The depth of financial markets is measured by the sum of total stock market capitalization and

outstanding domestic private debt securities as a percentage of GDP. Chart 2.7 shows that the

average depth of financial markets for OIC MCs is 53.9%, which is lower than the world

average (58.9%) and high income countries (97.3%). The financial markets in OIC MCs appear

to be relatively deeper than the average of middle income countries (32.4%). However, there is

a need for caution in reading this result as the average may not be representative for all

countries with only four countries having data on private debt securities.

Chart

2.7: Financial Markets-Depth

Source: Calculated from World Bank Global Financial Development database

Access

Access to financial institutions is approximated by measuring the percentage of adults (age of

more than 15 years) who have accounts at a formal financial institution such as a bank, credit

union or other financial institution (such as cooperative, microfinance institution or post

office). Chart 2.8 shows that the average access to financial institutions for 49 OIC MCs was

0

20

40

60

80

100

120

World

High

Middle

Low OIC

41,5

100,5

37,7

16,4

32,3

Private credit by deposit money banks and other financial institutions to GDP

(%)

0

20

40

60

80

100

World

High Middle

Low OIC

58,9

97,3

32,4

53,9

Stock market capitalization + Outstanding domestic private debt

securities to GDP (%)