National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

206

The Liquidity Management Centre (LMC) helps Islamic financial institutions manage their

liquidity mismatch by providing short and medium term Shariah compliant liquidity

instruments. The International Islamic Liquidity Management Corp. (IILM) issues short-term

Shari’ah-

compliant financial instruments to facilitate effective cross-border Islamic liquidity

management. IIFM has developed some templates for products that can be used in money

market transactions. IFSB has published a Technical Note (TN-1) on liquidity issues that covers

the development of Islamic money markets. However, there are no specific models or

templates for Islamic inter-bank money markets developed. Similarly, though the IFSB has

published a working paper that discusses different models of Shariah compliant LOLR facilities,

no guidelines or standards have been published yet.

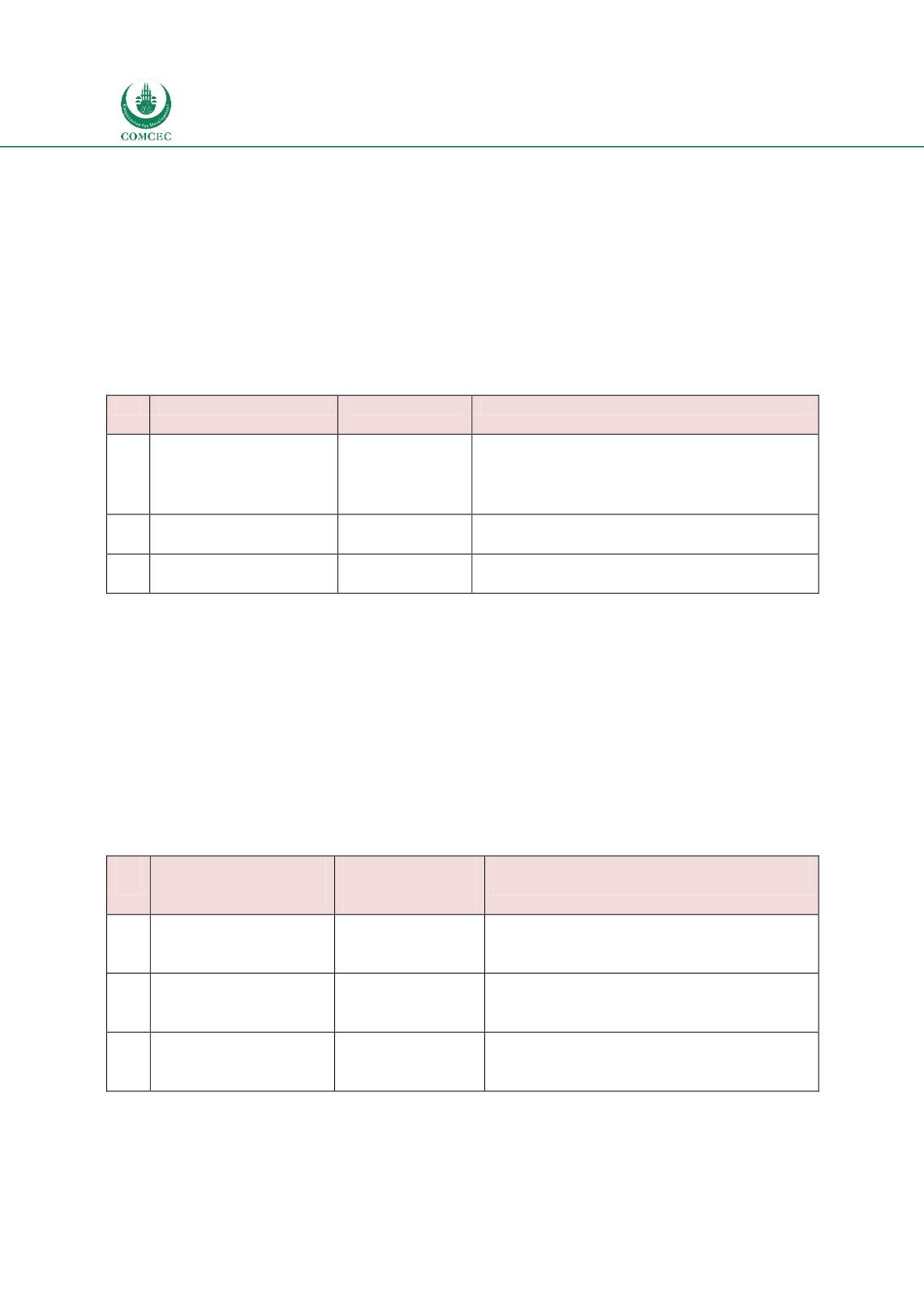

Table

6.15: International Institutions Related to Liquidity Infrastructure

No. Institutional Elements Existing

Institutions

Role and Responsibilities

4.1

Shariah

compliant

liquidity instruments

IIFM

LMC

IILM

Develop and Issue short-term Islamic

instrument for cross-border liquidity

management

4.2

Islamic money market

IFSB

Develop templates for Islamic money

markets

4.3

Lender of the last resort

(LOLR)

6.3.5.

Information Infrastructure

AAOIFI is responsible for developing accounting, auditing and governance standards for

Islamic financial institutions and has issued 27 financial accounting standards, 7 governance

standards, 2 codes of ethics and one guidance note. IFSB has also issued a standard on

disclosure and transparency (IFSB-4) for Islamic financial institutions. The Islamic

International Rating Agency (IIRA) provides ratings of Islamic financial institutions and Islamic

capital market products. IIRA is the only international rating agency that also carries out the

Shari’ah

Quality Rating (SQR) to assess the status of Shariah compliance in different financial

institutions.

Table

6.16: International Institutions Related to Information Infrastructure

No. Institutional

Elements

Existing

Institutions

Role and Responsibilities

4.1

Accounting

and

auditing standards

AAOIFI

Develop and publish accounting and

auditing standards for Islamic finance

4.2

Disclosure

and

Transparency

AAOIFI

IFSB

Develop and publish disclosure and

transparency standards for Islamic

finance

4.3

Rating agencies

IIRA

Provides credit and Shariah ratings for

Islamic financial institutions and

instruments