National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

211

Existence of an independent national Shariah body can help harmonize the Shariah rulings and

minimize diversity of fatwas that introduces legal and reputational risks. The national Shariah

board can either be established by the regulators or by the religious ministry. There can be a

separate Central Shariah Board for different financial sectors or one central board that deals

with all sectors. One of the roles of the national level Shariah board is to come up with Shariah

parameters or standards for different Islamic financial products. This will add to the

harmonization of Islamic financial practices within the jurisdiction and also reduce the costs of

Shariah governance at the organizational levels.

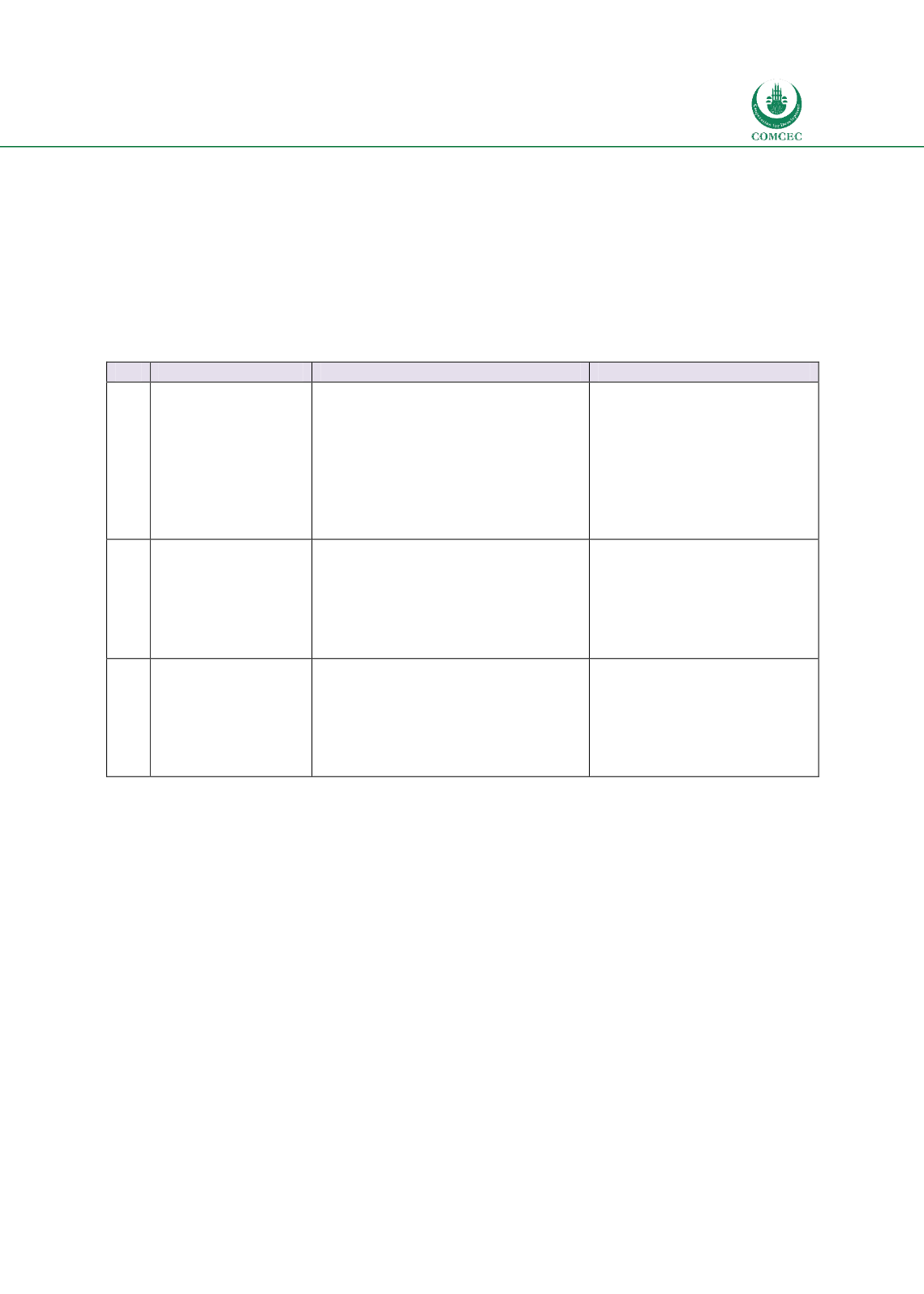

Table

7.3: Shariah Governance Framework

No. Recommendations Specific Steps

Implemented by

3.1

Legal/Regulatory

Requirement

for

Shariah Governance

(SG)

Shariah

governance framework

included in Islamic financial laws

Regulatory framework for SG in

Islamic banks

Regulatory framework for SG in

Takaful

Regulatory framework for SG in

Islamic capital markets

Government (Ministry of

Law/ Legal Affairs)

Banking sector regulator

Insurance/Takaful sector

regulator

Capital markets regulator

3.2

Central

Shariah

Advisory Board

(CSAB)

CSAB for Islamic banking sector

CSAB for Takaful sector

CSAB for Islamic capital markets

Government (Ministry of

Religious Affairs)

Banking sector regulator

Insurance/Takaful sector

regulator

Capital markets regulator

3.3

Developing

Shariah

parameters/

standards

Shariah

parameters/ standards

for Islamic banking sector

Shariah

parameters/ standards

for Takaful sector

Shariah

parameters/ standards

for Islamic capital markets

CSAB for Islamic banking

sector

CSAB for Takaful sector

CSAB for Islamic capital

markets

7.1.4. Liquidity Infrastructure

The liquidity infrastructure can be strengthened by providing the instruments, markets and

the facilities that Islamic financial institutions can tap into in case they need them. This would

require developing and issuing Shariah compliant liquidity instruments that Islamic financial

institutions can use either to place surplus funds or acquire funds when necessary. These

liquidity instruments can be issued either by the government or financial institutions. Note

that the government bodies have to come up with Shariah compliant liquid instruments that

satisfy conditions of High Quality Liquid Assets of the new Basel III liquidity requirements.