National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

201

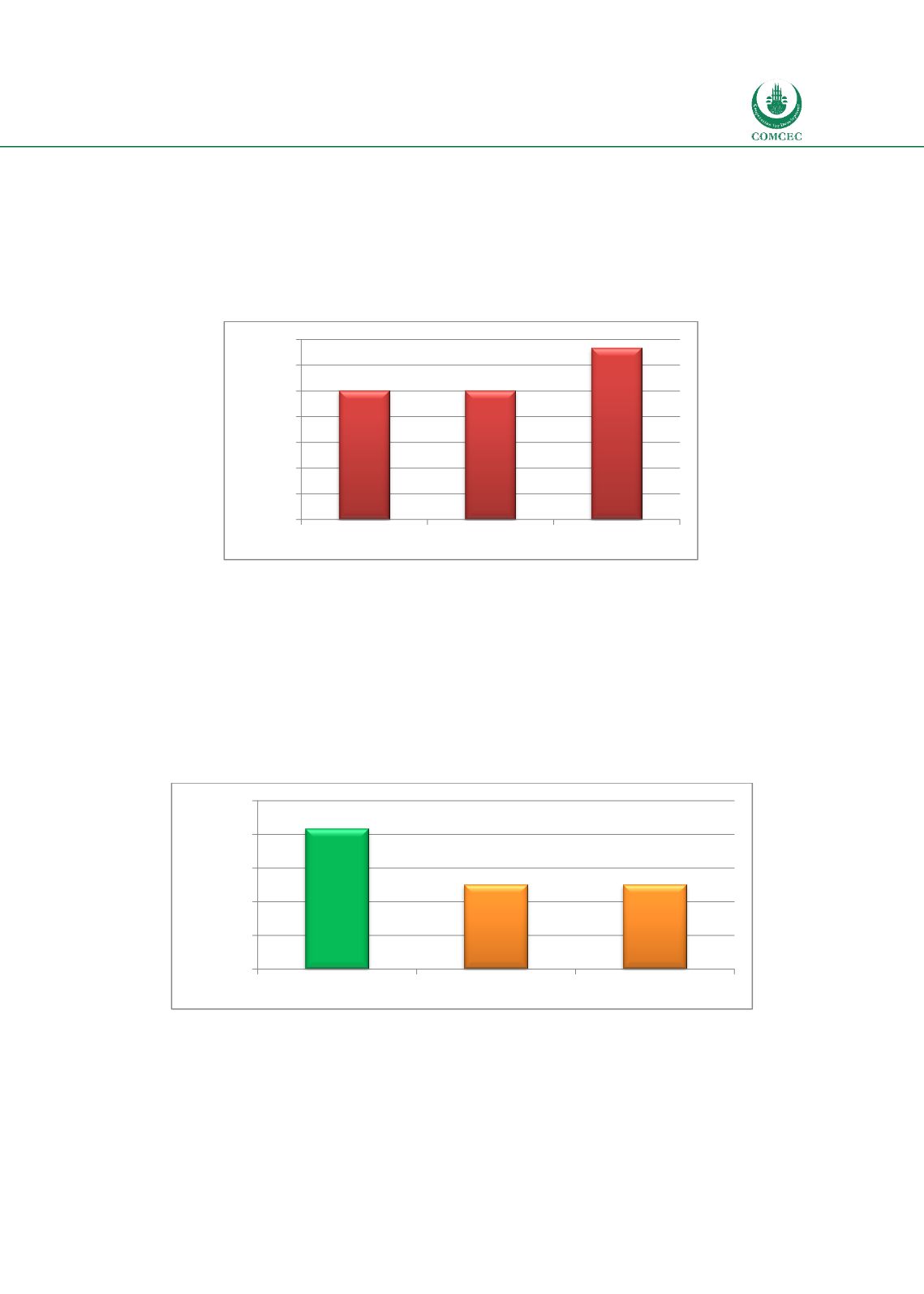

Chart 6.7 indicates that while only 25% of the countries in the sample have developed Shariah

standards or parameters for the banking and takaful sectors, 33.3% of the countries have

standards for the Islamic financial sector in general and sukuk in particular. The overall

statuses of Shariah standards and parameters for all three Islamic financial sectors is

‘underdeveloped’.

Chart

6.7: Shariah Standards/Parameters

6.2.4.

Liquidity Infrastructure

Chart 6.8 shows the status of different elements of the liquidity infrastructure of Islamic

finance. While 83.3% of the countries have some sort of Shariah compliant liquidity

instruments, only 50% have Islamic money markets and Shariah compliant lender of last

resort facilities. The results indicate that the status of liquidity instruments in sample

countries is ‘developed’ and the Islamic money market and lender of last resort is ranked as

‘developing’.

Chart

6.8: Liquidity Infrastructure

6.2.5.

Information Infrastructure

Chart 6.9 shows the status of accounting infrastructure in terms of using accounting reporting

and disclosures using Islamic accounting standards and rating agencies that evaluate Islamic

financial institutions and instruments. While 58.3% of the countries require using Islamic

25,0

25,0

33,3

0

5

10

15

20

25

30

35

Banking

Takaful

Capital Market

Percentage of total

83,3

50,0

50,0

0

20

40

60

80

100

Liquidity instruments Islamic money market Lender of Last Resort

Percentage of total