National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

202

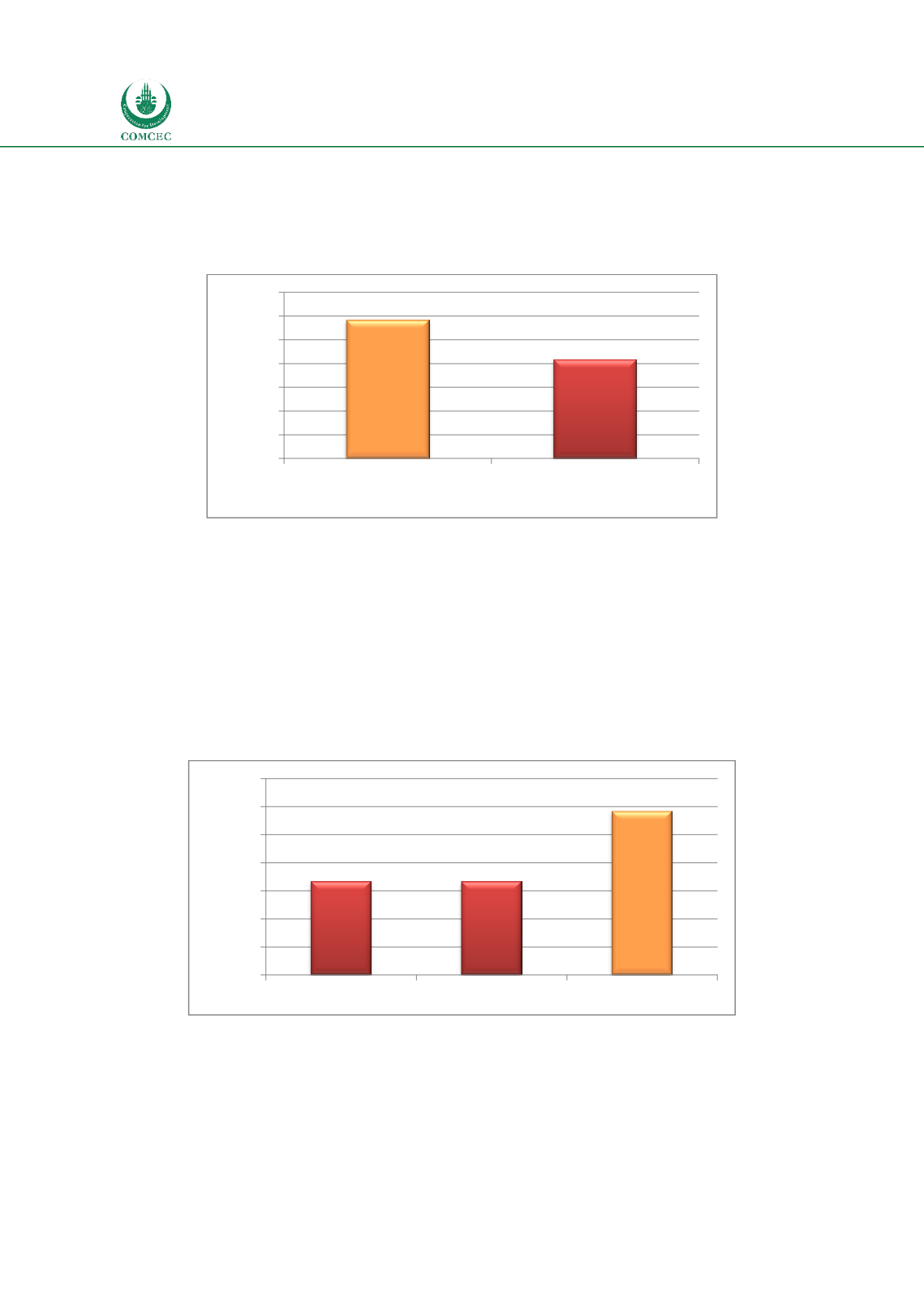

accounting standards (either AAOIFI or domestic), only 41.7% have ratings agencies that cater

to the needs of the Islamic financial sector. Thus, while the status of accounting reporting and

disclosure is ‘developing’, the ranking of rating agencies for Islamic finance is

‘underdeveloped’.

Chart

6.9: Information Infrastructure

6.2.6.

Consumer Protection & Financial Literacy

Chart 6.10 shows that only 33.3% of the countries have the consumer protection framework

for the Islamic financial sector and have Shariah compliant deposit insurance programs for

Islamic banks. In 58.3% of the case-study countries, there are financial literacy programs on

Islamic finance. While most of the financial literacy programs come from the regulatory bodies,

in a couple of cases the trade associations of Islamic banks promote them. The results indicate

that while aspects of consumer protection and deposit insurance are ranked ‘underdeveloped’,

the status of financial literacy is ‘developing’.

Chart

6.10: Consumer Protection & Financial Literacy

6.2.7.

Human Capital and Knowledge Development

Chart 6.11 shows the initiatives taken in countries by different institutions. Though in 66.7% of

the countries the public bodies have institutions providing education and training in Islamic

banking and finance, in 58.3% of the countries there are private sector initiatives to do the

58,3

41,7

0

10

20

30

40

50

60

70

Accounting Reporting &

Disclosure

Rating Agency

Percentage of total

33,3

33,3

58,3

0

10

20

30

40

50

60

70

Consumer Protection Deposit Insurance Financial literacy

Percentage of total