National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

27

finance has diversified and has grown rapidly to become a significant global sector. The

evolution of different Islamic financial institutions over time is shown in Table 2.2 and key

milestones are discussed below.

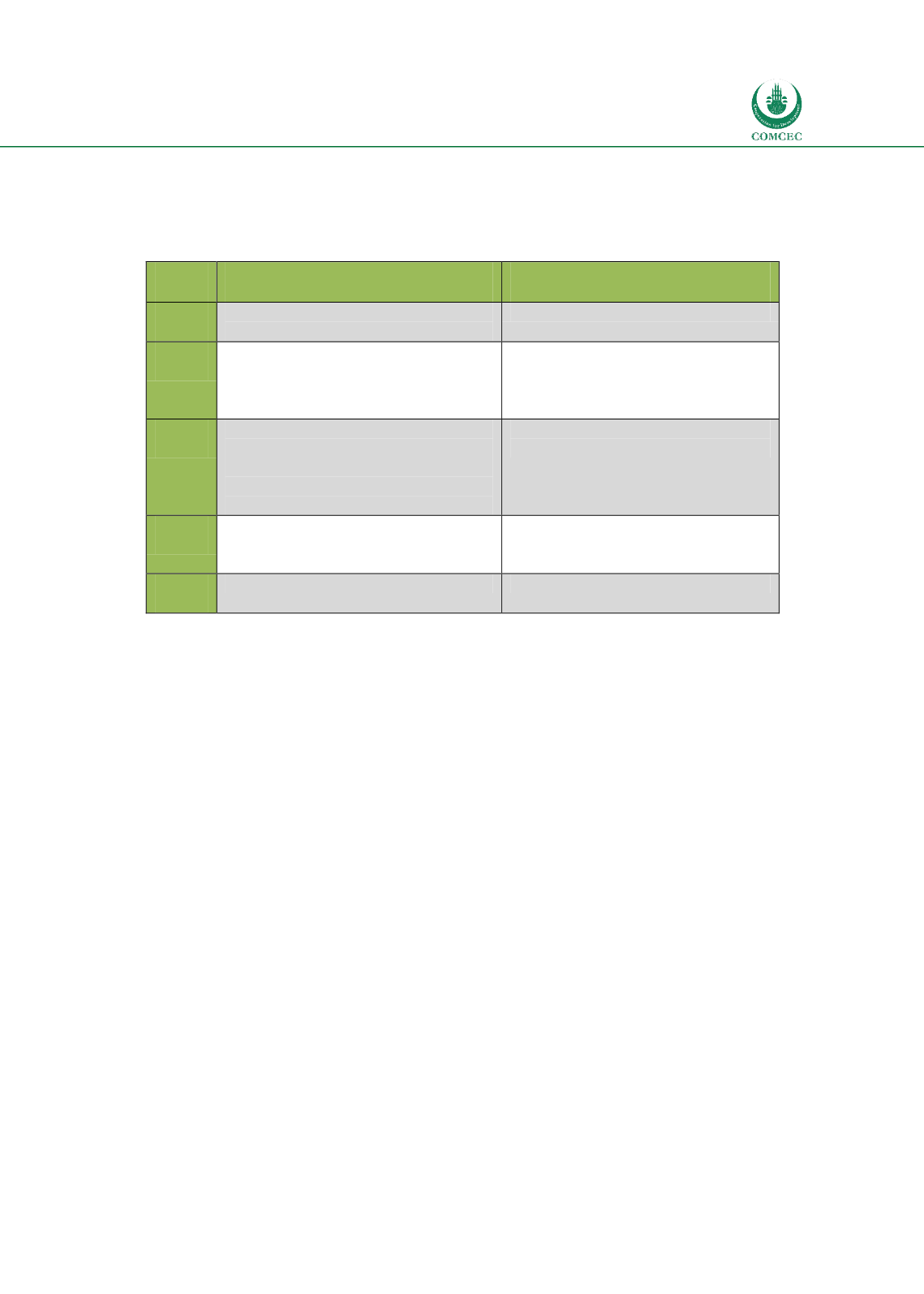

Table

2.2: Evolution of Islamic Financial Institutions and Markets

Period Financial Institutions

Financial Markets

1970s

Banks

Takaful

1980s

Retakaful

Mudarabah companies

Microfinance institutions

Cooperatives/Credit Unions

Mutual Funds

1990s

Private Equity & Venture Capital

Firms

Project finance

Pawn shops

Investment banks

Islamic indices

Corporate sukuk

2000s

Awqaf Properties Investment Fund

Infrastructure fund

Leasing companies

Sovereign sukuk

Hedge funds

Islamic REITs

2010s

Crowd funding platforms

1970s:

After the formation of the Organization of Islamic Conference (OIC) in 1973, the

Islamic Development Bank (IDB) was established in 1975 in Jeddah, Saudi Arabia. In the same

year, the first Islamic commercial bank, Dubai Islamic Bank, was established in UAE. Realizing

that conventional insurance had objections from a Shariah point of view, two Islamic insurance

companies were launched in 1979, the Islamic Arab Insurance Co. (IAIC) in UAE and the

Islamic Insurance Co. in Sudan.

1980s:

The 1980s witnessed the launch of a number of non-bank financial institutions.

Modaraba companies were established in Pakistan after the promulgation of the Modaraba

Ordinance 1980. One of the earlier Islamic microfinance institutions was Al-Fallah Aam

Unnayan Sangstha in Bangladesh, established in 1989. In non-Muslim countries where banking

laws did not allow the establishment of Islamic banks, Islamic cooperatives were introduced.

The first Islamic cooperative in the Western world, Ansar and Islamic Co-operative Housing

Corporation Ltd. was established in Toronto, Canada in 1981 to provide Shariah compliant

home financing to Muslims of the country. The Muslim Credit Union was established in

Trinidad and Tobago in 1983 and Pattani Islamic Saving Cooperative started operations in

1987.

Bank ABC, an investment bank based in Bahrain launched its Islamic services in 1987, thus

starting Islamic investment banking. With the expansion of takaful companies, retakaful

companies emerged in the 1980s (NuHtay et. al. 2014). Furthermore, larger Islamic financial

institutions also emerged during the 1980s that established other financial institutions such as

banks, takaful companies and investment banks in different parts of the world. One the first of

these institutions was the Dar al Maal Islami Trust that was established in Switzerland in 1981.