National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

209

7.

Policy Recommendations

Chapter 6 showed the status of different infrastructural institutions in different countries for

Islamic finance. While a few countries have sound and mature financial architecture for the

Islamic financial sector, the institutions are weak and underdeveloped in some other countries.

In this chapter, the policies that can be undertaken to strengthen the financial architecture for

Islamic finance are identified. The policies are presented in line with the architectural elements

discussed in previous chapters. It should be noted that the order in which the

recommendations are arranged for each of the architectural elements shows the priority in

terms of their importance.

68

7.1. Policies at the National Level

7.1.1. Legal Infrastructure

A key element in the legal infrastructure is to have supporting laws for different Islamic

financial sectors. Thus, governments need to come up with supporting Islamic financial laws to

give legal foundations for different segments of the Islamic financial industry. The tax laws

related to income (profit, withholding), transactions (capital gains and stamp duties) and

goods and services (value-added tax) need to be accommodated for tax neutrality and to level

the playing field of Islamic and conventional financial sectors.

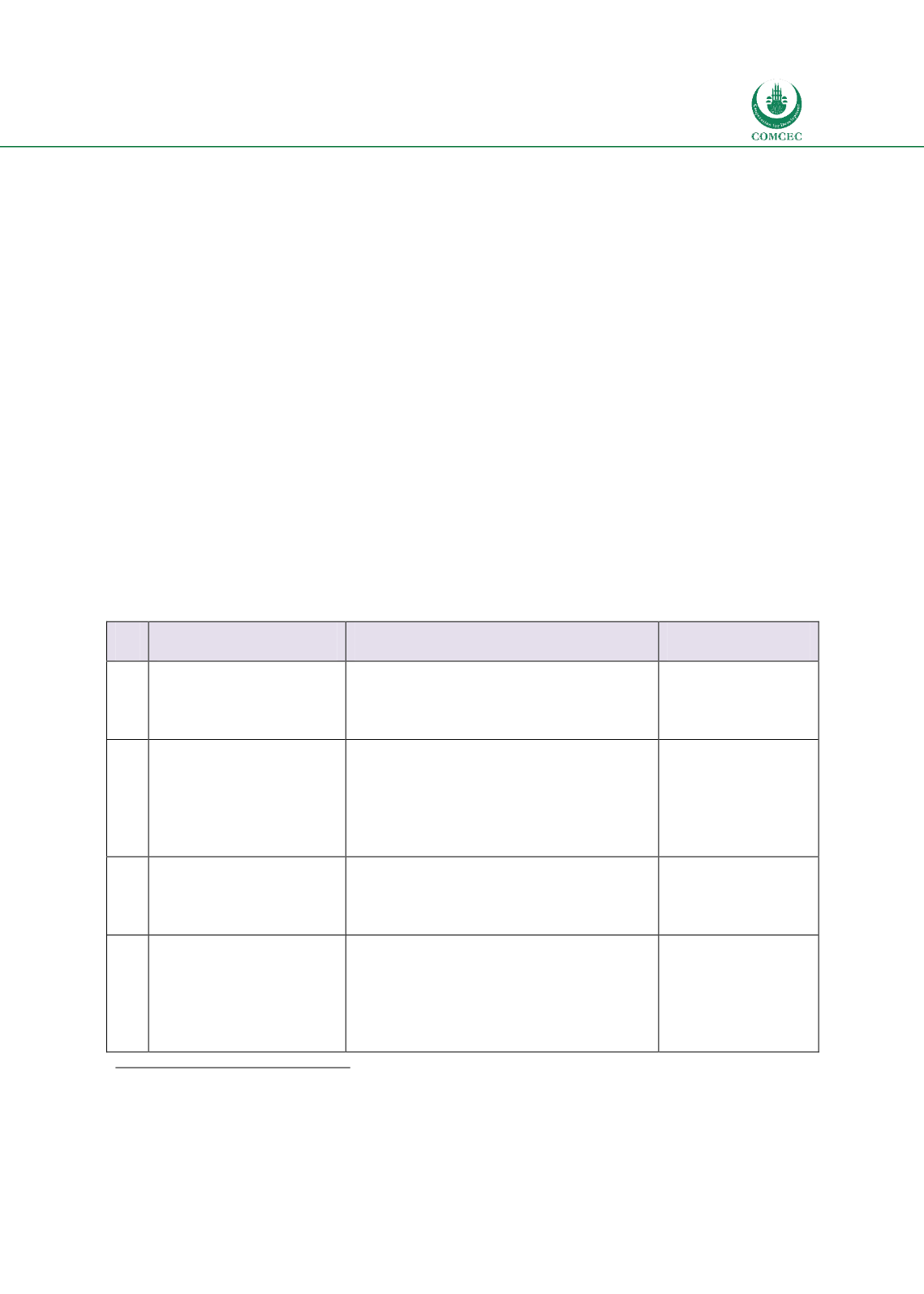

Table

7.1: Policy Recommendations for Legal Infrastructure

No. Recommendations

Specific Steps

Implemented by

1.1 Adopt Islamic financial

laws

Islamic banking law

Takaful law

Islamic capital markets law

Government

(Ministry of

Law/ Legal

Affairs)

1.2 Adopt Supporting Tax

Laws

for

Islamic

Financial sector

Change/accommodate tax neutrality

issues to level the playing field of

Islamic banking and conventional

banks

Change/accommodate tax neutrality

issues for sukuk issuance

Government

(Ministry of

Finance)

1.3 Appropriate

dispute

resolution framework

Arrangement in civil courts to

adjudicate Islamic finance disputes

Specific Islamic arbitration centers

Government

(Ministry of

Law/ Legal

Affairs)

1.4 Bankruptcy Framework

and Resolution of banks

Develop a general Islamic bankruptcy

framework for corporate sector

Develop specific framework of

resolution of Islamic banks

Shariah

scholars/board

Government

(Ministry of

Law/ Legal

Affairs)

68

Note that one of the criteria used to assess the priority of recommendations is the prevalence and frequency with which

they affect the Islamic financial sector. For example, for legal infrastructure ‘adoption of Islamic finance laws’ is given

priority as it is necessary for not only establishing new Islamic financial institutions but also governing their operations at all

times. An appropriate dispute resolution framework is applicable only when disputes arise.