National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

214

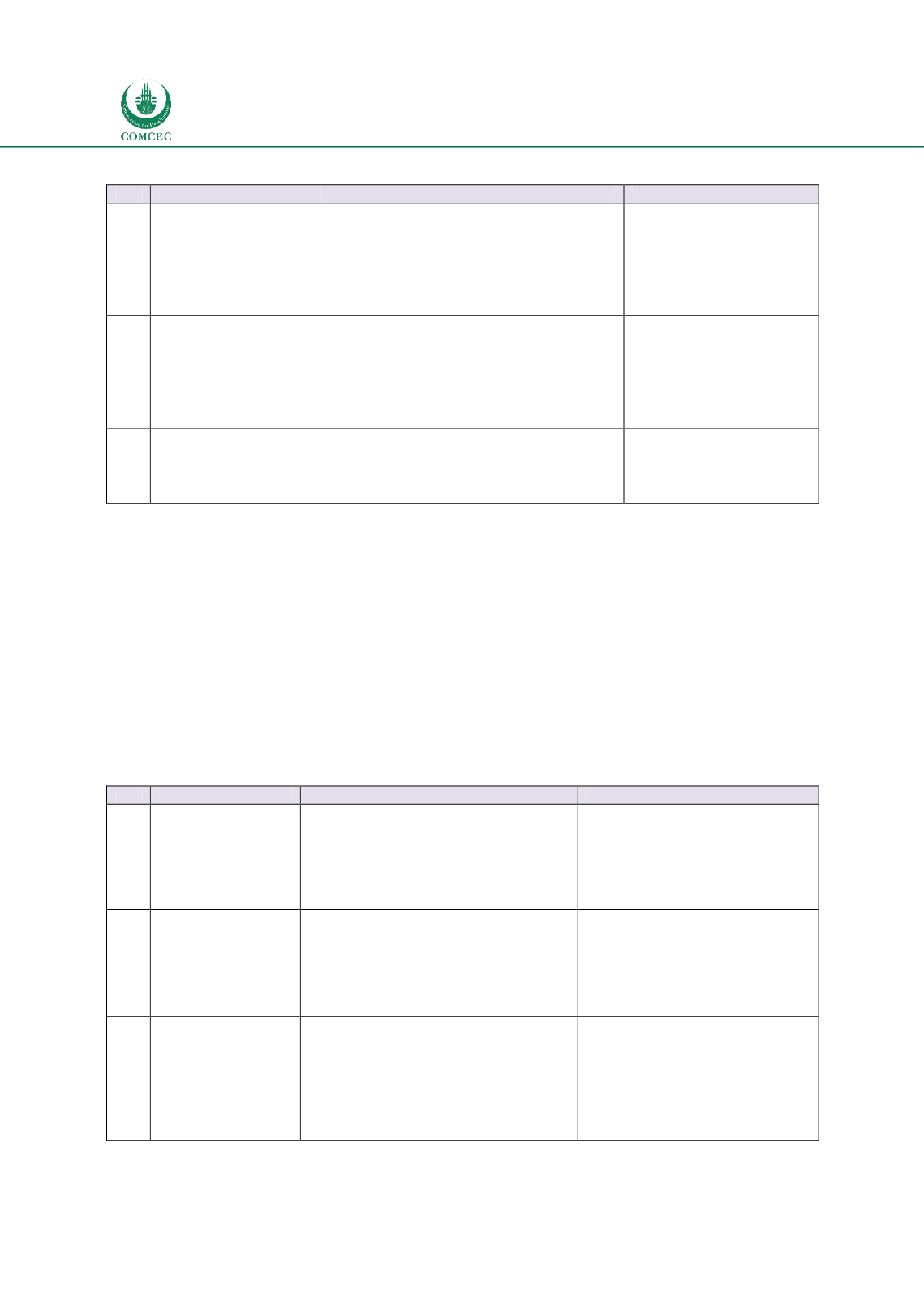

Table

7.6: Consumer Protection & Financial Literacy

No. Recommendations

Specific Steps

Implemented by

6.1

Consumer protection

framework

for

Islamic finance

Develop specific legal consumer

protection framework for Islamic

finance

Develop specific regulatory consumer

protection framework for Islamic

finance

Government

Regulators

6.2

Financial

literacy

programs

Develop financial literary literature

Disseminate knowledge at different

levels

Use social media to educate people on

Islamic finance

Government (Ministry

of education)

Regulators

Financial institutions

Islamic finance trade

associations

6.3

Deposit Insurance

Develop framework for Islamic deposit

insurance

Establish Islamic deposit insurance

company

Government

Regulators

7.1.7. Human Capital and Knowledge Development

A key factor that will determine the future expansion of the Islamic financial sector is to have

adequate human capital with the right knowledge and skills to drive the industry forward. At

the public level, governments and regulators can take initiatives to establish educational,

training and research institutions. One area of that needs focus is policy related research and

training including topics on the development of Islamic architectural institutions. At the

private level, different actors such as research and training institutions, advisory firms and

trade associations can do the same. Universities and academic institutions will play an

important role not only in providing education in Islamic finance but also to conduct research

that can support the industry.

Table

7.7: Human Capital and Knowledge Development

No. Recommendations

Specific Steps

Implemented by

7.1

Public

level

initiatives

Establish institutions that provide

education and training in Islamic

banking and finance

Sponsor policy related research and

training on Islamic finance including

Islamic infrastructure institutions

Governments

Regulators/central banks

7.2

Private

sector

initiatives

Provide education and training in

Islamic banking and finance

Initiatives for developing professional

certificates for Islamic financial

industry

Private sector institutes and

centers for education and

research

Private sector advisory firms

Islamic finance trade

associations

7.3

Academic

institutions

Provide education in Islamic banking

and finance

Conduct research in Islamic banking

and finance

Organize conferences and forums to

enhance awareness and exchange of

ideas

Colleges and universities

Research institutions

Islamic finance trade

associations