National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

213

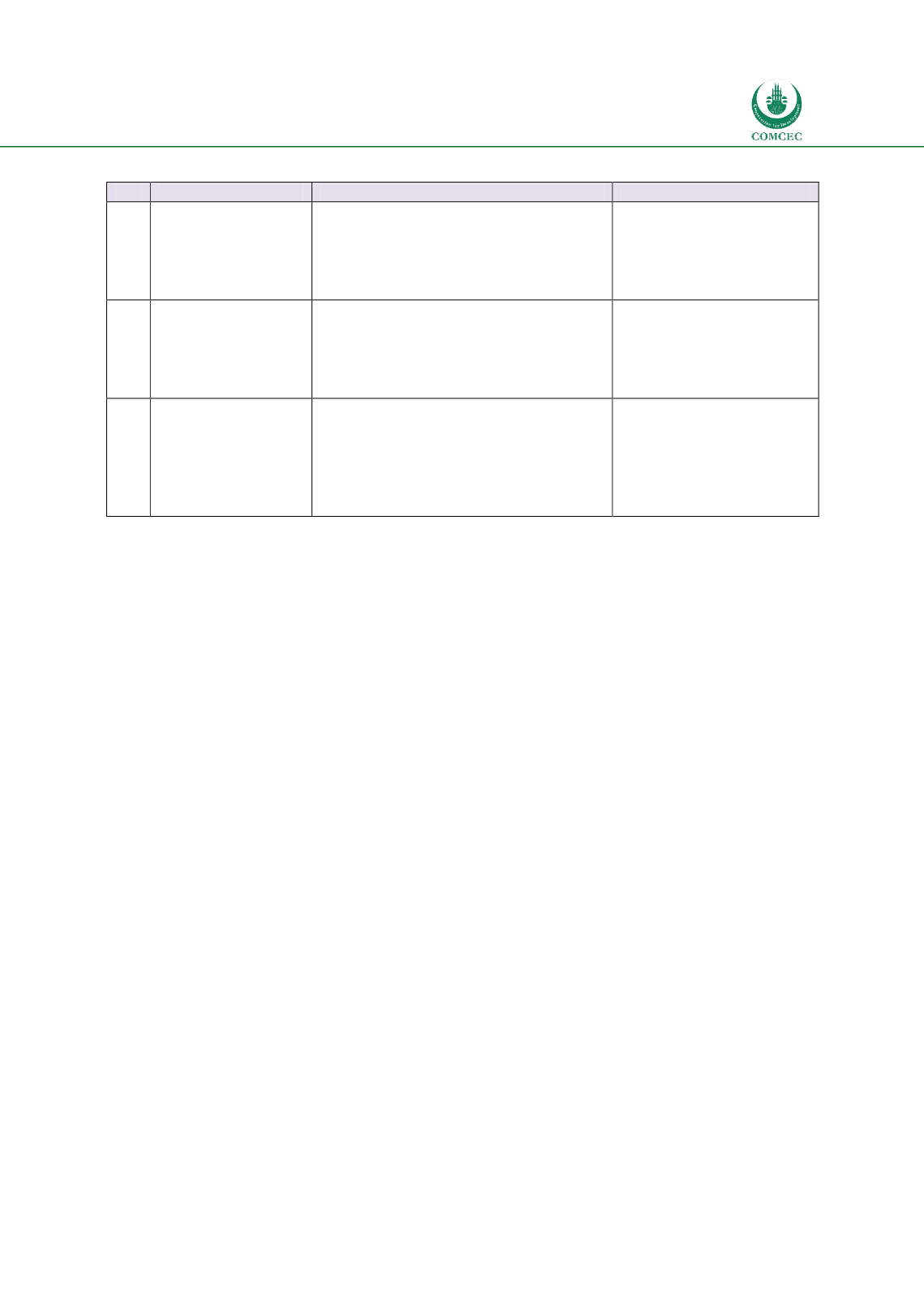

Table

7.5: Information Infrastructure

No. Recommendations Specific Steps

Implemented by

5.1

Accounting

and

auditing standards

Adopt AAOIFI standards for Islamic

financial institutions

Adapt domestic accounting

standards to accommodate features

of Islamic financial transactions

Regulators

Domestic Accounting

standards boards

5.2

Disclosure

and

Transparency

Specific disclosure guidelines for

Islamic finance sector

Require disclosure of Shariah

compliance of operations and

products

Regulators

Domestic Accounting

standards boards

5.3

Credit information

systems and rating

agencies

Establish credit information

systems not only for debt but also

equity based financing

Rating of Islamic financial

institutions and instruments

Rating of Shariah compliance

Public and private

credit information

systems

Rating agencies

7.1.6. Consumer Protection & Financial Literacy

A robust consumer protection regime is necessary for the development of a sound financial

system. As Islamic financial products confer various rights and obligations to different parties

of the contract, the laws and regulations must entail that specific consumers are protected.

Among others, information disclosure on the contracts used and their structures should be

disclosed to consumers. As many consumers choose Islamic finance due to religious

convictions, one of the key issues in protecting consumers of the Islamic financial sector would

be to not only ensure Shariah compliance but its full disclosure. A related issue on the demand

side is to have financial literacy programs to increase awareness and the level of

understanding of Islamic financial transactions. Islamic financial products are new for

consumer in most jurisdictions and there is a need to educate the consumers about the

features of these products. Other than introducing the Islamic finance concepts in school and

college curricula, different stakeholders such as regulators, financial institutions, Islamic

finance trade associations can use various methods to disseminate knowledge on Islamic

financial products and operations.

A Shariah compliant deposit insurance scheme should be in place to protect appropriate

depositors of Islamic banks. There is, however, a need to have clarity on the eligibility and

nature of profit-loss sharing investment account holders to have deposit insurance.