National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

207

6.3.6.

Consumer Protection & Financial Literacy

While the IFSB has published principles on Conduct of Business Islamic financial institutions

(IFSB-9) and a working paper on consumer protection

66

, there are no standards published on

consumer protection yet. IFSB has also published a working paper that outlines different

models of Shariah compliant deposit insurance scheme.

.67

However, no guidelines or standards

have been issued on either of these institutional elements. Similarly, there is a need to develop

a framework for financial literacy programs for the Islamic financial sector.

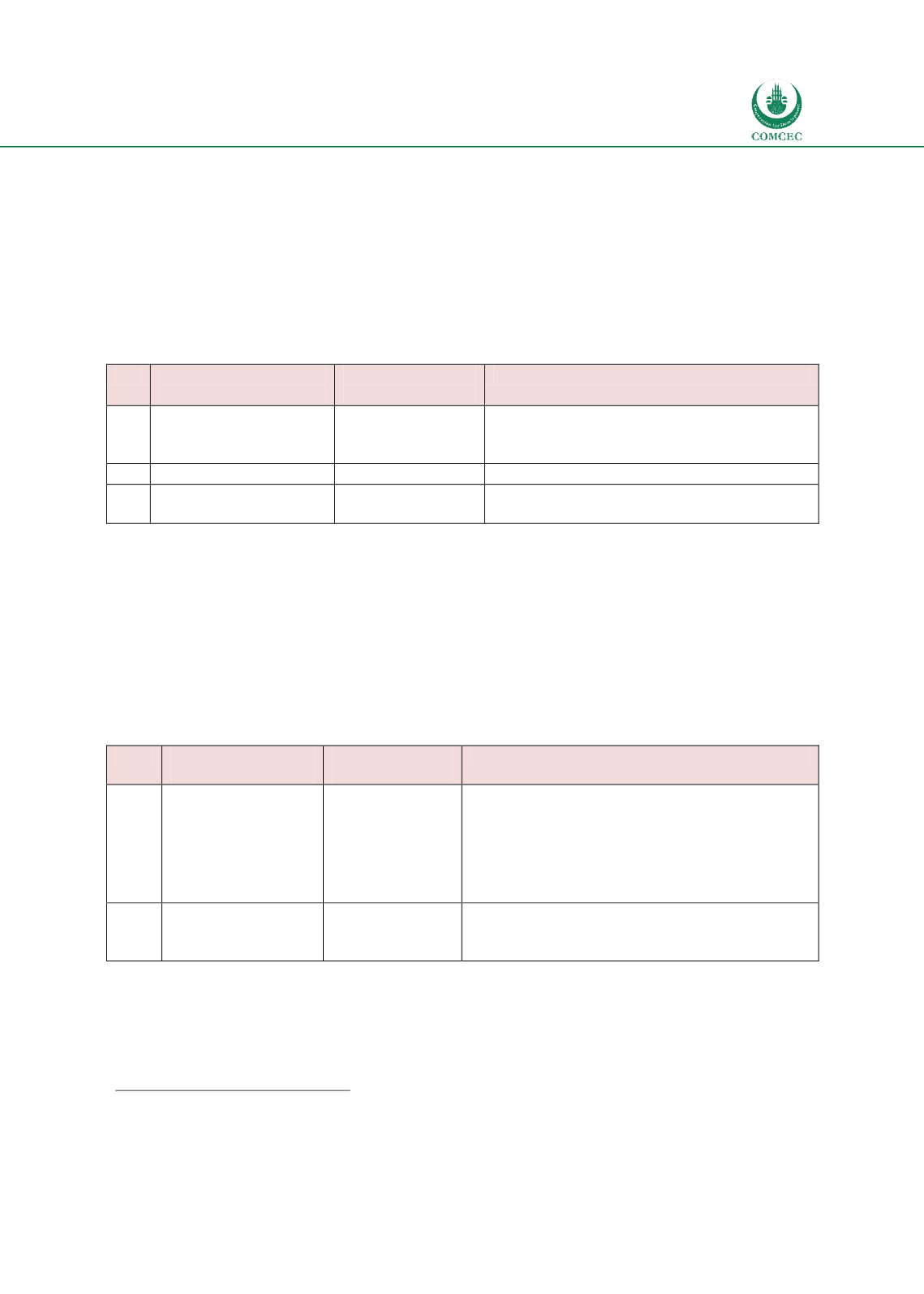

Table

6.17: Consumer Protection & Financial Literacy

No. Institutional

Elements

Existing

Institutions

Role and Responsibilities

4.1

Consumer

protection

framework for Islamic

finance

4.2

Deposit Insurance

4.3

Financial

literacy

programs

6.3.7.

Human Capital and Knowledge Development

Islamic Research and Training Institute (IRTI) undertakes basic and applied research and

training to promote the Islamic financial sector. Global Islamic Finance Development

Center (GIFDC) of the World Bank also conducts research and training and provides technical

assistance and advisory services to different countries to develop Islamic financial institutions

and markets. While the IFSB provides some training on its published standards, other areas of

Islamic financial infrastructure are not covered.

Table

6.18: Human Capital and Knowledge Development

No.

Institutional

Elements

Existing

Institutions

Role and Responsibilities

4.1

Research

and

Development

IRTI

GIFDC

Promote research & training in Islamic

economics & finance

Conduct training, advisory services for

development of Islamic finance

Organize conferences/ forums on Islamic

economics and finance

4.2

Knowledge/skills on

infrastructure

institutions

IFSB

Research and training on Islamic

infrastructure institutions

66

Neinhaus (2015)

67

Najeeb and Mustafa (2016)