National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

198

Table

6.10: Status of Human Capital and Knowledge Development

Human Capital & Knowledge

Development

Countries

Initiatives by public bodies

Egypt, Malaysia, Nigeria, Oman, Pakistan, Saudi

Arabia, Sudan

Initiatives

by

educational

institutions/universities

Bangladesh, Egypt, Indonesia, Malaysia, Nigeria,

Pakistan, Saudi Arabia, Senegal, Sudan, Turkey, UAE

Private

sector

initiatives

including NGOs

Bangladesh, Indonesia, Pakistan, Senegal, Turkey,

UAE

6.2.

Overall Statuses of Islamic Finance Architectural Institutions

In this section, an evaluation of the infrastructural institutions for the whole sample of 12

countries is carried out. The status of the different elements of the Islamic financial

architecture is based on the following criteria: if the infrastructural institution exists in less

than 50% of the countries then it will be deemed ‘underdeveloped’ (identified in red in the

charts); if the infrastructural institution exists between 50% to 75% of the countries then it

will be considered ‘developing’ (identified in amber in the charts); and if the infrastructural

institution exists in more than 75% of the countries then it will be rated ‘developed’ (identified

in green in the charts).

6.2.1.

Legal Infrastructure

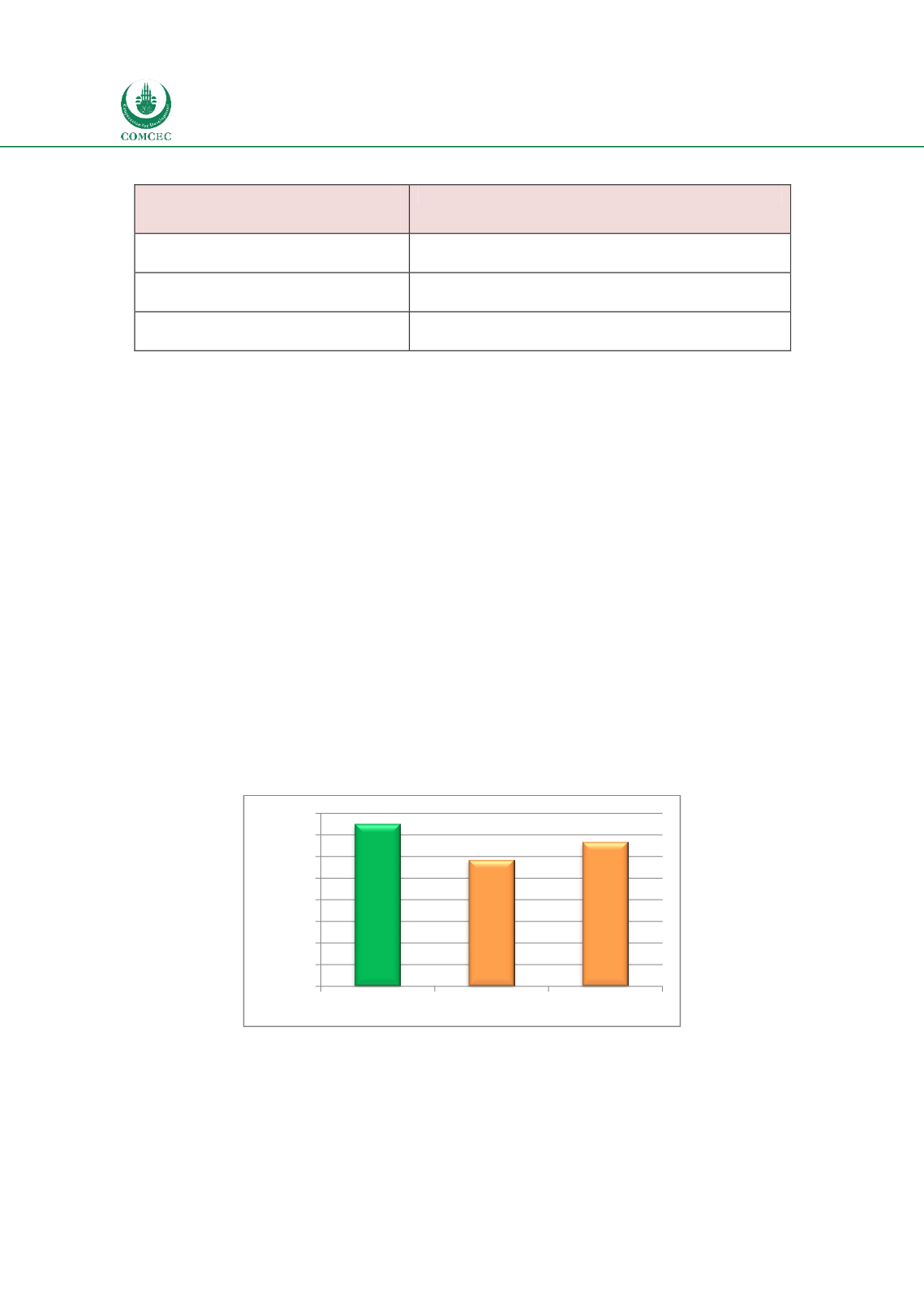

Chart 6.1 shows the overall status of the countries with different types of Islamic financial laws.

While 75% of the countries have Islamic banking laws, 58.3% have laws supporting the takaful

sector and 66.7% laws relate to Islamic capital markets. The results indicate that while on the

average the status of financial laws in the sample countries for the banking sector are

developed, the legal statuses for the takaful and capital markets are ‘developing’. Thus, there is

a need to strengthen the laws for takaful and Islamic capital markets.

Chart

6.1: Legal Infrastructure--Countries with Islamic Financial Laws (% of total)

Chart 6.2 shows the status of other legal infrastructure institutions. Note that in three

countries the tax laws are not relevant either because the whole financial sector is Islamic

(Sudan) or due to the absence of taxes that affect financial transactions (Saudi Arabia and

UAE). In the remaining nine countries, 66.7% of them adjust tax laws to accommodate the

special features of Islamic finance transactions, thereby leveling the playing field with

75,0

58,3

66,7

0

10

20

30

40

50

60

70

80

Banking

Takaful

Capital Market

Percentage of total