National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

24

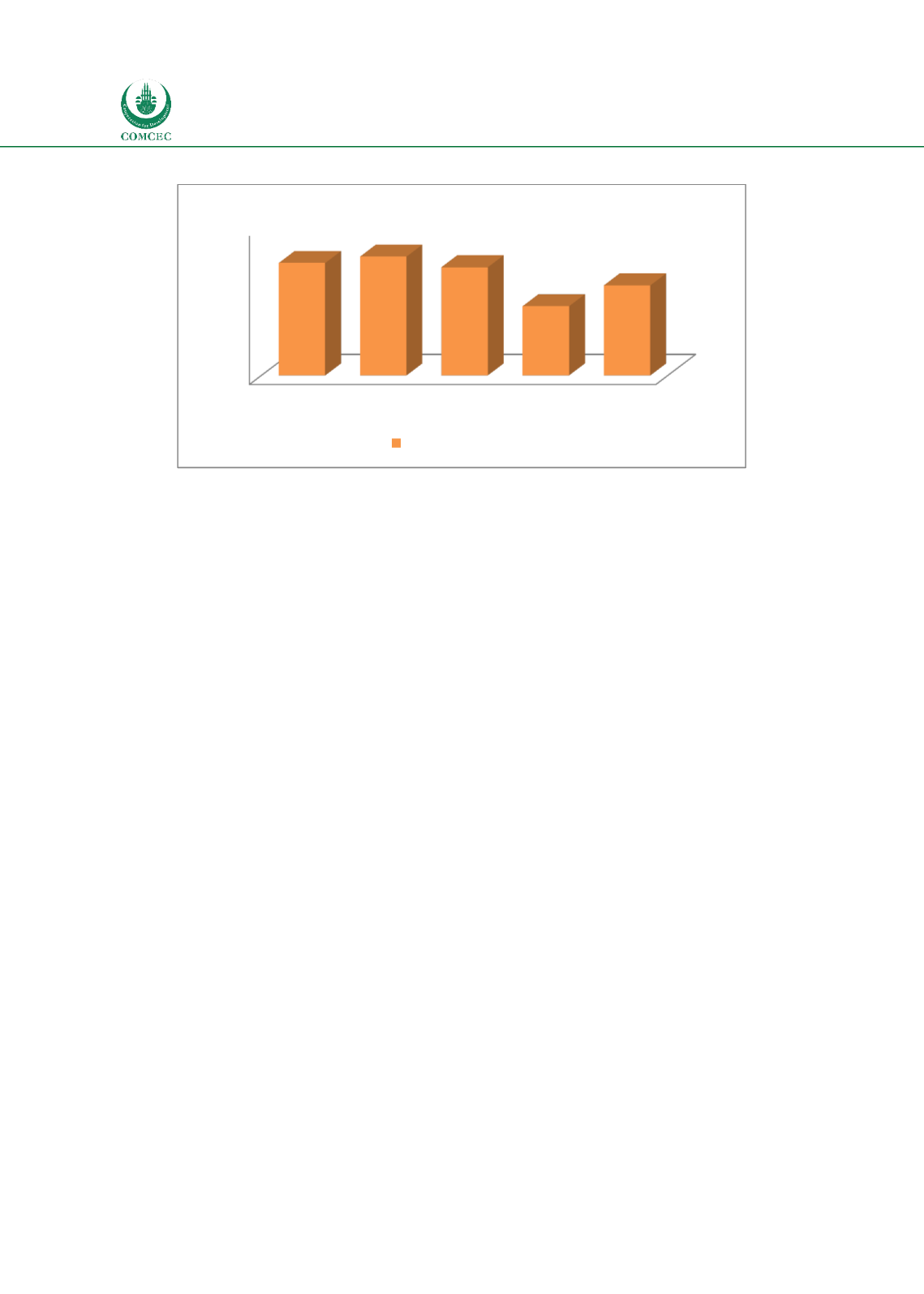

Chart

2.13: Financial Markets-Stability

Source: Calculated from World Bank Global Financial Development database

In summary, the results show that while the banking sector in OIC MCs is close to the world

average, the insurance sector is relatively smaller. Similarly, whereas the debt securities

market is relatively smaller, the equity market has an average size that is larger than the world

average. In terms of various features of the financial sector, the results show that while

financial institutions of OIC MCs have a relatively lower depth, access and efficiency, they are

more stable. The capital markers appear to have depth that is closer to the world average and

have higher efficiency and stability, but their access is lower compared to the world average.

2.3. Islamic Finance: Foundational Principles and Contracts

Islamic law (

Shariah

) is comprehensive and covers various aspects of life including economic

dealings. Other than providing legal rules,

Shariah

also provides moral principles relating to

economic activities and transactions. It defines the founding concepts of an economic system such

as property rights, rationality, and the objectives of economic activities and principles that govern

economic behavior and activities of individuals, markets, and the economy. Al-Ghazali identifies

the essential goals of

Shariah

(

maqasid al Shariah

) to constitute safeguarding the faith (

din

),

self (

nafs

), intellect (‘

aql

), posterity (

nasl

), and wealth (

mal

) (Chapra 2006). The objective of

Islamic commercial law and an Islamic economy would strive to protect and enhance one or

several of the

maqasid

. Specifically, commercial transactions are sanctified and encouraged as

they preserve and support property and progeny (Hallaq 2004).

The implications of

maqasid

in an economy and the financial sector can be viewed in different

ways. One categorization of

maqasid

would be to classify them at the macro/general level

(

maqasid ammah

) and micro/specific level (

maqasid khassah

) (Abozaid 2010, Dusuki 2009,

Dusuki and Bouheraoua 2011). While macro/general

maqasid

relates to the benefits and well-

being of the overall society, micro/specific

maqasid

deals with issues relating to individual

transactions. A brief overview of

maqasid

from these perspectives for the financial sector is

presented below.

Maqasid

at the macro level is similar to the broader goals of Shariah and involve realizing

human wellbeing by enhancing

maslahah

(benefit) on the one hand and preventing

mafsadah

(harm) on the other hand (Laldin and Furqani 2012). Different scholars suggest the macro

0

5

10

15

20

World

High

Middle

Low OIC

15,2

16,1

14,6

9,4

12,2

Stock price volatility