Infrastructure Financing through Islamic

Finance in the Islamic Countries

179

various stakeholders to be structured. One way to resolve this problem, particularly in markets

where sukuk is relatively new, is to establish an advisory company that can assist in the

issuance of sukuk. A good example of such an institution is the Sudan Financial Services

Company Ltd. (SFSC) established by the Central Bank of Sudan (CBOS) and the Ministry of

Finance and National Economy. Among other things, SFSC provides advisory services to

develop financial products including Islamic securities in accordance with Shariah rules and

designs and executes a marketing policy for the issuance of sukuk. Most of the government

Islamic certificates in Sudan are issued by SFSC. Since issuing sukuk is complex and costly and

involves investment banks, it is suggested that a GLC similar to SFSC be established in OIC

member countries which can develop standardized templates for sukuk and advise on the

structuring and issuance of sukuk at lower costs. This will contribute to both the development

of the sukuk market and also help raise funds for infrastructure projects.

Since the size of the Islamic financial sector is relatively small, one way to raise funds is to

issue retail sukuk. Examples of retail sukuk in Malaysia and Indonesia show that the retail

sector can also be tapped into to raise funds for infrastructure projects. Retail sukuk not only

provides opportunities to retail investors to place funds in Shariah compliant assets, it can also

potentially open up new and potentially large sources of funds for infrastructure development.

Retail sukuk can also contribute to financial inclusion by providing retail investors with

opportunities to invest in alternative saving instruments. However, this would require

increasing financial literacy and using technology to deliver the retail sukuk product in a cost-

effective and efficient manner. The policy recommendations to increase the role of Islamic

capital markets in infrastructure development are outlined in Table 5.7.

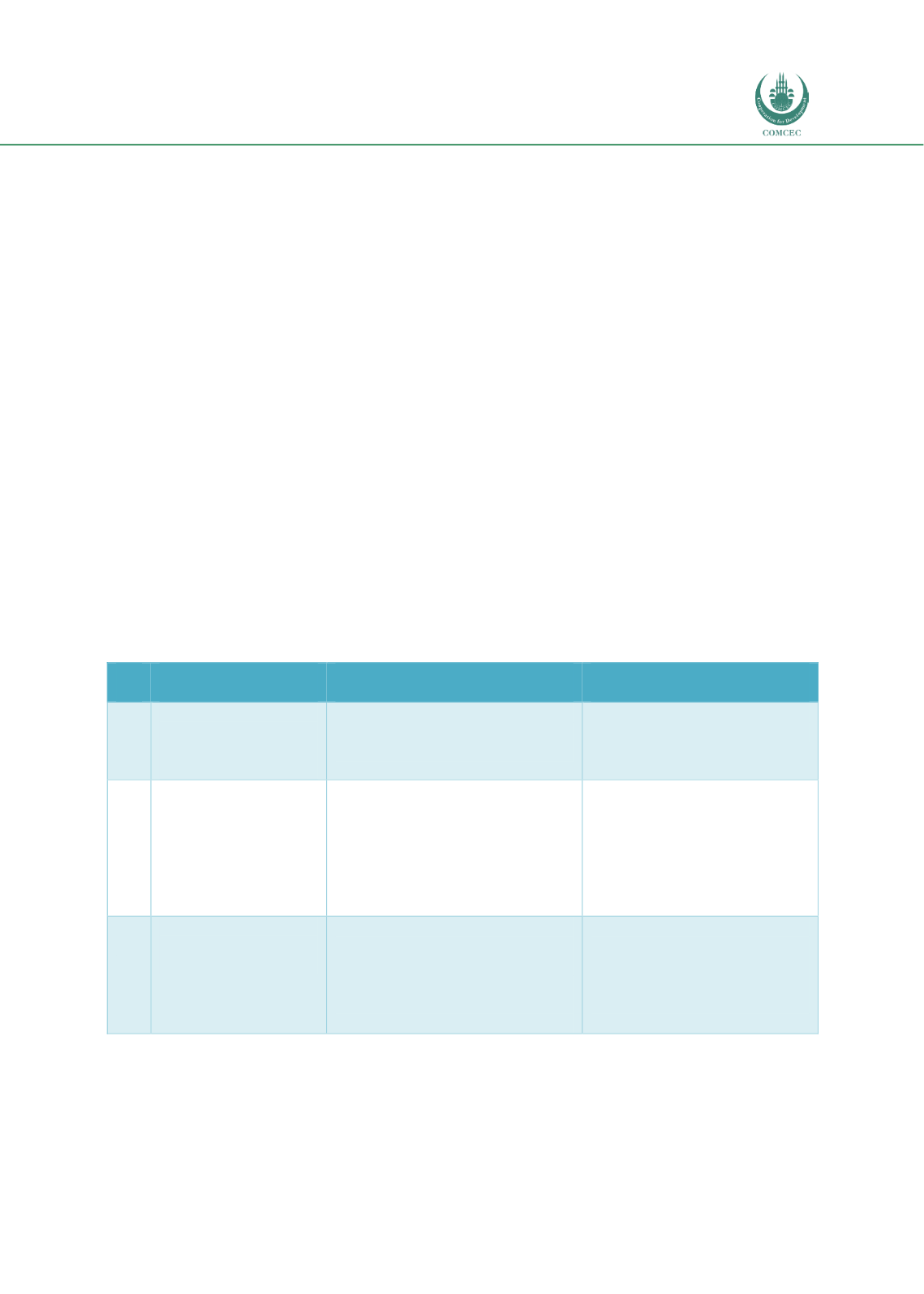

Table 5. 7: Policy Recommendations for Capital Markets

No. Recommendations

Specific Steps

Implemented by

6.1 Market and

Infrastructure

Development

Trading platform

Efficient registration and

approval process

Government and capital

markets regulatory body

6.2 Supply Side Support

for efficient issuance

of sukuk

Establish an advisory GLC to

advise on the issuance of

sukuk

The advisory GLC can also

provide templates for the

issue of sukuk for

infrastructure projects

Relevant government

ministry of capital markets

regulatory body

6.3 Tap into retail

investors

Enhance Islamic financial

literacy

Introduce an efficient

mechanism for the

delivery/redemption of

sukuk issues

Relevant government

ministry of capital markets

regulatory body

Islamic Financial

institutions