National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

204

6.3.

Infrastructure Institutions at the International Level

As the Islamic financial industry grows, there are certain issues that can facilitate the

promotion of the Islamic financial industry and architecture at the national levels.

Furthermore, there are certain cross border operations that would require the harmonization

of laws and regulations and standardized accounting and auditing standards to mitigate legal

risks. The areas in which the international level institutions provide support and the gaps for

different types of architectural institutions are discussed in this section. Note that the way in

which these gaps can be filled are discussed in the next chapter.

6.3.1.

Legal Infrastructure

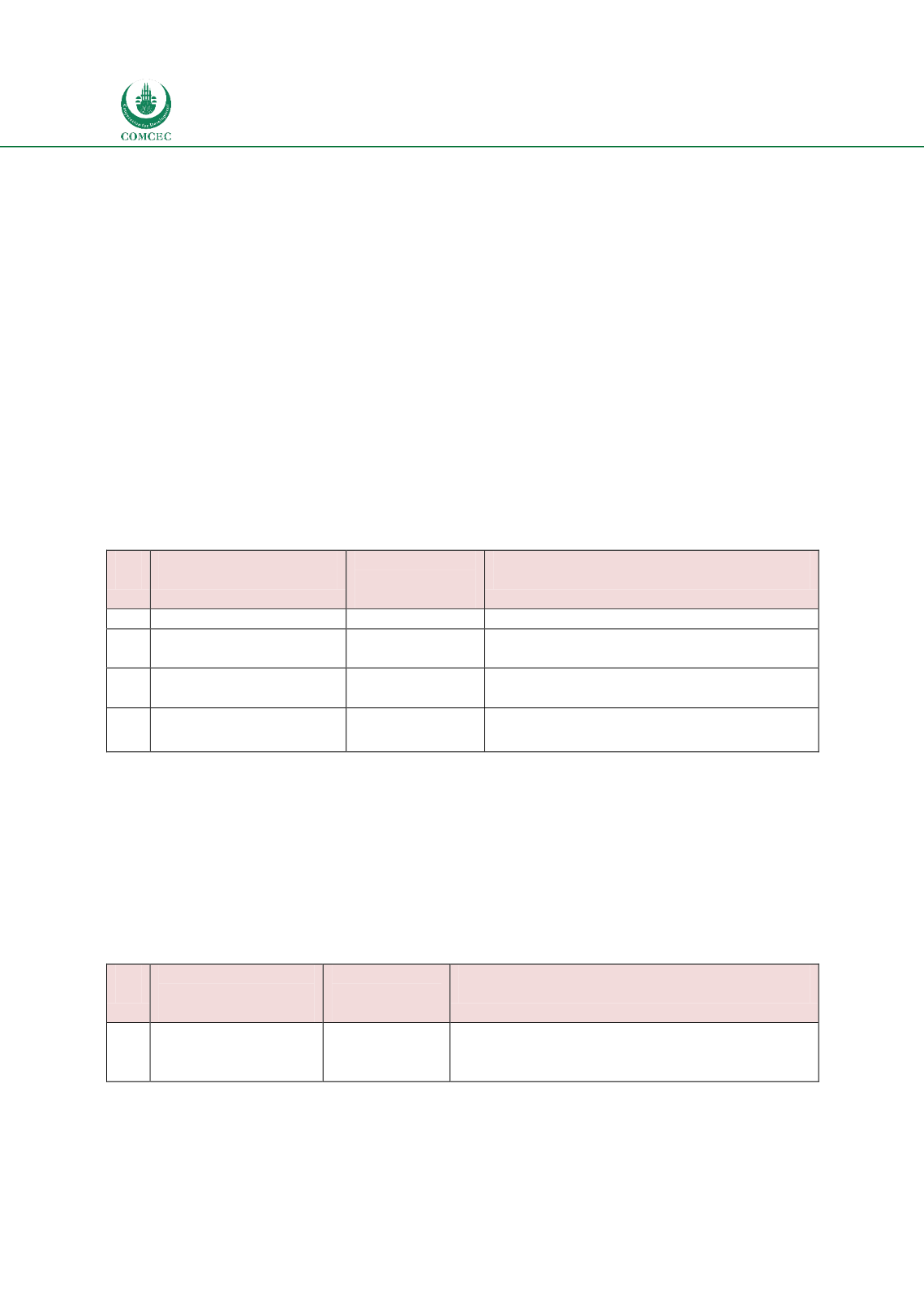

Table 6.11 shows that among the legal infrastructure, only one international institution, the

International Islamic Center for Reconciliation and Commercial Arbitration (IICRCA) is

providing an alternative dispute resolution and reconciliation platform to settle international

disputes arising in the Islamic financial industry applying Islamic law for disputes. However, in

other areas of the infrastructure, there are no other international bodies contributing to

supporting the legal framework for Islamic finance.

Table

6.11: International Institutions Related to Legal Infrastructure

No. Institutional Elements

Existing

Institutions

Role and Responsibilities

1.1

Islamic financial laws

1.2

Supporting

Laws

for

Islamic Financial sector

1.3

Appropriate

dispute

resolution framework

IICRCA

Alternative dispute resolution platform

for Islamic finance using Islamic law

1.4

Bankruptcy Framework

and Resolution of banks

6.3.2.

Regulation and Supervision

While in conventional finance different regulatory standard setting bodies exist for banking

(BCBS), insurance (IAIS) and capital markets (IOSCO), the Islamic Financial Services Board

(IFSB) is the regulatory standard setter for the Islamic financial sector. It has published

standards, guiding principles, guidance notes and technical note for the body of Islamic banks,

takaful and Islamic capital markets.

Table

6.12: International Institutions Related to Regulations

No. Institutional

Elements

Existing

Institutions

Role and Responsibilities

2.1

Islamic

financial

regulations

IFSB

Publish standards and guidelines for

regulations and supervision of Islamic

banking, takaful and Islamic capital markets

The specific regulatory and supervisory standards and guidance notes published by IFSB to

date are shown in Table 6.13. As can be seen, while the regulatory standards for Islamic