National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

194

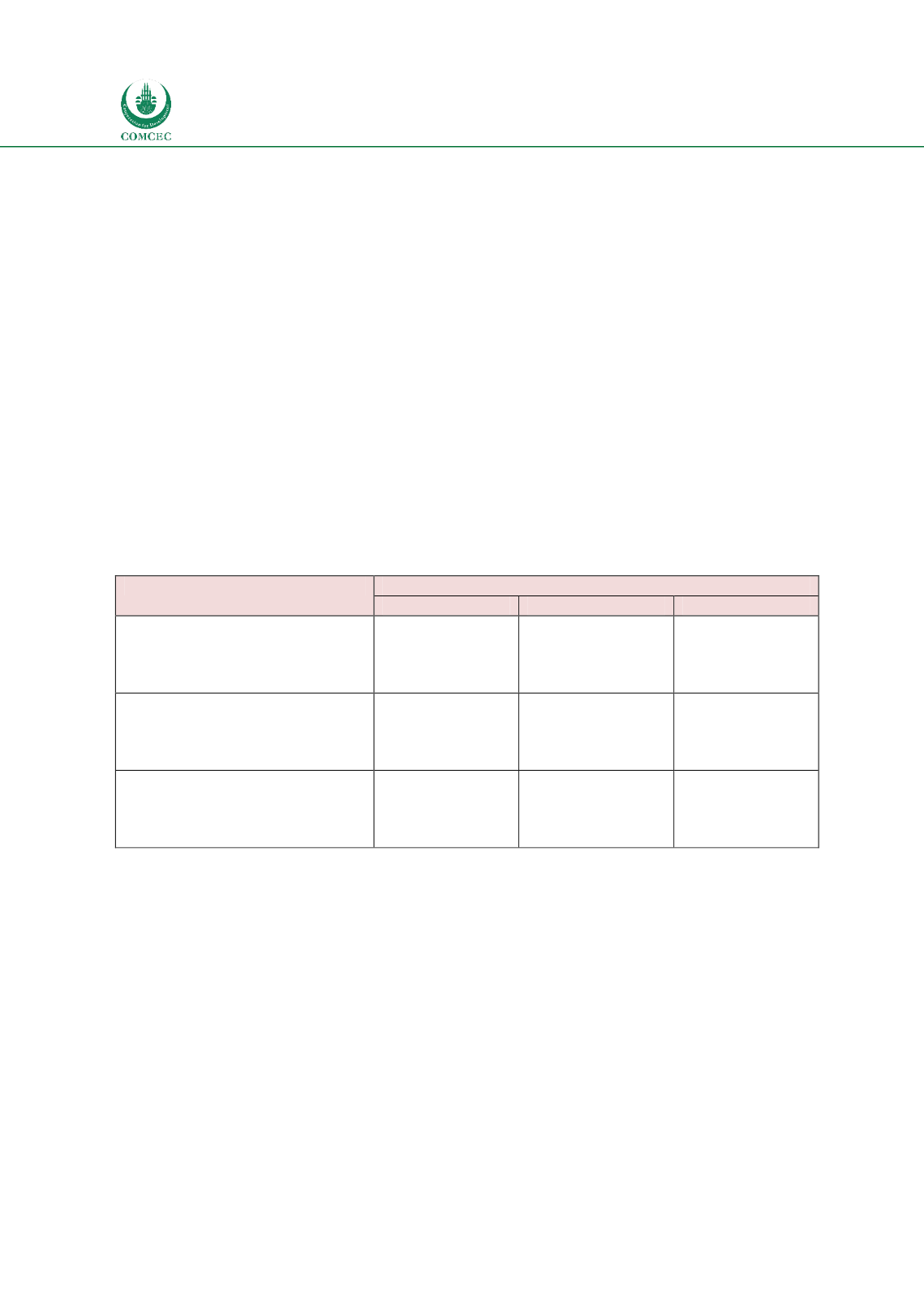

The regulatory framework for Islamic finance in different countries can be assessed by

examining two institutional aspects: whether there is separate regulatory framework for

Islamic finance that is overseen by a specific department and whether specific regulatory

initiatives have been taken for Islamic finance. Note that while the former would usually imply

the later, there may be some cases where regulators may issue specific regulations related to

Islamic finance but do not have a separate department looking after regulatory issues of

Islamic finance. Category 1 is a robust regulatory framework where a country has specific

regulations related to Islamic finance that is overseen by a separate department that oversees

the Islamic financial sector. Countries in this group for the Islamic banking sector are

Indonesia, Malaysia, Oman, Pakistan and Sudan. All these countries, except Oman also have a

robust regulatory framework for the takaful and capital markets sectors. The second category

of countries are countries that do not have a separate department to deal with Islamic finance

but have separate regulatory guidelines for the industry. Countries in this category are Nigeria

and the UAE for all financial sectors and Oman for takaful and Islamic capital markets. The

third category of countries has the weakest regulatory framework with neither a department

nor specific regulations for Islamic finance. The countries included in this category are Egypt,

Saudi Arabia, Senegal and Turkey. Note that while in Bangldesh the regulatory body for the

banking sector has taken initiatives for Islamic banks, this is not the case for the takaful and

capital markets sectors.

Table

6.5: Status of Regulatory Framework

Institutional Setup

Financial Sectors

Banking

Takaful

Capital Markets

a)

Independent/separate

regulatory department and b)

specific

regulatory

initiatives

taken for Islamic finance

Indonesia,

Malaysia, Oman,

Pakistan, Sudan

Indonesia,

Malaysia, Pakistan,

Sudan

Indonesia,

Malaysia,

Pakistan, Sudan

a)

No

independent/separate

regulatory department and b)

specific

regulatory

initiatives

taken for Islamic finance

Bangladesh,

Nigeria, UAE

Nigeria,

Oman,

UAE

Nigeria,

Oman,

UAE

a)

No

independent/separate

regulatory department and b) no

specific

regulatory

initiatives

taken for Islamic finance

Egypt,

Saudi

Arabia, Senegal,

Turkey

Bangladesh, Egypt,

Saudi

Arabia,

Senegal, Turkey

Bangladesh,

Egypt,

Saudi

Arabia, Senegal,

Turkey

6.1.3.

Shariah Governance

The status of Shariah governance can be determined by different factors. First, the existence of

legal or regulatory requirements or guidelines related to Shariah governance issues. This

would be in the form of either the law and/or regulations specifying rules for a Shariah

governance framework at the financial institution level. Second would be the existence of a

national Shariah board to provide rulings and guidance to the Islamic financial sector on

Shariah related issues. Finally, some Shariah standards or parameters, either national or

international, exist that financial institutions are required to follow.

The status of Shariah governance regimes according to the criteria identified above in case-

study countries are shown in the table below. Three countries (Indonesia, Malaysia and

Pakistan) have robust Shariah regimes which have all three aspects of Shariah governance

elements. That is, they have laws/regulations regarding Shariah governance for financial