National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

22

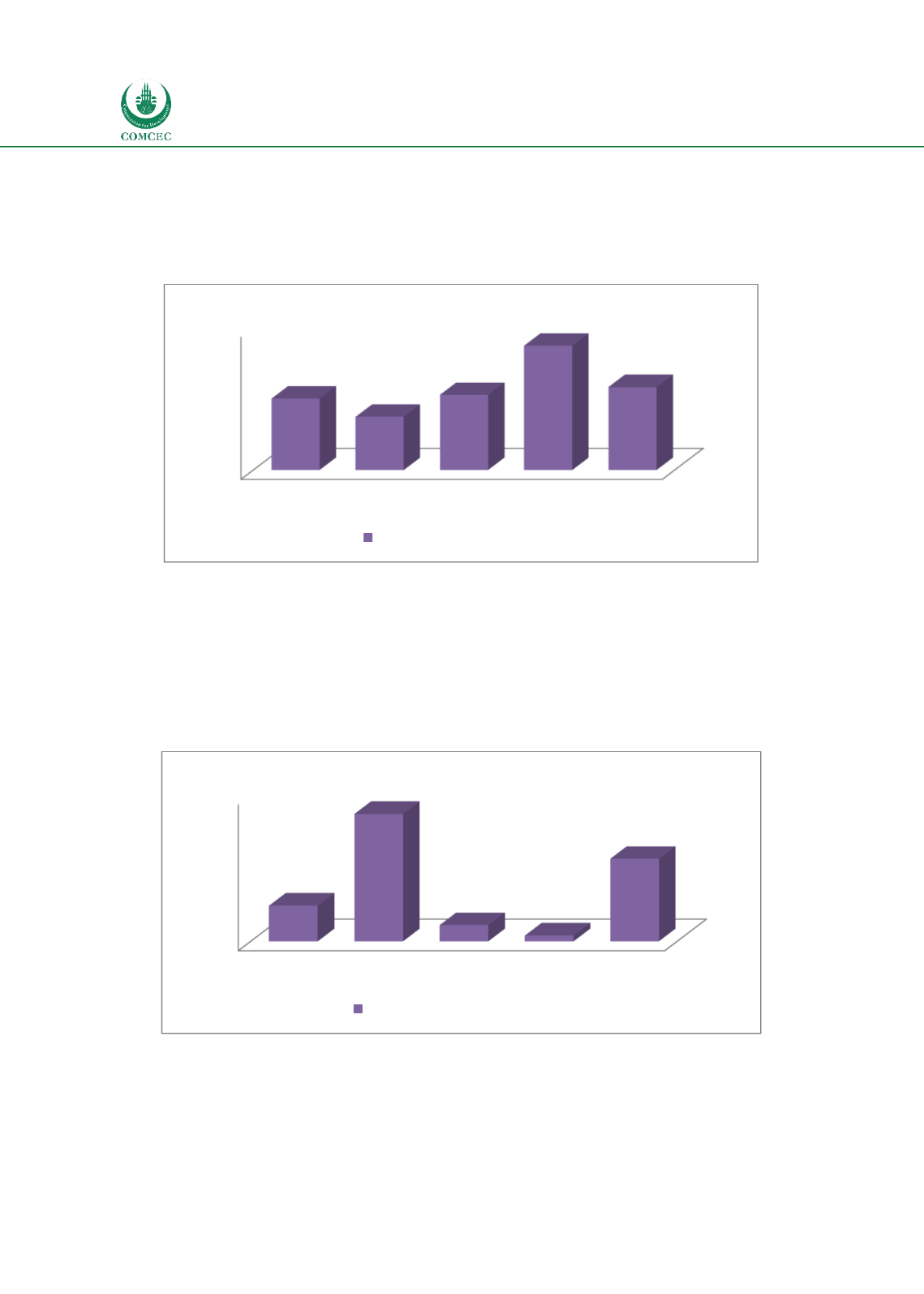

the world (6%), high income countries (4.5%) and middle income countries (6.3%). Although

financial institutions of OIC MCs are more efficient than low income countries (10.5%), the

average for spread shows that they are relatively inefficient compared to that of the other

income groups and the world average.

Chart

2.10: Financial Institutions-Efficiency

Source: Calculated from World Bank Global Financial Development database

Efficiency of financial markets is estimated by the stock market turnover ratio which is

measured by total value of shares traded during the period over the stock market

capitalization. Chart 2.11 shows that the average efficiency of 22 OIC MCs is 28.3%, which is

much higher than the average for the world (12.2%), the middle income countries (5.55) and

low income countries (2%). The results indicate that financial markets in OIC MCs are

relatively more efficient than the world average.

Chart

2.11: Financial Markets-Efficiency

Source: Calculated from World Bank Global Financial Development database

0

2

4

6

8

10

12

World

High

Middle

Low OIC

6,0

4,5

6,3

10,5

7,0

Bank lending-deposit spread

0

10

20

30

40

50

World

High

Middle

Low

OIC

12,2

43,7

5,5

2,0

28,3

Stock market turnover ratio (%)