National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

212

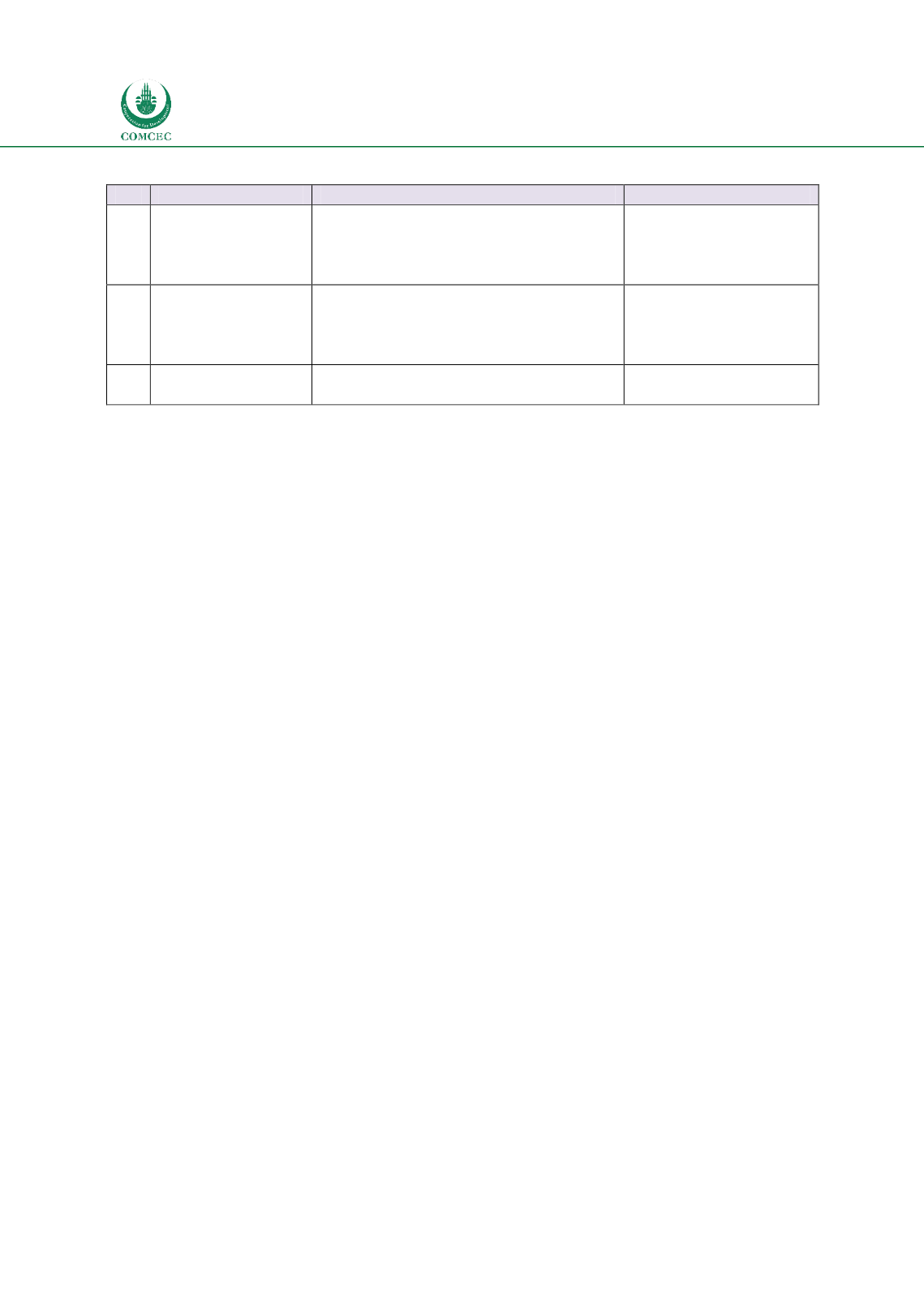

Table

7.4: Liquidity Infrastructure

No. Recommendations Specific Steps

Implemented by

4.1

Shariah compliant

liquidity

instruments

Issue government sponsored Islamic

liquidity instruments

Issue private sector sukuk issues

Government

(Ministry of finance)

Central bank

Financial institutions

4.2

Islamic money

market

Develop infrastructure for secondary

markets for Islamic instruments

Develop a framework for inter-bank

money market

Central bank

Regulator (capital

markets)

Financial institutions

4.3

Lender of the last

resort

Shariah complaint liquidity facilities

for Islamic financial institutions

Central bank

There is also a need to develop an active money market that would use some of these

instruments to meet the short-term liquidity needs in an organized way. This platform can be

established by the government in the countries where Islamic finance is in the initial stages of

development. Finally, Shariah complaint lender of the last resort would be required so that

Islamic financial institutions can benefit from the liquidity facility in case of emergencies.

7.1.5. Information Infrastructure

As some features of Islamic financial transactions require using specific accounting and

auditing treatments, there is a need to require Islamic banks to use accounting standards that

reflect these. In this regard, countries need to either adopt AAOIFI accounting and auditing

standards or introduce changes in the domestic accounting and auditing standards to

accommodate features of Islamic financial transactions. There is a need also to come up with

disclosure and transparency requirements that are relevant for Islamic finance. Some of these

disclosure requirements are identified in AAOIFI standards and the IFSB also has published

standards on the topic. One of the key issues that should be disclosed is the Shariah compliance

related issues to enhance the confidence of the customers. Not only should the structure of

products be disclosed but also the basis of Shariah rulings for them. While the domestic Islamic

accounting and disclosure standards need to be developed by the national accounting

standards setting board, their implementation would be required by the regulators.

Credit information services and ratings agencies provide relevant information to different

stakeholders that can be used to make financial decisions. While the former relates to the

clients of financial institutions, the latter provides an assessment of organizations and

instruments. However, most of the credit information and rating agencies provide assessments

relating to credit worthiness for debt based financing. As Islamic finance emphasizes both debt

and equity based financing, the credit information services and rating agencies should be able

to provide both perspectives. Thus there is a need to have public and private institutions that

provide relevant information on clients, organizations and instruments dealing with the

Islamic financial sector.