National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

215

7.2. International Policies and Recommendations

Given that the Islamic financial industry is a relatively new industry, many of its architectural

institutions are evolving in many countries. The industry can benefit from various

international multilateral organizations that have developed standards and models dealing

with different aspects of financial architectural institutions. When a country lacks a specific

standard or code, a suitable strategy would be to develop it using an international bench mark.

Countries can examine these standards and frameworks and adapt them to suit the specific

needs of the local economy and financial systems. The roles that different multilateral

organizations can play in various Islamic financial architectural aspects are discussed below.

7.2.1. Legal Infrastructure

Table 7.8 shows international institutions that can support the development of legal

infrastructure institutions. While the International Islamic Center for Reconciliation and

Commercial Arbitration (IICRCA) provides an alternative dispute resolution and reconciliation

platform to settle cases applying Islamic law for disputes arising in Islamic financial industry,

there are no other international bodies supporting the legal framework. As can be seen in

Table 7.8 an international body that can come up with model laws related to Islamic finance

would help drive the industry forward. In this regard, there are a few examples in conventional

finance that are providing assistance to support a robust legal infrastructure. A good example

is the

Law and Policy Reform Program

of the Asian Development Bank which was launched in

1995 to support member countries through technical assistance projects relating to legal and

judicial reforms and legal empowerment (ADB 2001 and 2016). Among others, this program

publishes knowledge products and provides training related to legal aspects arising in

environmental issues. Similarly, the World Bank has developed principles and guidelines for

creditor rights and insolvency systems that provide, among others, a legal framework for

corporate insolvency (World Bank 2001). Similarly, the United Nations Commission on

International Trade Law prepared the UNCITRAL model law on International Commercial

Arbitration in 1985 that is used by different national arbitration centers globally.

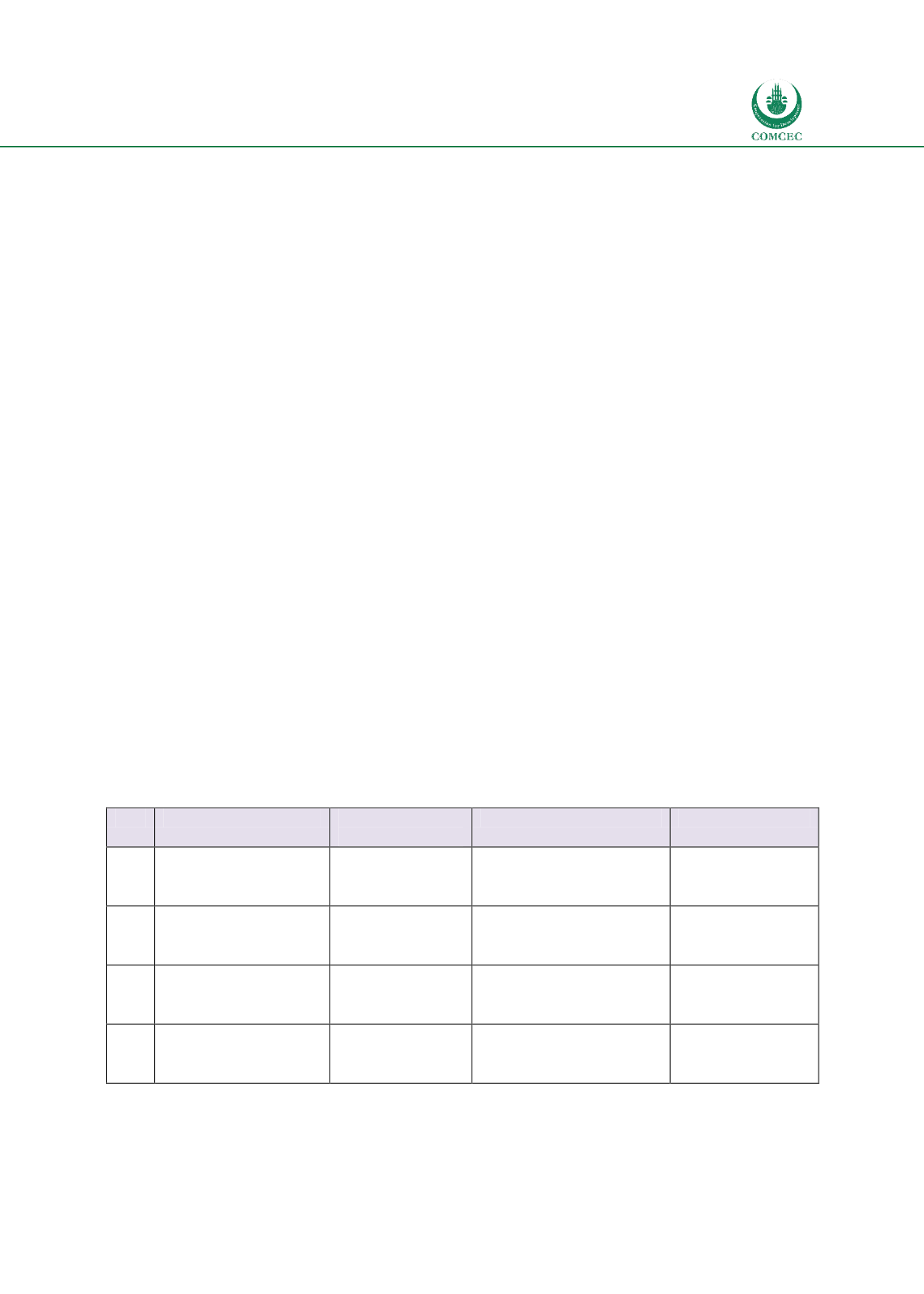

Table

7.8: Legal Infrastructure and Global Institutions

No. Recommendations

Existing

Institutions

Gaps Need to be filled

Implemented by

1.1

Islamic financial laws

Model Islamic financial

laws

IDB (Law &

Legal Policy

Program)

1.2

Supporting Laws for

Islamic

Financial

sector

Model tax laws dealing

with Islamic finance

IDB (Law &

Legal Policy

Program)

1.3

Appropriate dispute

resolution framework

IICRCA

Model law for Islamic

financial arbitration

IDB

(Law

&

Legal

Policy

Program)

1.4

Bankruptcy

Framework

and

Resolution of banks

Model Islamic

bankruptcy laws

IDB (Law &

Legal Policy

Program)

The most appropriate multilateral institution to initiate law and legal policy issues related to

Islamic finance would be the Islamic Development Bank. As one of the strategic goals of IDB is