National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

199

conventional finance. Civil courts in 41.7% of the countries in the sample deal with Islamic

finance disputes. While some countries (Oman, Saudi Arabia and Oman) use Islamic law to

adjudicate cases in courts, other countries (Malaysia and Pakistan) seek advice on Shariah

issues from external Shariah boards. One third of the countries (33.3%) have arbitration

centers that deal with disputes of Islamic banks and also have bankruptcy laws that deal with

issues related to bankruptcies related to Islamic banks.

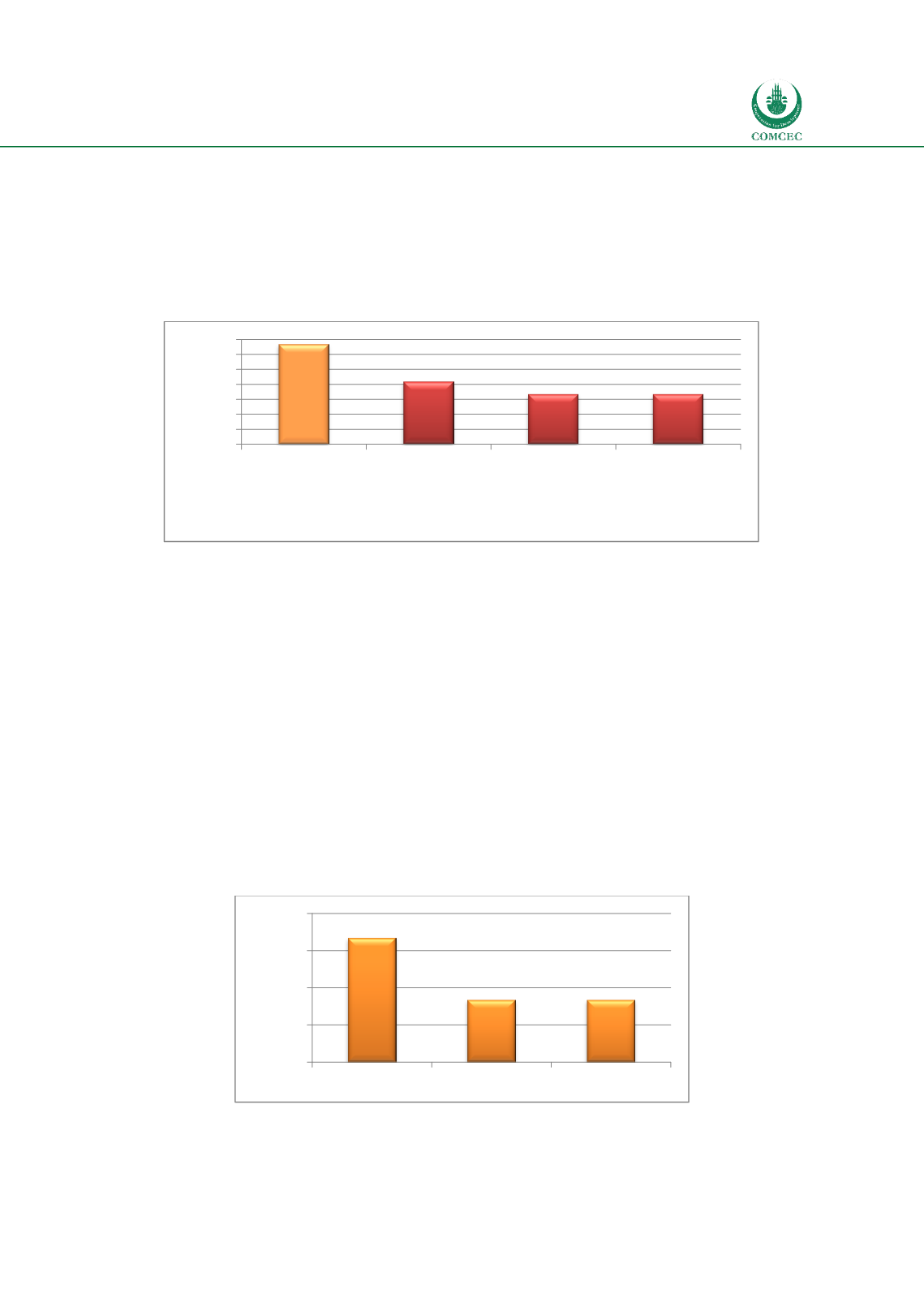

Chart

6.2: Countries with Islamic Legal Infrastructure (% of total)

In conclusion, while the tax laws in the sample countries have the status of ‘developing’, the

other legal infrastructure institutions (dispute resolution in courts and arbitration centers and

bankruptcy laws) are ‘underdeveloped’.

6.2.2.

Regulation and Supervision

Chart 6.3 shows that in 66.7% of the case-studies, countries have a regulatory framework for

Islamic banking and 58.3% have the same for the takafula and capital market sectors. Overall,

the average regulatory framework in the sample countries scores the status of ‘developing’.

However, relatively fewer countries have specific regulatory departments or units that deal

with Islamic financial sectors. Chart 6.4 shows that, while 50% of the countries have a separate

department dealing with the Islamic banking sector, only 40% of the countries has such

departments for the takaful and Islamic capital market sectors. Thus the institutional

arrangements of having separate departments to regulate Islamic financial sectors in the case-

study countries are ‘underdeveloped’.

Chart

6.3: Regulatory Framework Islamic Financial Sector

66,7

41,7

33,3

33,3

0

10

20

30

40

50

60

70

Tax laws

Dispute

Resolution (in

Courts)

Dispute

Resolution

(Arbitration

Centers)

Bankruptcy Laws

Percentage of total

66,7

58,3

58,3

50

55

60

65

70

Banking

Takaful

Capital Market

Percetnage of total