National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

17

number of countries used to estimate the OIC MCs average is identified when discussing the

results.

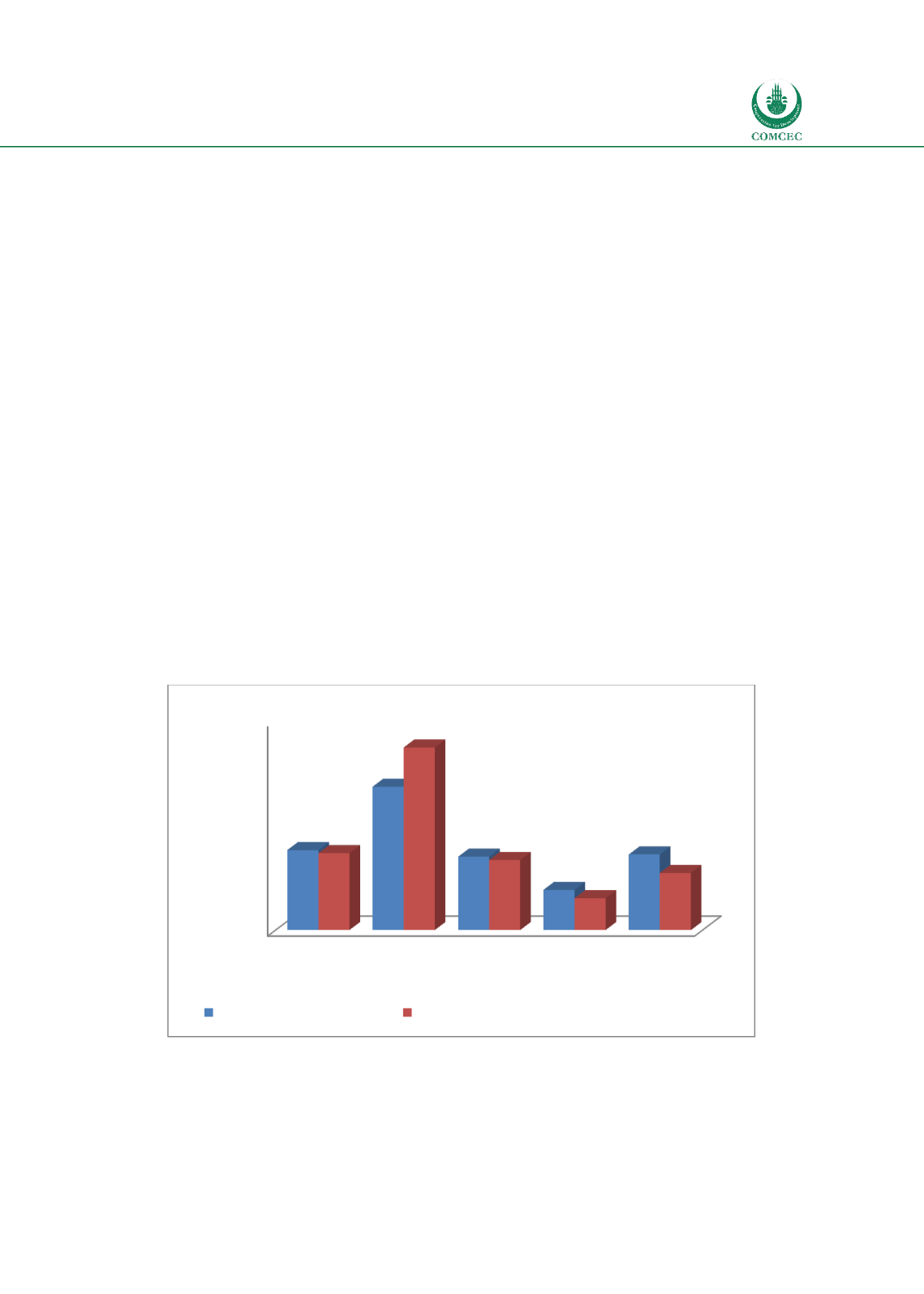

2.2.1. Relative Size of the Financial Sector

The size of the financial industry relative to the GDP is a good indicator of the sector’s

development. The relative size of the banking, insurance and capital markets of OIC member

countries and the average for world, high, middle and low income groupings are presented

below.

Banking Sector

Two variables used to assess the size of the banking sector are demand, time and savings

deposits in deposit money banks as a share of GDP (bank deposits as % to GDP) and claims on

the domestic real nonfinancial sector by deposit money banks as a share of GDP (domestic

credit to private sector as a % of GDP). Chart 2.3 shows that the average percentage of bank

deposits for 49 OIC MCs is 43.4% of GDP compared to 45.9% for the world. While the average

for OIC MCs is lower than that of high income countries (82.2%), it is significantly higher than

low income countries (23.1%) and is close to that of middle income countries. However, the

average for credit given to the private sector for 48 OIC MCs is 32% which is lower than the

averages for the world (44.1%), high income countries (104.7%), and middle income countries

(40.2%). These numbers indicate that while the status on the liability side of the banking

sector of OIC MCs is similar to the averages of the world and middle income countries, the

average size on the banking assets financing the private sector is lower.

Chart

2.3: Size of the Banking Sector

Source: Calculated from World Bank Global Financial Development database

0

20

40

60

80

100

120

World

High

Income

Middle

Income

Low

Income

OIC

45,9

82,2

42,1

23,1

43,4

44,1

104,7

40,2

18,3

32,8

Percentage

Bank deposits to GDP (%) Domestic credit to private sector (% of GDP)