National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

19

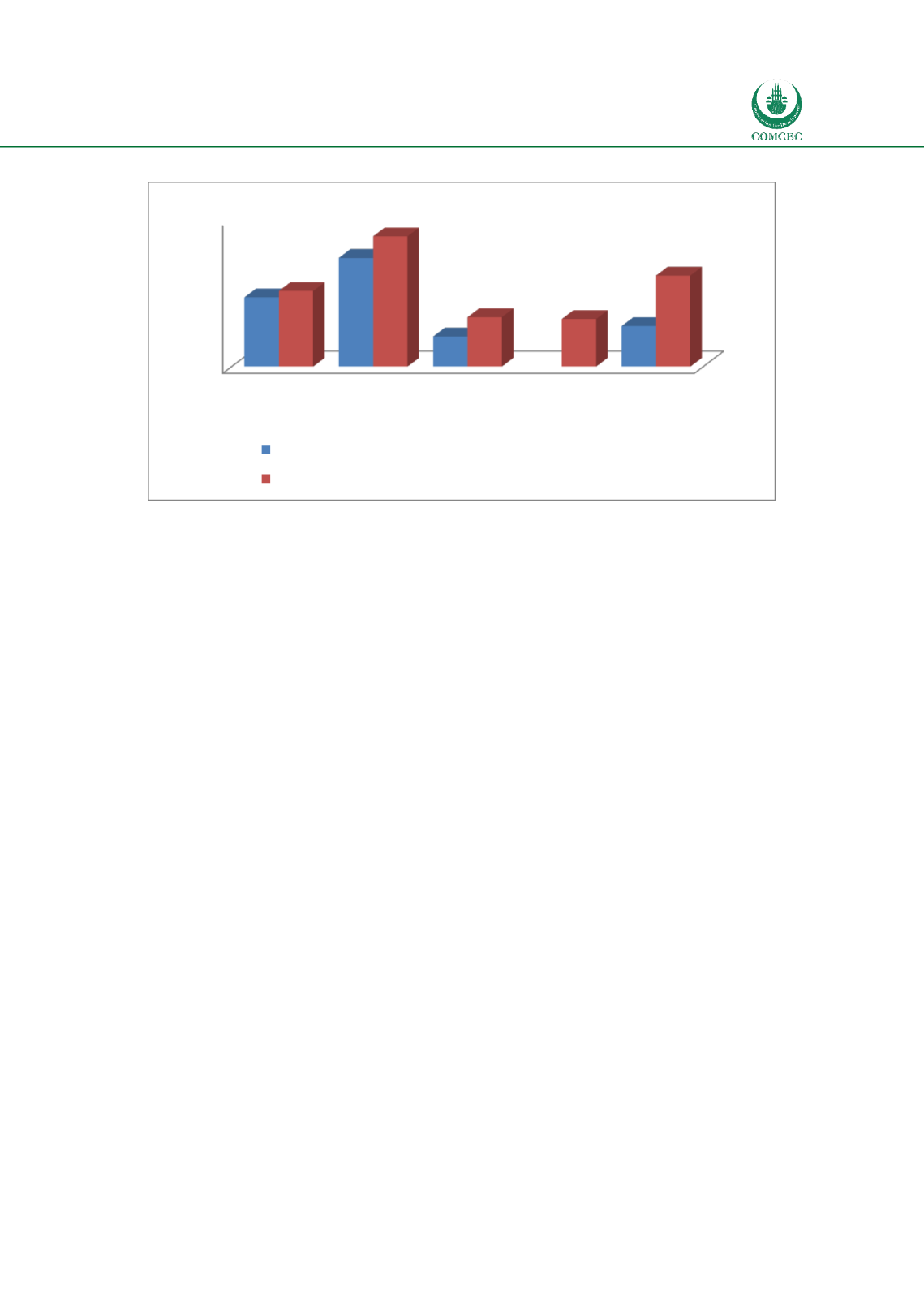

Chart

2.5: Size of the Capital Markets

Source: Calculated from World Bank Global Financial Development database

In summary, the results show that while the size of the banking sector of OIC MCs is close to

that of the world average, the insurance sector is still relatively small. Similarly, in capital

markets, the stock market in OIC MCs is relatively large, but the debt securities market is

smaller than the world average.

2.2.2. Features of the Financial Sector of OIC MCs

The World Bank’s Global Financial Development Report uses four characteristics to assess the

status of various aspects of the financial sectors of different countries. Financial institutions

and financial markets are evaluated according to their depth, access, efficiency and stability.

The status of OIC MCs for each of these characteristics relative to countries in different income

groupings are presented below.

Depth

The depth of financial institutions is defined by domestic private credit to the real sector by a

deposit of money banks and other financial institutions as a percentage of GDP. Chart 2.6

shows that the average depth of 51 OIC MCs is 32.3% which is lower than the average of the

world (41.5%), high income countries (100.5%), and middle income countries (37.7%).

Though the OIC MCs average larger than that of low income groups (16.4%), the overall results

indicate that their financial institutions are relatively shallow.

0

10

20

30

40

50

60

World

High

Income

Middle

Income

Low Income OIC

28,2

44,2

12,3

16,6

30,8

53,0

20,1

19,4

37,1

Outstanding domestic private debt securities to GDP (%)

Stock market capitalization to GDP (%)