Infrastructure Financing through Islamic

Finance in the Islamic Countries

180

5.7.

Islamic Social Sector

Chapter 3 shows that there is a great potential to use the Islamic social sector to provide

services to the poorer sections of the population. As indicated, the potential figures of

collecting zakat in the Muslim world can be between USD 114.34 billion and USD 304.9 billion

annually. Similarly, there are a huge amount of assets that are locked in waqf that can

potentially generate significant returns and benefits. Given the current low status and

projected huge gaps and shortfalls in the infrastructure in OIC member countries, the Islamic

social sector can be tapped to provide some infrastructure services.

The country case studies show several ways in which the Islamic social sector (zakat and waqf)

can contribute to providing certain infrastructure services. For example, waqf has been used in

Malaysia and Saudi Arabia to provide medical services to the poor and needy. While the social

sector is mostly involved in social infrastructure such as education and health services, the

social sector can also use certain innovative ways to serve other infrastructure sectors. The

example of BAZNAS and UNDP using zakat funds to provide a Micro Hydro Power Plant that

will provide electricity to 803 households in four remote villages that did not have access to

power shows the way the Islamic social sector can be used to provide infrastructure services

to the deprived segments of the population.

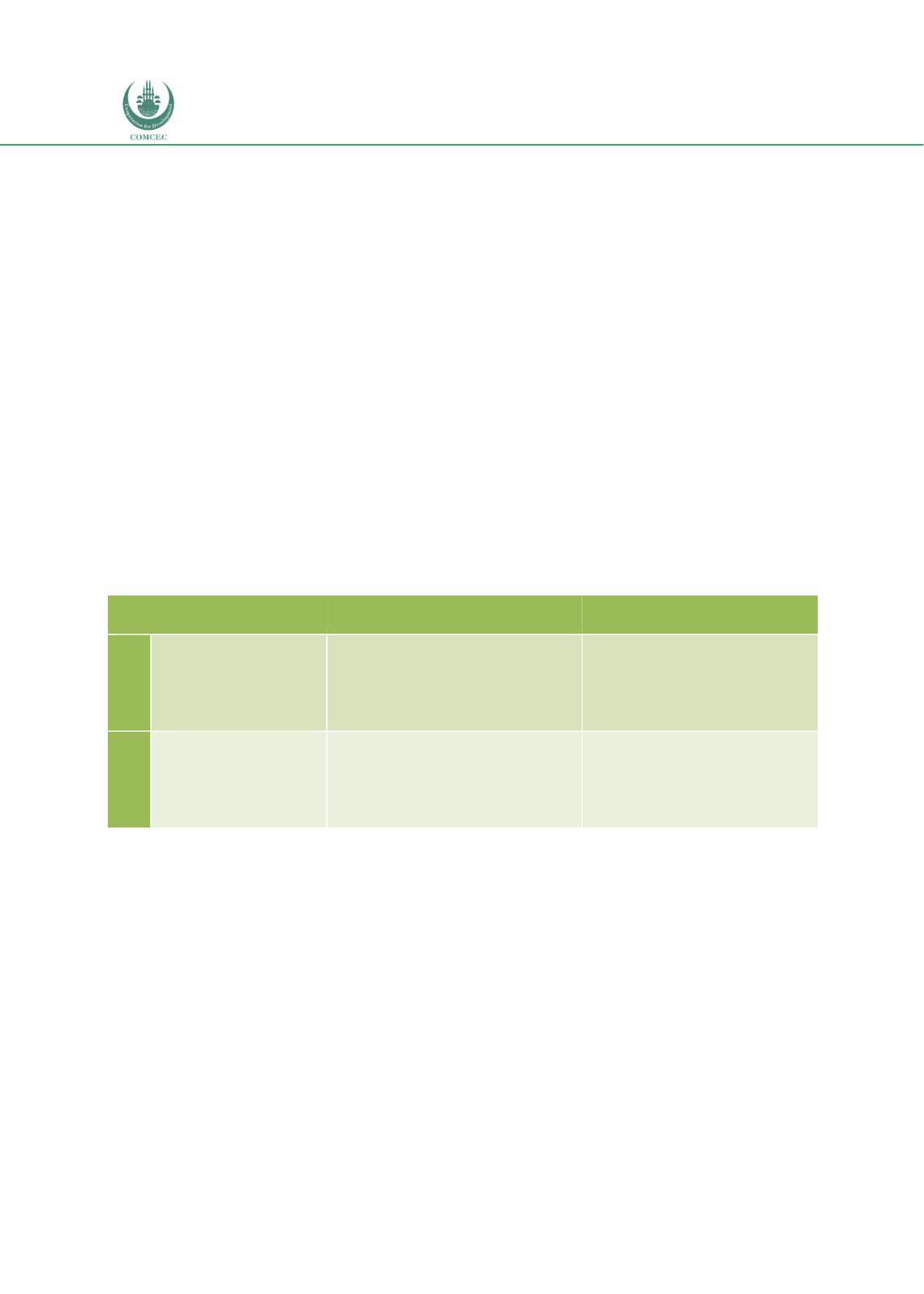

Table 5. 8: Policy Recommendations for Islamic Social Sectors

No. Recommendations

Specific Steps

Implemented by

7.1

Use Zakat in

provisions of

infrastructure

services

Develop innovative models of

using zakat to provide social,

innovative infrastructure

services

Zakat institutions,

government bodies and

international

organizations

7.2

Use Waqf in the

provision of

infrastructure

services

Develop innovative models of

using waqf to provide social,

innovative infrastructure

services

Waqf institutions,

government bodies and

international

organizations

5.8.

Multilateral Development Institutions

The Islamic Development Bank is the only multilateral development bank that provides

Shariah-compliant financing to its member countries. The distribution of the financing

provided by IDB in different regions from 2016 onwards is shown in Chart 5.4. A total of 148

projects worth USD 7.12 billion were financed by IDB. These figures indicate that the average

size of the projects financed by IDB is valued at USD 48.1 million only.