National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

193

countries has an arrangement for getting Shariah input for cases involving Islamic finance in

civil courts. Even though Islamic financial disputes will be tried in civil courts in Oman, the

court uses Shariah in dealing with contracts. In Pakistan, there is a Shariah appellate court and

in Malaysia a bench in the high court deals with disputes related to Islamic finance. The courts

in these countries refer any Shariah related issues to a central Shariah Advisory Council/Board

for suggestions. The third group of countries have Islamic arbitration centers. Countries in this

group include Indonesia, Malaysia, Sudan and UAE. The final group does not have any specific

arrangements for Islamic finance cases and disputes will be adjudicated in civil courts using

the laws of the country. The lack of dispute resolution framework in Bangladesh, Egypt,

Nigeria, Senegal and Turkey introduces legal risks in Islamic finance.

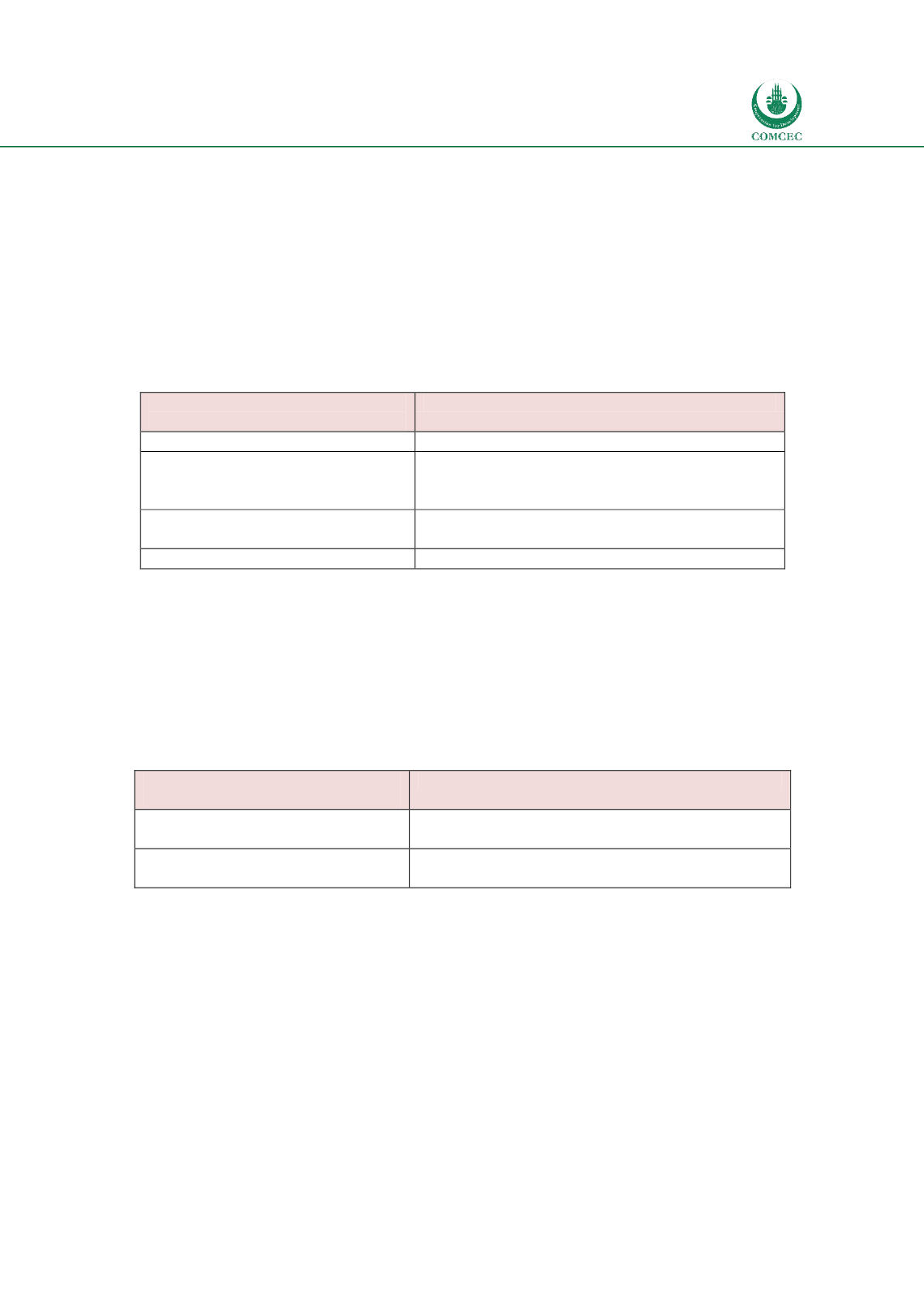

Table

6.3: Status of Dispute Resolution Framework for Islamic Finance

Legal

Infrastructure:

Dispute

Resolution

Countries

Islamic Courts

Saudi Arabia, Sudan

Dispute Resolution for Islamic

finance (Shariah inputs in civil

courts)

Malaysia, Oman, Pakistan

Dispute Resolution for Islamic

finance (arbitration centers)

Indonesia, Malaysia, Sudan, UAE

Civil courts

Bangladesh, Egypt, Nigeria, Senegal, Turkey

Bankruptcy Framework and Resolution of Banks

The bankruptcy framework and resolution of banks framework in the case studies can be

separated into two categories. Firstly there are countries that have specific issues in their

bankruptcy and bank resolution framework that have specific issues dealing with unique

features of Islamic finance (Malaysia, Oman, Pakistan and Sudan). Secondly, in the remaining

countries a single bankruptcy framework applies to all financial institutions including the

Islamic ones.

Table

6.4

: Status of Bankruptcy Framework

Legal Infrastructure: Bankruptcy

and Resolution of Banks

Countries

Specific bankruptcy for Islamic

finance

Malaysia, Oman, Pakistan, Sudan,

Single

bankruptcy/resolution

arrangement

Bangladesh, Egypt, Indonesia, Nigeria, Saudi Arabia,

Senegal, Turkey, UAE

6.1.2.

Regulation and Supervision

The case-studies show different types of overall regulatory frameworks for various financial

sectors. While there may be a single regulatory body for all three financial sectors (such as OJK

in Indonesia), in most other countries there are multiple regulatory bodies for various sectors.

A few countries separate individual regulators for each of the three sectors (such as

Bangladesh, Nigeria, Senegal, Sudan, Turkey, and the UAE. In most of these countries the

central bank regulates the banking sector and in some countries it also regulates the

insurance/takaful sectors (e.g., Malaysia, Saudi Arabia). The capital market is regulated by

separate capital market regulators and in some cases this regulatory body also regulates the

insurance/takaful sectors (Egypt, Oman, Pakistan).