National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

196

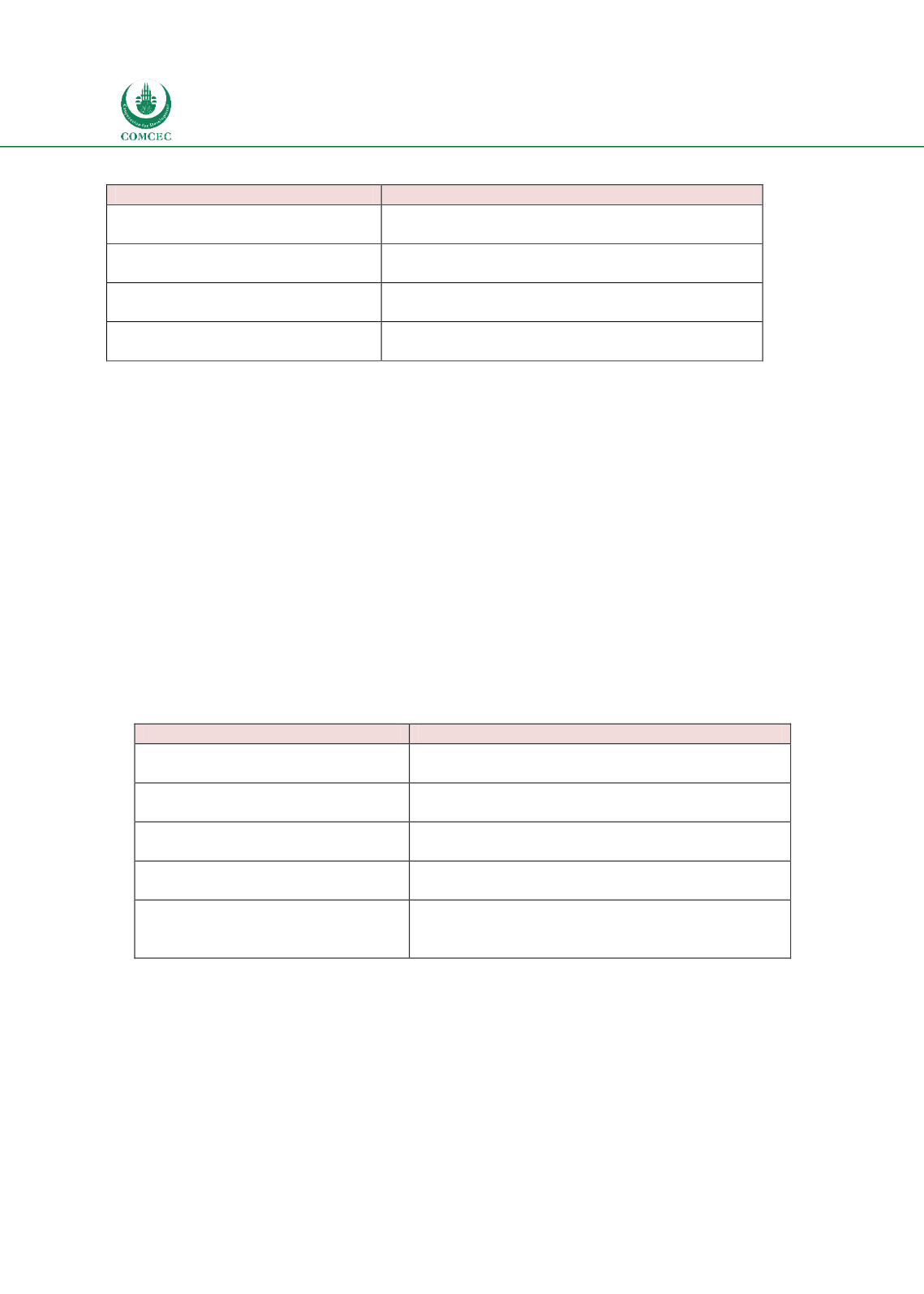

Table

6.7: Status of Liquidity Infrastructure

Liquidity Infrastructure

Countries

Government sponsored liquidity

instruments

Bangladesh, Indonesia, Malaysia, Nigeria, Oman,

Pakistan, Saudi Arabia, Sudan, Turkey, UAE

Islamic money market

Bangladesh, Indonesia, Malaysia, Oman, Pakistan,

Sudan

Lender of the last resort

Indonesia, Malaysia, Nigeria, Pakistan, Saudi Arabia,

Sudan

No specific elements in liquidity

infrastructure

Egypt, Senegal

In some countries, only part of the liquidity infrastructure element exists. For example, while

in Nigeria only the liquidity instruments and LOLR facilities exist, there is the Islamic money

market that Islamic banks can turn to in case they need to. This may be partly due to the

smaller size of the Islamic financial sector and also the relatively nascent nature of the

industry. Similarly, Islamic banks in Bangladesh and Oman have liquidity instruments and

money market facilities but no Shariah compliant LOLR. While Turkey and UAE have one

Shariah compliant instrument that Islamic banks can use to avail funds from the central bank,

in Egypt, Saudi Arabia and Senegal none of the elements of an Islamic liquidity infrastructure

exist.

6.1.5.

Information Infrastructure

The two key elements of the information infrastructure are the accounting and disclosure

standards used by Islamic financial institutions and the existence of rating agencies that assess

credit ratings and the Shariah compliance of Islamic financial institutions and instruments.

Table

6.8: Status of Information Infrastructure

Information Infrastructure

Countries

Adopted

AAOIFI

accounting

standards

Oman, Sudan

Accommodate Islamic finance in

domestic accounting standards

Bangladesh, Indonesia, Malaysia, Nigeria, Pakistan

Rating agencies assessing Islamic

financial institutions/sukuk

Bangladesh, Indonesia, Malaysia, Sudan, Pakistan

Rating agencies assessing Shariah

compliance

-

No elements of Islamic finance in

domestic accounting standards or

rating agencies

Egypt, Saudi Arabia, Senegal, Turkey, UAE

Only two countries (Oman and Sudan) in the sample require Islamic financial institutions to

use AAOIFI accounting standards. In some countries (Indonesia, Malaysia, Nigeria and

Pakistan), the domestic accounting standards are generally used but are adjusted for Islamic

financial transactions. In Bangladesh, while Islamic banks are required to use domestic

accounting standards, the regulators require some additional disclosure related to Islamic

financial instruments. While ratings agencies in some countries provide credit-ratings of

Islamic financial institutions and securities such as sukuk, none of them rate their Shariah