National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

205

banking and takaful sectors are adequate, there is a need to come up with standards for Islamic

capital markets.

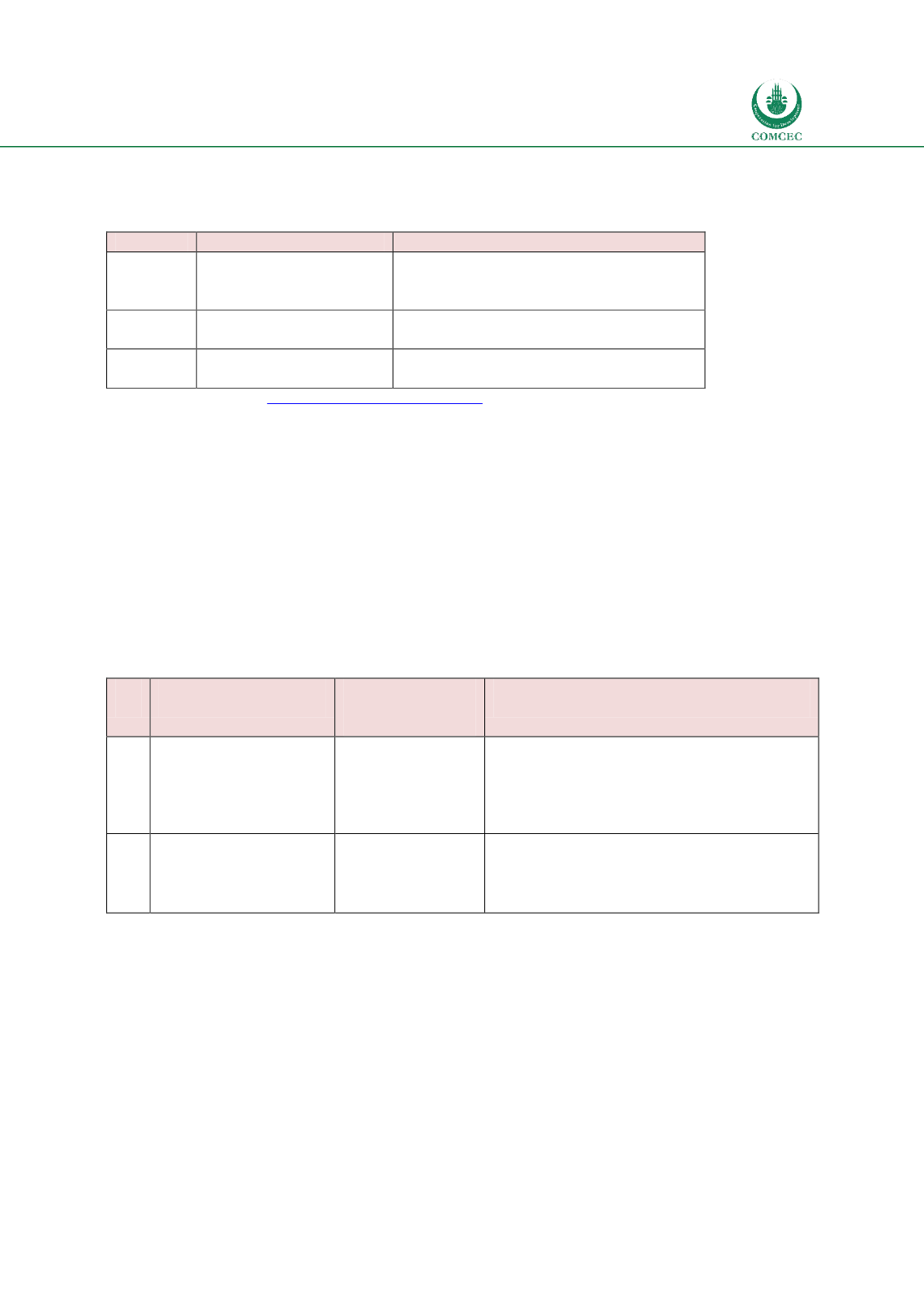

Table

6.13: IFSB Standards and Guidance Notes for Different Islamic Financial Sectors

Sectors

Risk Management

Regulations/ Supervision

Banking

IFSB-1, IFSB-13

IFSB-2, IFSB-5, IFSB-7, IFSB-15, IFSB-16,

IFSB-17

GN-1, GN-2, GN-3, GN-4

Takaful

IFSB-14

IFSB-11, IFSB-18,

GN-5

Capital

Markets

Source: IFSB (2015) an

d http://www.ifsb.org/published.php6.3.3.

Shari’ah Governance Framework

The Islamic Financial Services Board (IFSB-10) and Accounting & Auditing Organization for

Islamic Financial Institutions (AAOIFI) have published Shariah governance principles and

standards for Islamic financial institutions. As for developing Shariah standards and

parameters, Islamic Fiqh Academy (IsFA) has issued rulings on economic and financial matters

relevant for the Islamic financial sector. Accounting and Auditing Organization for Islamic

Financial Institutions (AAOIFI) has published 54 Shariah standards of different types of Islamic

financial contacts. International Islamic Financial Markets (IIFM) has also come up with Islamic

financial contracts and products templates related to the capital and money market, corporate

finance and trade finance.

Table

6.14: International Institutions Related to Shariah Governance

No. Institutional Elements Existing

Institutions

Role and Responsibilities

3.1

Legal/Regulatory

Requirement

for

Shariah

Governance

(SG)

IFSB

AAOIFI

Published Shariah governance standards

for Islamic financial institutions

3.3

Developing

Shariah

parameters/ standards

IsFA

AAOIFI

IIFM

Issue Islamic legal rulings/resolutions on

different issues including Islamic finance

Develop Shariah standards and

templates for Islamic financial products

6.3.4.

Liquidity Infrastructure

One of the problems of establishing a liquid international secondary market for Islamic

financial instruments are the differences of legal and regulatory regimes of various countries

and also the diversity of Shariah opinions across jurisdictions. Specifically sukuk structures

entail various supporting laws such as property, tax, bankruptcy, trust, etc. However, the

differences in common law and civil law legal systems and legal institutions and across OIC

member countries makes it difficult to come up with unified sukuk structures that satisfy the

individual national legal frameworks and requirements (Karim 2015: 228). Similarly,

perspectives on Shariah compliant sukuk structures also differ from one jurisdiction to

another. This reduces the marketability of sukuk globally making them relatively illiquid.