National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

210

As civil courts in most of the OIC MCs use national laws to adjudicate disputes, there is a need

to have some arrangements where the Islamic financial contacts can be examined according to

the principles of Islamic law. This can be done by either having a separate Shariah bench

within the civil courts or referring the Shariah issues to an external Shariah board or authority

for advice. Alternatively, arbitration centers that use Islamic law to adjudicate cases can be

used for disputes arising in the Islamic financial sector. Finally an Islamic bankruptcy legal

framework that can deal with insolvencies and resolutions involving the Islamic financial

sector is needed to mitigate legal risks.

7.1.2. Regulations and Supervision

As the introduction of Shariah principles changes the nature risks and return of Islamic

financial transactions compared to their conventional counterparts, the regulatory treatment

of the former would be different compared to the latter. As such, there is a need to come up

with a relevant regulatory framework for the Islamic financial sector. In this regard, the

regulatory standards developed by IFSB will be relevant. As the Islamic financial sector

becomes larger, there should be separate regulatory departments/units to deal with the issues

arising in different Islamic financial sectors. To mitigate regulatory arbitrage, the licensing and

regulatory requirements of conventional and Islamic banks should be clearly defined and

applied.

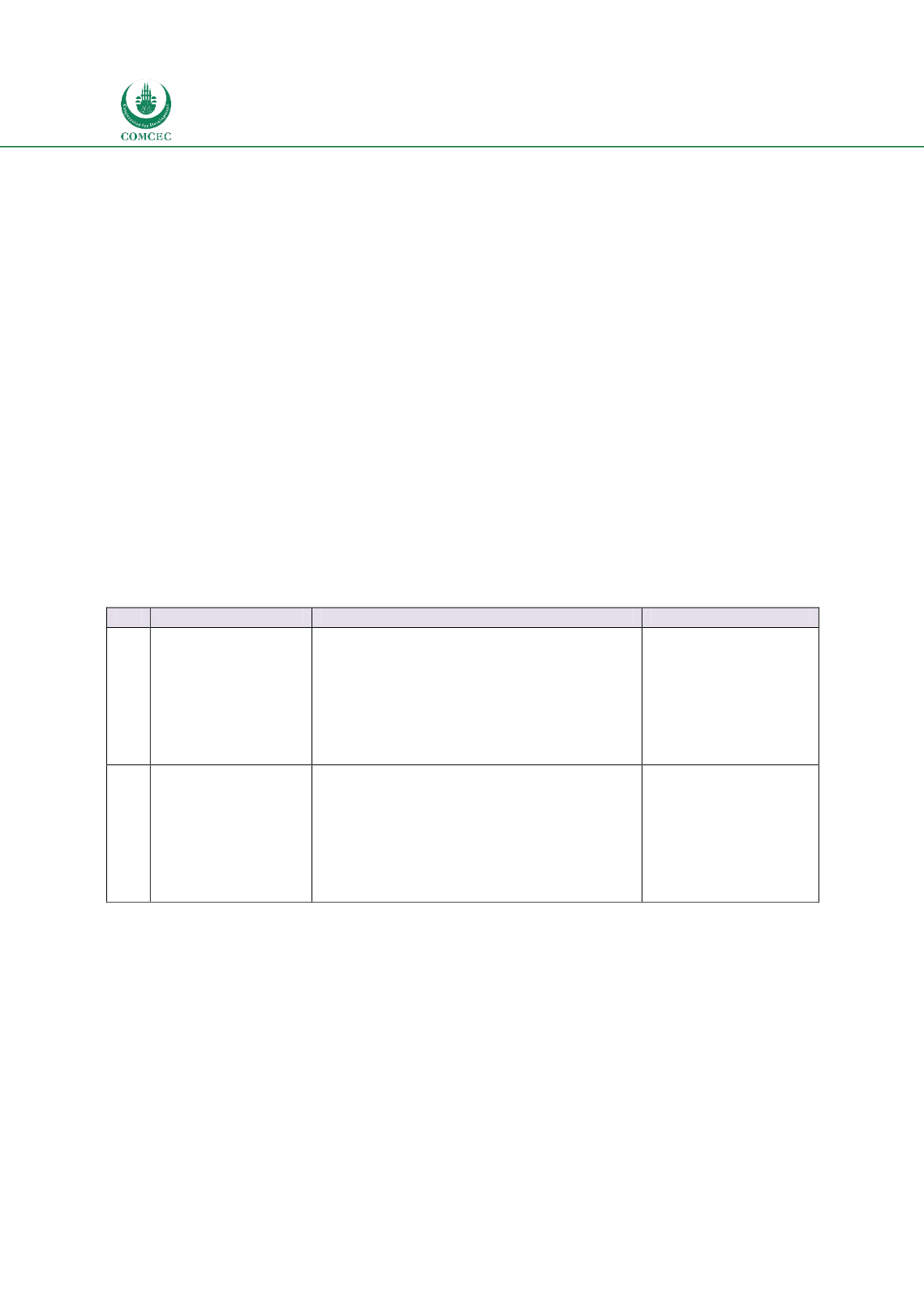

Table

7.2: Regulations and Supervision

No. Recommendations Specific Steps

Implemented by

2.1

Adopt Islamic

financial regulations

Adopt regulatory framework for Islamic

banks in line with IFSB standards

Adopt regulatory framework for Takaful

in line with IFSB standards

Adopt regulatory framework for Islamic

capital markets in line with IFSB

standards

Banking sector

regulator

Insurance/Takaful

sector regulator

Capital markets

regulator

2.2

Separate regulatory

department dealing

with Islamic finance

Establish separate regulatory

department dealing with Islamic banks

Establish separate regulatory

department dealing with Takaful

Establish separate regulatory

department dealing with Islamic capital

markets

Banking sector

regulator

Insurance/Takaful

sector regulator

Capital markets

regulator

7.1.3.

Shariah

Governance Framework

As Shariah compliance is the key distinguishing feature of Islamic finance, there is a need to

have a Shariah governance framework to ensure that the products and operations of Islamic

financial institutions do not contradict the principles of the Shariah. One of the key elements of

ensuring a sound Shariah governance framework is to make it a legal/regulatory requirement.

This can be done either by adding the requirement of Shariah governance at the financial

institution level in Islamic financial laws or in regulations. The regulators can come up with

specific Shariah governance guidelines that banks are required to follow. Among others, this

should include the requirement of Shariah audit to ensure that all the operations of financial

institutions are in compliance with Shariah.