National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

195

institutions, have a national Shariah board and also have issued Shariah standards/parameters

for Islamic financial transactions. A second group of countries have legal/regulatory

requirements for Shariah governance and a central Shariah authority for certain financial

sectors. Bangladesh, Nigeria, Oman and Sudan fall under this category of countries. Note that

while in most countries the central Shariah board is introduced by the regulators, in Indonesia

it is established by the Ministry of Religious Affairs and in Bangladesh the Islamic banks have

taken this initiative with the encouragement of regulators.

A third group of countries have weaker Shariah governance regimes with only laws and/or

regulations mentioning some sort of Shariah governance but no specific guidelines on their

form or structures. UAE falls in this category. In the last group of countries (such as Saudi

Arabia, Senegal and Turkey) there are no legal/regulatory initiatives for Shariah governance.

Note that there are some sector wise disparities in the Shariah governance regimes for

different sectors. For example, in Bangladesh the banking sector has a central Shariah board,

but the takaful and capital market segments do not have one. Similarly, there is the regulatory

framework for Shariah governance for the takaful sector in Egypt for which there are no

corresponding requirements for the banking and capital market segments in the country.

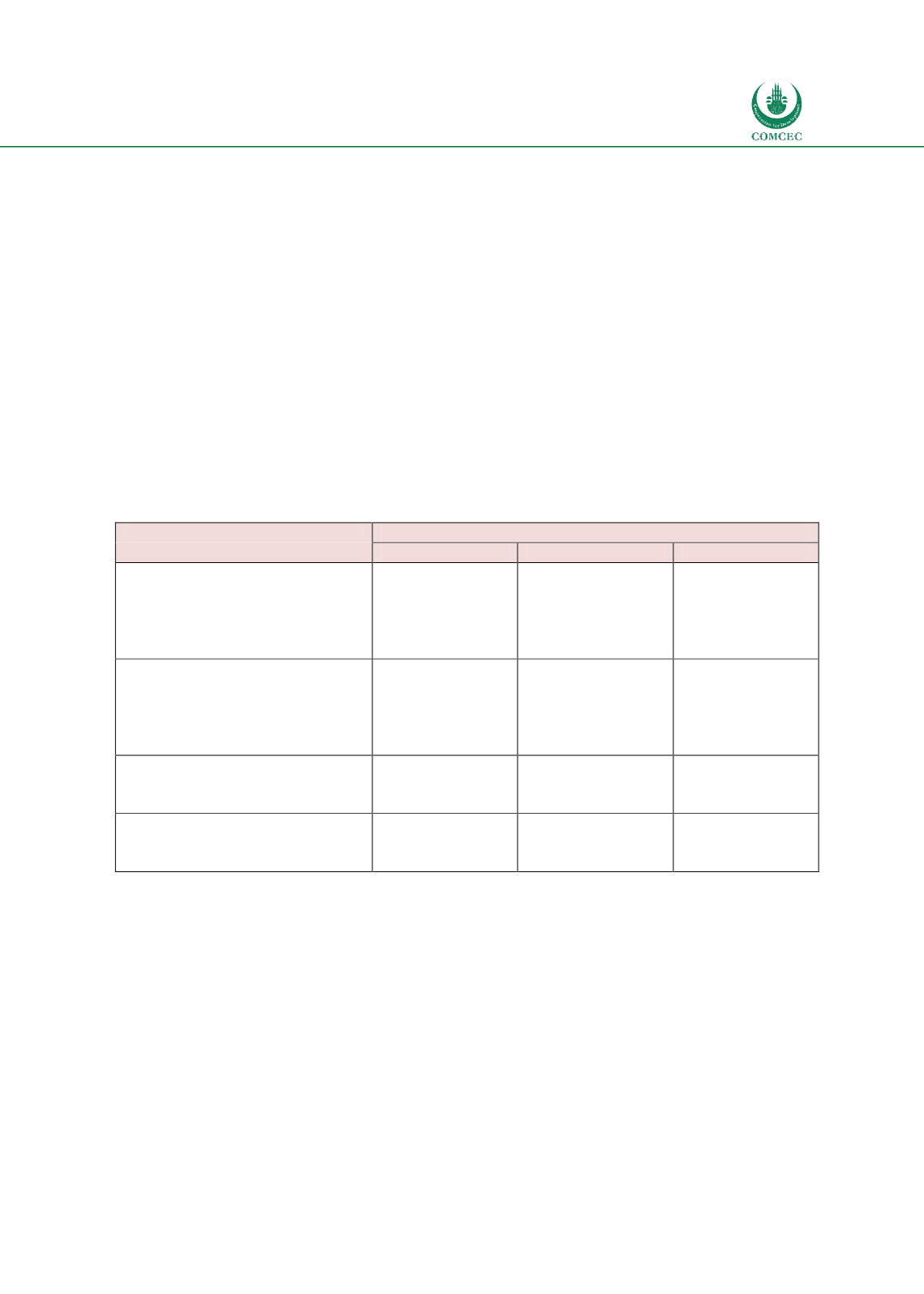

Table

6.6: Status of Shariah Governance Regimes

Institutional Setup

Financial Sectors

Banking

Takaful

Capital Markets

Legal/Regulatory

requirements

for Shariah governance

Bangladesh,

Indonesia,

Malaysia, Nigeria,

Oman, Pakistan,

Sudan, UAE

Egypt,

Indonesia,

Malaysia, Nigeria,

Oman,

Pakistan,

Sudan, UAE

Egypt, Indonesia,

Malaysia, Nigeria,

Oman, Pakistan,

Sudan

Existence of national Shariah

Supervisory/Advisory Board

Bangladesh,

Indonesia,

Malaysia, Nigeria,

Oman, Pakistan,

Sudan

Indonesia,

Malaysia, Nigeria,

Oman,

Pakistan,

Sudan

Indonesia,

Malaysia, Oman,

Pakistan, Sudan

Shariah standards/parameters

Indonesia,

Malaysia,

Pakistan

Indonesia,

Malaysia, Pakistan

Indonesia,

Malaysia,

Pakistan, UAE

No Shariah related issues in laws

and regulations

Egypt,

Saudi

Arabia, Senegal,

Turkey

Bangladesh, Saudi

Arabia,

Senegal,

Turkey

Bangladesh, Saudi

Arabia, Senegal,

Turkey

6.1.4.

Liquidity Infrastructure

The liquidity infrastructure for Islamic finance would include appropriate Shariah complaint

liquidity instruments and money markets in the private domain and the lender of last resort

facility provided by the central bank. The case studies show variation in the liquidity

infrastructure. A sound liquidity infrastructure for Islamic finance can be found in Indonesia,

Malaysia, Pakistan and Sudan where all three elements of liquidity infrastructure identified

above are present.