National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

200

Chart

6.4: Regulation & Supervision of Islamic Finance (Separate Dept./Unit)

6.2.3.

Shariah Governance

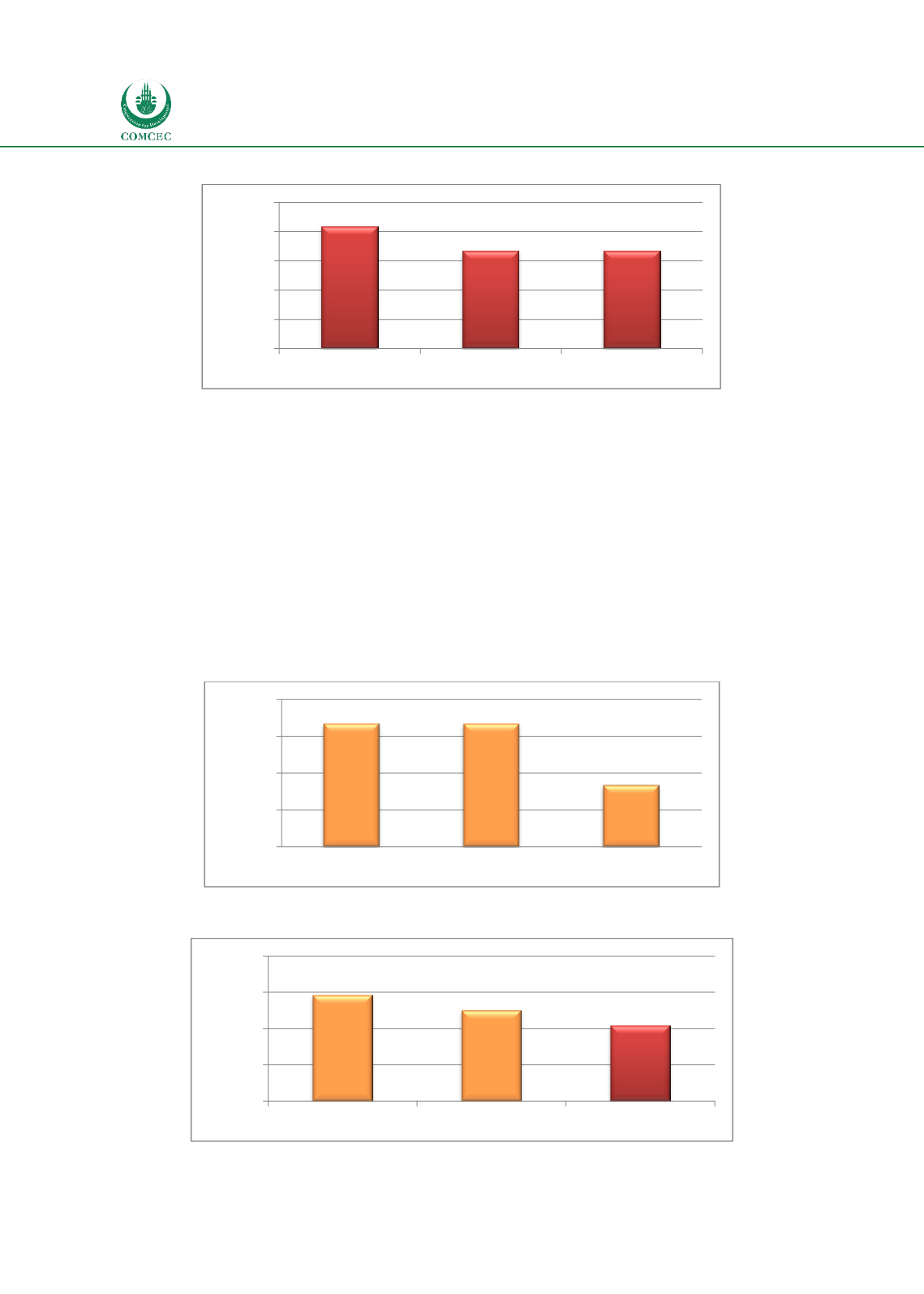

Chart 6.5 shows that there are regulatory requirements on Shariah governance issues in most

countries. While 66.7% of the countries have requirements for Islamic banks and takaful

sectors, for capital markets 58.3% of the countries have such requirements. The status of

legal/regulatory requirements for Shariah governance for all financial sectors is ‘developing’.

Chart 6.6 shows that 58.3% percent of the countries have some kind of central Shariah body

overseeing the overall Shariah related issues for the Islamic banking. For the takaful and

capital market sectors, the corresponding figures are 50% and 41.7%. Thus, the status of

central Shariah boards for banking and takaful sectors is ‘developing’ and for capital markets it

is ‘underdeveloped’.

Chart

6.5: Legal/Regulatory Requirements for Shariah Governance

Chart

6.6: Central Shariah Supervisory/Advisory Board

41,7

33,3

33,3

0

10

20

30

40

50

Banking

Takaful

Capital Market

Percentage of Total

66,7

66,7

58,3

50

55

60

65

70

Banking

Takaful

Capital Market

Percentage of total

58,3

50,0

41,7

0

20

40

60

80

Banking

Takaful

Capital Market

Percentage of total