Infrastructure Financing through Islamic

Finance in the Islamic Countries

182

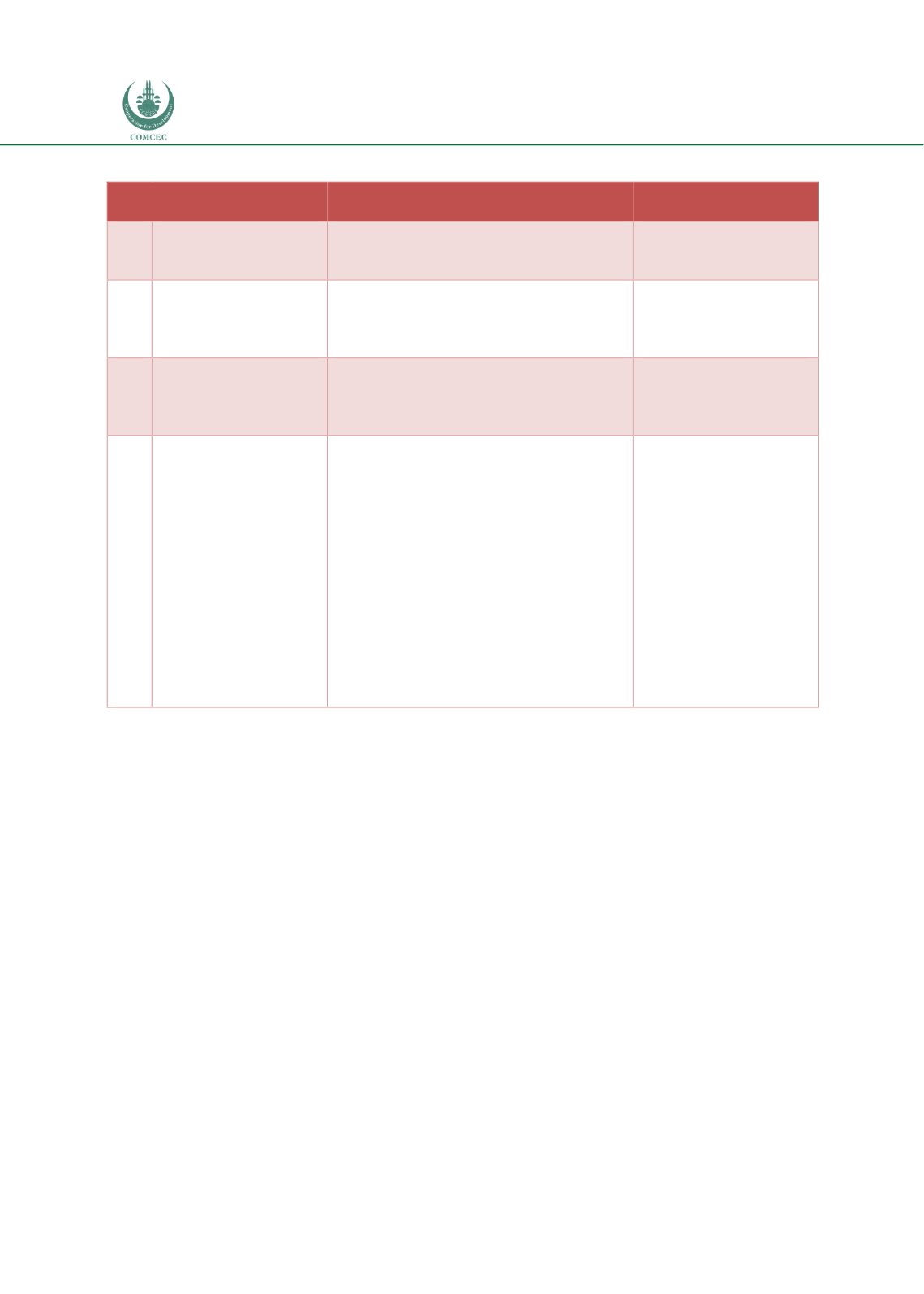

Table 5. 9: Policy Recommendations for Multilateral Development Institutions

No. Recommendations

Specific Steps

Implemented by

8.1 Increase resource

base of IDB

Increase the capital of IDB

Raise funds by issuing sukuk

IDB

8.2 Raise funds from

institutional

investors

Develop and launch Islamic

infrastructure funds

IDB

8.3. Collaborate with

other multilateral

organizations

Develop partnerships with other

multilateral development banks to

create infrastructure funds

IDB and other

multilateral

development banks

8.4 Establish an

International Islamic

Infrastructure Bank

(IIIB)

Establish an International Islamic

Infrastructure Bank to deal

specifically with infrastructure

financing and related issues

Capital can be raised from IDB,

member countries, Islamic

institutional investors and Islamic

financial institutions

Standardize the Islamic

infrastructure financing contracts

and sukuk

Provide advisory services on

structuring Islamic infrastructure

financing contracts and sukuk

International

multilateral

organizations in

collaboration with

other Islamic

institutional

investors

5.9.

Reduce Knowledge Gap and Capacity Building

Since infrastructure finance is multifaceted and new for many Islamic financial institutions,

there is a knowledge gap on how Islamic finance can be used for PPP projects. This gap can be

closed by increasing the awareness among stakeholders to increase the use of Islamic finance

for infrastructure projects. One option is to develop detailed case studies and a data repository

on Islamic PPP project financing from different parts of the world (World Bank et. al 2017).

This role can be performed by either the IDB or the proposed International Islamic

Infrastructure Bank. This database on Islamic infrastructure financing will be similar to the

Private Participation in Infrastructure (PPI) Database developed by World Bank.

One of the key issues involving Islamic finance in infrastructure projects is in having Shariah-

compliant products. Since the projects are large and involve complex contractual

arrangements, there are many intricacies that need to be resolved from a Shariah point of

view. However, there is a limited supply of Shariah scholars who understand the complexities

of project financing and advisory services can also be costly. This problem can be resolved if

templates for Shariah structures that can be used for different infrastructure projects can be

made available to stakeholders to encourage them to invest in the sector. This initiative can be

taken by a national Shariah board at the national level with the assistance of MDBs such as IDB

that have extensive experience in project financing. At the international level, AAOIFI can

develop Shariah standards for PPPs and infrastructure financing.