Infrastructure Financing through Islamic

Finance in the Islamic Countries

177

had a total value of RM 140.8 billion in assets in 2017 with 49.7% invested in Shariah-

compliant assets.

Another potential source for Shariah-compliant funds for the infrastructure sector in some

countries is sovereign wealth funds. While in most cases these funds invest in the equity of

some of the key infrastructure-related GLCs, they can also raise further funds for projects by

issuing sukuk. For example, the strategic investment fund created by the Ministry of Finance in

Malaysia, Khazanah Nasional Berhad, had assets amounting to RM 157.2 billion in 2017 and

had investments in sectors such as power, healthcare, transport and logistics, and

infrastructure and construction. Other than investing in key infrastructure sectors that can

promote long-term economic growth, Khazanah also plays a catalytic role in the development

of Islamic finance. Similarly, Public Investment Fund (PIF), the sovereign wealth fund of Saudi

Arabia has investments in many infrastructure-related companies related to the power, water

utility and sewerage, telecommunications and transportation sectors.

While Islamic nonbank financial institutions can potentially play an important role in

providing alternative sources of funds for infrastructure development, the key limiting factor is

their size and underdevelopment. Chapter 2 shows that global takaful assets are valued at USD

42.5 billion and assets of other Islamic financial institutions are worth USD 124.4 billion.

Moving forward, there is a need to develop these sectors to not only provide the relevant

financial services such as takaful and pension to different stakeholders but to also accumulate

funds that can be used for long-term investments.

The case of the UK shows the facilitative role that governments can play to provide a

framework where nonbank financial institutions can contribute to the infrastructure sector. As

indicated in Chapter 4, the HM Treasury, National Association of Pension Funds and Pension

Protection Fund launched the Pensions Infrastructure Platform (PIP) that invests in the

infrastructure sector. The Association of British Insurers also initiated the Insurers’

Infrastructure Investment Forum to have a platform and dialogue of how the insurance

companies can invest in infrastructure projects. The governments in OIC member countries

can take similar initiatives and establish a Shariah-compliant infrastructure fund in which both

Islamic and conventional nonbank financial institutions can place funds for investments in

infrastructure projects. The policy recommendations to increase the role of Islamic nonbank

financial institutions in infrastructure development are outlined in Table 5.6.

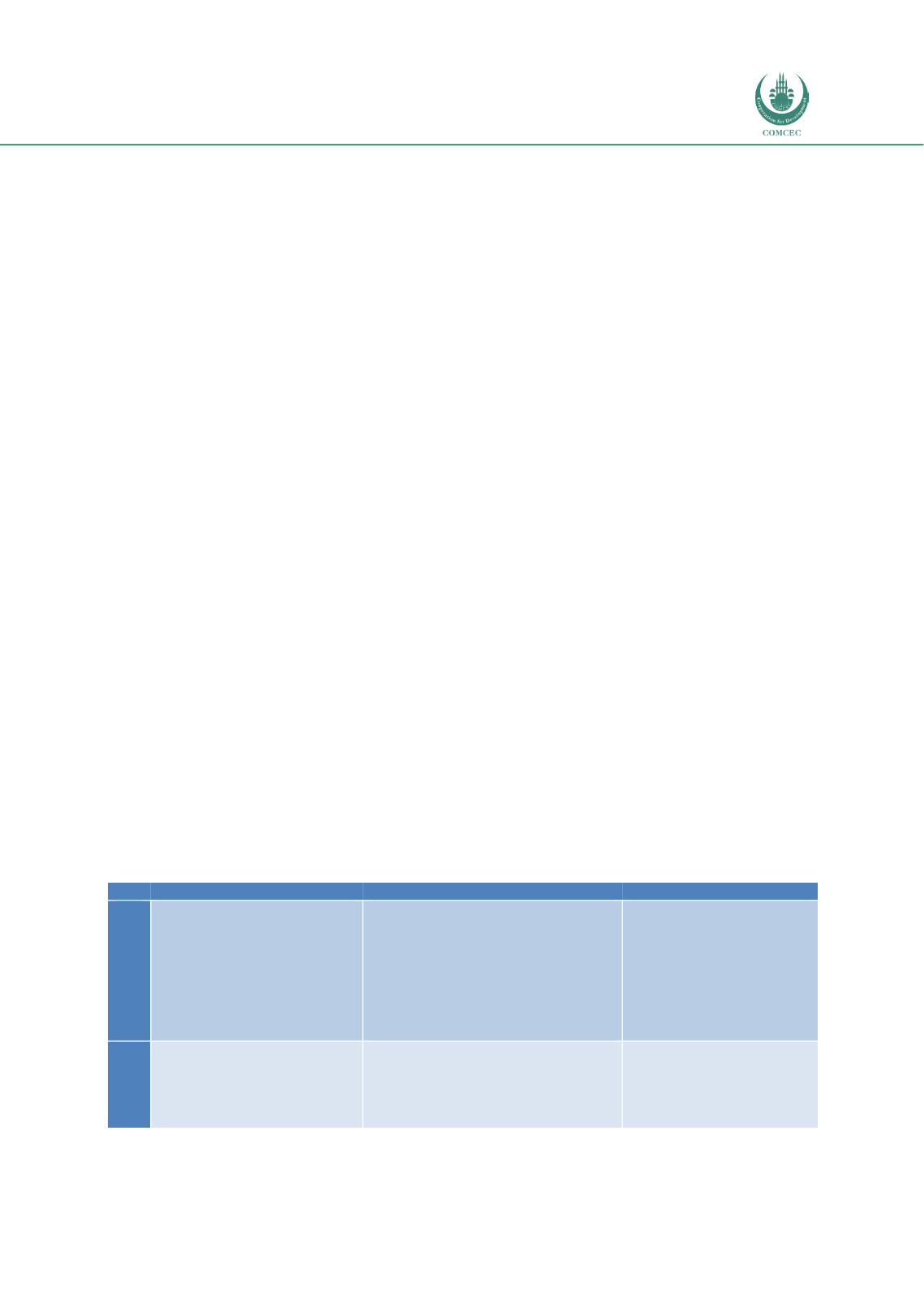

Table 5. 6: Policy Recommendations for Islamic Nonbank Financial Institutions

No.

Recommendations

Specific Steps

Implemented by

5.1

Increase the share of Islamic

nonbank

financial institutions in

infrastructure investments

Enlarge the family of the takaful

sector

Establish new, or increase the

share of, the Shariah-compliant

component in pension funds

Increase the share of the Shariah-

compliant component in

sovereign wealth funds

Industry players

Regulatory bodies

5.2

Establish new Islamic

Nonbank Financial

Institutions for increasing

investments in

infrastructure projects

Develop a national infrastructure

bank

Develop national infrastructure

funds/platforms

Industry players

Relevant government

ministries